Certification: Oracle Hyperion Financial Management 11 Certified Implementation Specialist

Certification Full Name: Oracle Hyperion Financial Management 11 Certified Implementation Specialist

Certification Provider: Oracle

Exam Code: 1z0-532

Exam Name: Oracle Hyperion Financial Management 11 Essentials

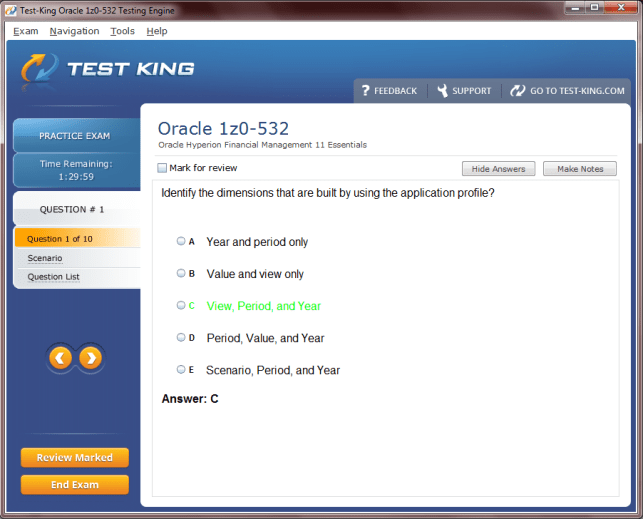

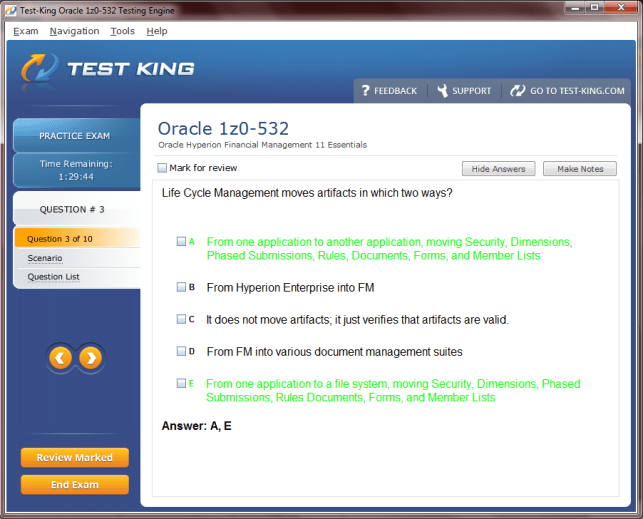

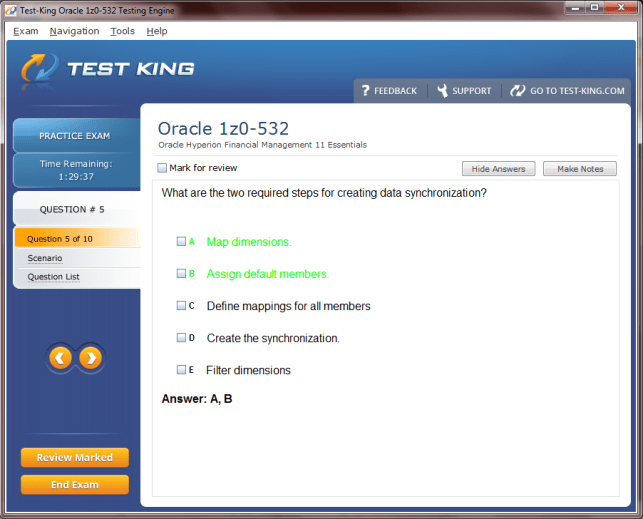

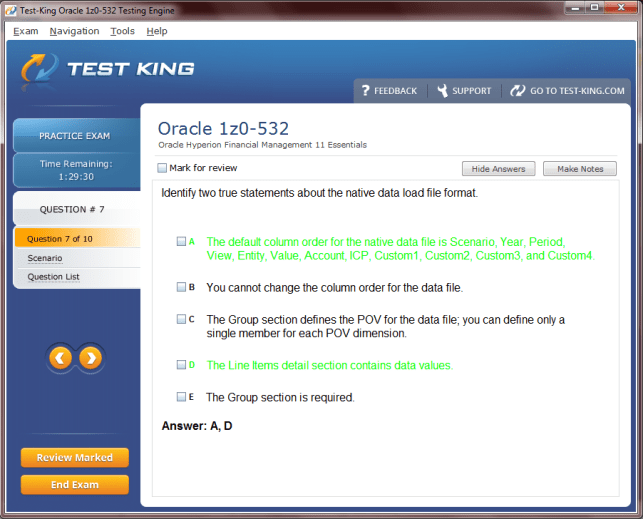

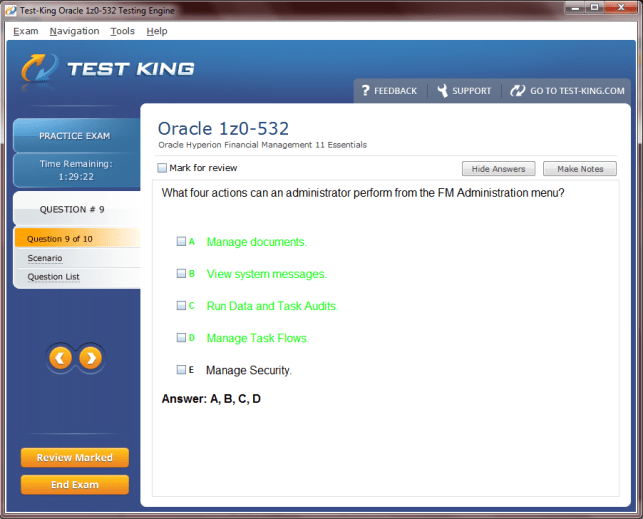

1z0-532 Exam Product Screenshots

Frequently Asked Questions

How can I get the products after purchase?

All products are available for download immediately from your Member's Area. Once you have made the payment, you will be transferred to Member's Area where you can login and download the products you have purchased to your computer.

How long can I use my product? Will it be valid forever?

Test-King products have a validity of 90 days from the date of purchase. This means that any updates to the products, including but not limited to new questions, or updates and changes by our editing team, will be automatically downloaded on to computer to make sure that you get latest exam prep materials during those 90 days.

Can I renew my product if when it's expired?

Yes, when the 90 days of your product validity are over, you have the option of renewing your expired products with a 30% discount. This can be done in your Member's Area.

Please note that you will not be able to use the product after it has expired if you don't renew it.

How often are the questions updated?

We always try to provide the latest pool of questions, Updates in the questions depend on the changes in actual pool of questions by different vendors. As soon as we know about the change in the exam question pool we try our best to update the products as fast as possible.

How many computers I can download Test-King software on?

You can download the Test-King products on the maximum number of 2 (two) computers or devices. If you need to use the software on more than two machines, you can purchase this option separately. Please email support@test-king.com if you need to use more than 5 (five) computers.

What is a PDF Version?

PDF Version is a pdf document of Questions & Answers product. The document file has standart .pdf format, which can be easily read by any pdf reader application like Adobe Acrobat Reader, Foxit Reader, OpenOffice, Google Docs and many others.

Can I purchase PDF Version without the Testing Engine?

PDF Version cannot be purchased separately. It is only available as an add-on to main Question & Answer Testing Engine product.

What operating systems are supported by your Testing Engine software?

Our testing engine is supported by Windows. Andriod and IOS software is currently under development.

Oracle 1Z0-532 Certification Exam Guide: Hyperion Financial Management 11 Essentials

The Oracle 1Z0-532 certification exam is meticulously designed for professionals who have prior exposure to Oracle Hyperion technology and aspire to enhance their careers through advanced validation of their skills in Hyperion Financial Management 11. This certification, known formally as the Oracle Hyperion Financial Management 11 Certified Implementation Specialist credential, is not merely an acknowledgment of theoretical understanding but an affirmation of hands-on expertise, practical proficiency, and the capacity to implement financial management solutions effectively within a corporate environment. Individuals pursuing this credential often find that their preparation journey deepens their comprehension of financial reporting, metadata management, data loading methodologies, and the nuances of application administration, ensuring they are equipped to address complex business requirements with confidence.

Candidates exploring this exam will encounter a rigorous assessment of their knowledge, which includes understanding the foundational principles of financial reporting. They are expected to articulate the core concepts that underpin reporting structures, recognize the importance of accurate and consistent financial data, and appreciate the intricacies involved in building and maintaining a reliable Hyperion Financial Management system. The design of the HFM environment, including the logical structuring of accounts, entities, and reporting hierarchies, forms a critical portion of the learning curve, as it influences not only the flow of financial data but also the efficacy of analytical reporting and regulatory compliance.

Understanding Oracle Hyperion Financial Management and Exam Objectives

Creating an application within Hyperion Financial Management involves a sequence of methodical steps, beginning with establishing an application profile that defines the configuration and operational parameters of the environment. The profile determines the scope of dimensions, properties, and application settings, allowing the practitioner to tailor the system to the specific needs of the organization. Managing and extracting metadata becomes essential for ensuring that all elements of the system—ranging from account definitions to entity hierarchies—are accurate and aligned with reporting objectives. In addition, constructing a Chart of Accounts requires a comprehensive understanding of financial structures and the implications of dimensional hierarchies, as each member and property must be correctly specified to support efficient data aggregation and analysis. Dimensionality, an integral concept within Hyperion Financial Management, allows for multi-dimensional reporting and analysis, enabling organizations to slice and dice financial data across various perspectives, from entities and accounts to scenarios and time periods.

The Oracle EPM Architect, or EPMA, introduces a paradigm that contrasts with the classic approach to HFM application management. EPMA provides a unified framework for defining dimensions, deploying applications, and maintaining consistency across multiple systems. Understanding the advantages and limitations of using EPMA compared to the classic methodology is crucial for practitioners aiming to optimize application development and deployment. Within EPMA, dimensions can be defined, maintained, and synchronized, ensuring that all deployed applications operate cohesively and that updates propagate seamlessly across environments. Application deployment through EPMA involves careful planning and execution, where the synchronization of data and structural elements is critical to maintaining the integrity and reliability of the financial system.

Loading and analyzing data is a fundamental activity in Hyperion Financial Management. Practitioners must be adept at importing data from various native formats, recognizing alternative methods to populate applications efficiently, and performing data manipulation tasks such as copying and clearing data when necessary. This proficiency ensures that the financial system accurately reflects transactional and operational realities, providing a dependable foundation for reporting and decision-making. Calculation management, orchestrated through the HFM Rules and Calculation Manager, allows users to define complex rules, invoke functions, and utilize variables and subroutines, facilitating automation of calculations and ensuring consistency and accuracy across the reporting landscape. This capability empowers financial analysts to implement intricate logic for consolidations, intercompany eliminations, currency translations, and other essential operations.

Constructing and managing member lists within Hyperion Financial Management constitutes another layer of operational mastery. Member lists define the organizational, financial, and reporting dimensions that underpin analytical capabilities. The creation, usage, loading, and extraction of these lists are interdependent processes that support both reporting and calculation functions. Practitioners must exercise precision in these activities to avoid discrepancies and ensure that all reporting outcomes align with organizational objectives.

Shared Services, encompassing security and lifecycle management, constitutes a critical dimension of HFM expertise. Understanding the architecture of security—users, groups, roles, and classes—allows administrators to provision and manage access appropriately, safeguarding sensitive financial information while enabling collaboration. Lifecycle management services facilitate the transfer of artifacts between applications, supporting the seamless evolution of financial systems, implementation of updates, and migration of configurations across environments. Effective administration in HFM extends beyond basic operational tasks; it includes copying applications, executing process controls, and tuning systems for optimal performance, which collectively ensure the stability, efficiency, and reliability of financial management solutions.

End users interact with the HFM environment through a variety of tools, including task lists, data grids, and data entry forms. The ability to navigate these interfaces, record transactions, and manage journals underpins the day-to-day financial processes within organizations. Advanced functions, such as intercompany reporting, introduce complexities that require nuanced understanding and meticulous attention to detail. These functions allow organizations to consolidate data across multiple entities, reconcile intercompany balances, and generate reports that provide transparency into financial interactions and compliance with regulatory requirements.

Financial Reporting Studio enhances the capabilities of Hyperion Financial Management by enabling sophisticated report creation. Users leverage relationship functions and report features to generate insights that inform strategic decisions. Understanding the full spectrum of reporting tools ensures that practitioners can design reports that meet both managerial and statutory requirements, facilitating clear communication of financial performance and operational results. Supporting tools, including Financial Data Quality Management and extended analytics, supplement these capabilities by ensuring data integrity, validating input, and providing advanced analytical functions, further enriching the decision-making process.

Preparation for the Oracle 1Z0-532 examination necessitates a structured approach that blends formal training, practical exercises, and experience in professional settings. Engaging with training resources such as Hyperion Financial Management creation and management courses provides foundational knowledge, while practice exams and simulation exercises reinforce learning by exposing candidates to the types of scenarios and problem-solving exercises they will encounter in the actual assessment. The convergence of theoretical knowledge, applied practice, and real-world problem-solving constitutes the optimal strategy for achieving certification, ensuring that successful candidates not only understand concepts but can translate them into actionable results in organizational contexts.

The Oracle Hyperion Financial Management Essentials credential serves as a definitive measure of proficiency, establishing a professional’s credibility and reinforcing their capacity to implement, manage, and optimize financial management solutions. By mastering the interconnected topics of application creation, metadata management, EPMA, data loading, calculation rules, member lists, shared services, administration, end-user functions, advanced reporting, and supporting tools, candidates demonstrate a holistic grasp of both technical and functional aspects of the system. This breadth of expertise is critical for those seeking to contribute meaningfully to the financial management infrastructure of their organizations, offering tangible value through enhanced reporting accuracy, operational efficiency, and strategic insight.

Mastering Application Creation, Metadata, and EPMA Architecture

The journey toward achieving the Oracle 1Z0-532 certification delves deeper into the intricacies of Hyperion Financial Management, emphasizing the essential competencies required to create, configure, and administer robust financial applications. A proficient practitioner begins by understanding the foundational principles of application creation, which involves constructing an environment capable of supporting complex financial structures while maintaining data integrity and operational efficiency. The creation of application profiles forms the cornerstone of this endeavor, dictating the structural and functional parameters within which all subsequent activities occur. An application profile is meticulously defined, encompassing attributes, properties, and system settings that ensure the resulting application adheres to organizational standards and reporting requirements. Within this framework, the practitioner establishes dimensional hierarchies, specifies account and entity structures, and determines the essential settings for calculation and consolidation processes, ensuring that the system can accommodate both current operational needs and future expansion.

Metadata management constitutes a pivotal element in the Oracle Hyperion environment, serving as the blueprint for financial operations and reporting structures. Administrators must not only load metadata accurately but also manage, extract, and update it efficiently, ensuring consistency across all system dimensions. The Chart of Accounts, which represents the backbone of financial reporting, is carefully constructed to align with both organizational policies and regulatory requirements, allowing for the aggregation of data across multiple hierarchies and perspectives. The meticulous specification of properties, such as account types, consolidation rules, and dimensional associations, ensures that calculations, reporting, and analytics function as intended, preventing errors and facilitating strategic decision-making. Dimensionality further enhances the analytical capabilities of the system, enabling multi-faceted examination of financial data across entities, accounts, scenarios, and periods, which proves indispensable for both internal and external reporting obligations.

The Oracle EPM Architect, known for its streamlined management capabilities, represents a transformative approach to deploying and maintaining Hyperion applications. Unlike classic methodologies, EPM Architect provides a centralized framework for defining dimensions, deploying applications, and maintaining consistency across disparate systems. Professionals mastering EPMA must understand the relative advantages and limitations of its architecture, appreciating how its features can reduce redundancy, improve synchronization, and facilitate governance. Within EPMA, dimensions are defined and maintained through a controlled environment that allows for simultaneous updates across multiple applications, ensuring coherence and minimizing errors. The deployment of applications via EPMA requires careful planning, wherein practitioners orchestrate the movement of artifacts, synchronize data structures, and verify the alignment of settings with business objectives. Data synchronization, a core feature of EPMA, ensures that modifications in one application propagate accurately to related systems, maintaining structural and functional integrity across the enterprise landscape.

Data loading and analysis within Hyperion Financial Management extends beyond mere importation, demanding a comprehensive understanding of multiple methodologies for populating applications. Native file formats provide a standard conduit for data integration, while alternative approaches offer flexibility in managing diverse input sources. Copying and clearing data, often necessary during consolidation cycles or testing scenarios, must be executed with precision to prevent corruption or inconsistency. Effective practitioners appreciate the nuances of these operations, recognizing that the quality and reliability of data directly influence reporting accuracy and analytical insights. The Rules and Calculation Manager is instrumental in automating complex calculations, defining variables, subroutines, and functions that ensure consistency across all financial operations. By employing these capabilities, analysts can efficiently implement logic for currency translations, intercompany eliminations, and scenario-based consolidations, optimizing both accuracy and operational efficiency.

Creating and managing member lists forms an additional cornerstone of effective Hyperion Financial Management practice. Members, representing entities, accounts, or reporting categories, must be meticulously defined, loaded, and extracted to facilitate calculation, reporting, and analytics. Each list is interdependent, with precise relationships and hierarchies that impact the aggregation of data and the validity of financial results. Practitioners must maintain rigorous attention to detail to prevent inconsistencies that could undermine the reliability of reporting outputs or compromise compliance with internal and external regulatory standards.

Shared Services, encompassing security, user management, and lifecycle administration, is a fundamental dimension of Hyperion Financial Management expertise. Security structures, including users, groups, roles, and classes, must be thoughtfully configured to ensure appropriate access, safeguarding sensitive information while maintaining operational efficiency. Provisioning users and groups, assigning classes, and managing permissions require a combination of procedural knowledge and strategic foresight, as improper configuration can lead to operational inefficiencies or exposure of critical data. Lifecycle management services complement security by facilitating the transfer of applications, artifacts, and configurations across environments, supporting both developmental updates and production deployment with minimal disruption.

Administration within Hyperion Financial Management integrates application management, process control, and performance optimization. Copying applications, implementing procedural controls, and fine-tuning system performance are essential to maintaining a stable and responsive financial management environment. Administrators must balance operational requirements with strategic objectives, ensuring that applications remain robust, responsive, and capable of supporting both routine transactions and complex financial analysis. The orchestration of these activities requires both technical acumen and practical experience, reflecting the holistic nature of proficiency demanded by the Oracle 1Z0-532 certification.

End-user interactions with Hyperion Financial Management are facilitated through tools such as task lists, data grids, and data entry forms. The practical application of these tools underpins the daily operations of financial departments, enabling the accurate entry, tracking, and management of financial data. Journals serve as a critical instrument in documenting and reconciling transactions, providing both audit trails and analytical insights. Mastery of these interfaces allows users to efficiently capture and process financial information, contributing to organizational transparency and accountability.

Advanced functionalities, including intercompany reporting, introduce further complexity into the practitioner’s responsibilities. Intercompany reporting requires careful orchestration of multiple entities’ data, reconciling balances and ensuring the elimination of internal transactions to produce consolidated financial statements. Professionals adept in this area leverage both calculation rules and reporting structures to deliver accurate results, demonstrating their capacity to manage sophisticated financial operations within a multi-entity organization.

Financial Reporting Studio extends the analytical and reporting capabilities of Hyperion Financial Management. Users employ its features to generate comprehensive reports, utilizing relationship functions and sophisticated reporting techniques to communicate financial performance effectively. These capabilities enable practitioners to translate raw financial data into actionable insights, facilitating informed decision-making and strategic planning. Supporting tools, including Financial Data Quality Management and extended analytics, reinforce these capabilities by validating data integrity, monitoring compliance, and providing advanced analytical frameworks to enrich organizational intelligence.

Preparing for the Oracle 1Z0-532 examination requires a deliberate and structured approach, integrating formal training, hands-on exercises, and practical application. Training programs focused on Hyperion Financial Management provide foundational knowledge, while practice exercises and real-world simulations cultivate the capacity to apply concepts in dynamic operational contexts. Candidates are encouraged to engage with diverse scenarios, experiment with calculation rules, data loading strategies, and application configuration, and reflect upon the outcomes to consolidate their understanding. The interplay of theoretical mastery, experiential learning, and strategic problem-solving forms the basis for successful attainment of certification, ensuring that professionals are not only knowledgeable but also capable of executing tasks with precision and confidence.

This credential serves as a hallmark of professional capability, signaling to employers and peers alike that the individual possesses comprehensive knowledge of Hyperion Financial Management 11, coupled with the practical ability to implement, administer, and optimize financial applications. Through mastery of application creation, metadata management, EPMA architecture, data loading, calculation management, member lists, security structures, administration, end-user functions, advanced reporting, and supporting tools, candidates demonstrate the breadth and depth of expertise necessary to excel in complex financial environments. The skills acquired through this preparation not only facilitate the accurate management of financial data but also empower professionals to deliver strategic insights, drive operational efficiency, and contribute meaningfully to organizational decision-making processes.

Enhancing Proficiency in Data Management, Calculation, and Reporting

The Oracle 1Z0-532 certification demands a sophisticated understanding of Hyperion Financial Management, emphasizing the ability to integrate complex financial structures with analytical precision. For aspirants aiming to validate their expertise, mastery of data management, calculation methodologies, and reporting mechanisms is essential. Practitioners navigating this environment must cultivate not only technical proficiency but also the foresight to anticipate organizational reporting needs, reconcile disparate financial elements, and maintain systemic integrity throughout transactional cycles. This journey extends beyond conventional configuration tasks, encompassing strategic considerations that influence the accuracy, timeliness, and transparency of financial information across the enterprise.

Data loading in Hyperion Financial Management constitutes a foundational competency, pivotal to the reliability and integrity of the entire system. Practitioners are expected to import data using native file formats while also exploring alternative methods that accommodate unique operational requirements. Each data import involves meticulous attention to structure, ensuring that values align with predefined dimensions and that hierarchies are preserved. The ability to copy and clear data efficiently underpins testing, reconciliation, and scenario modeling, where multiple simulations may be necessary to validate financial outcomes. The subtle intricacies of this process require careful planning, as even minor misalignments can propagate errors through calculations and reporting outputs, affecting the credibility of financial results.

Calculation management within Hyperion Financial Management represents a nexus of analytical rigor and technical execution. Using the Rules and Calculation Manager, practitioners define subroutines, variables, and functions that automate complex financial operations. These calculations encompass currency conversions, intercompany eliminations, allocations, and consolidations, each necessitating precise logical structuring. The capacity to invoke functions and utilize reusable variables ensures both efficiency and consistency, reducing the potential for discrepancies in multi-dimensional reporting environments. Experts in this domain recognize that thoughtful orchestration of calculation logic not only facilitates accurate reporting but also enhances operational agility, allowing organizations to respond rapidly to evolving business conditions.

Constructing and administering member lists is another critical aspect of Hyperion Financial Management mastery. Members, representing accounts, entities, or reporting classifications, form the structural backbone of financial analysis. Their creation, maintenance, and extraction must adhere to rigorous standards to ensure coherence across applications. Each member’s attributes influence the aggregation of financial data, the application of calculation rules, and the validity of analytical insights. Practitioners develop expertise in aligning these lists with business hierarchies, regulatory expectations, and reporting conventions, recognizing that errors or inconsistencies can significantly undermine the reliability of consolidated financial statements.

Shared Services within Hyperion Financial Management introduces layers of administrative sophistication that extend beyond technical configuration. Security management, encompassing users, groups, roles, and classes, requires meticulous design and ongoing oversight to safeguard sensitive information while enabling operational efficiency. Provisioning, assignment, and monitoring of access rights ensure that financial data remains protected and that accountability is maintained across transactional workflows. Lifecycle management services further augment operational capabilities, facilitating the migration of applications, metadata, and configurations between environments. This ensures that updates, enhancements, and deployments occur with minimal disruption, preserving data integrity and maintaining organizational continuity.

Application administration within Hyperion Financial Management integrates oversight, process control, and optimization. Copying applications, performing system tuning, and managing procedural controls are essential responsibilities that demand a combination of technical acumen and strategic judgment. Effective administrators anticipate potential bottlenecks, monitor performance indicators, and implement adjustments to maintain both stability and responsiveness. This dimension of proficiency is crucial not only for daily operations but also for supporting broader organizational objectives, ensuring that financial applications serve as reliable platforms for decision-making and regulatory compliance.

End-user functionalities form a critical interface between practitioners and operational data. Task lists, data grids, and data entry forms constitute the primary mechanisms through which financial information is recorded, tracked, and managed. The proper utilization of journals enables documentation of transactions, reconciliation of accounts, and creation of audit trails, providing transparency and accountability. Users adept at navigating these tools contribute significantly to organizational efficiency, translating operational activities into accurate financial representation and actionable insights.

Intercompany reporting introduces a further level of complexity within Hyperion Financial Management. Practitioners managing intercompany transactions must reconcile balances between entities, eliminate redundant entries, and ensure consistency across consolidated financial statements. This process demands precise calculation management, meticulous attention to dimensional hierarchies, and a comprehensive understanding of organizational relationships. The ability to perform intercompany eliminations and generate accurate consolidated results demonstrates advanced proficiency and underscores the strategic value of certification in a professional context.

Financial Reporting Studio extends the analytical capabilities of Hyperion Financial Management, providing sophisticated tools for report creation and presentation. Users employ relationship functions, advanced reporting features, and end-user customization to generate insights that inform managerial decision-making. These capabilities enable the translation of raw financial data into coherent narratives, allowing organizations to evaluate performance, identify trends, and formulate strategies with clarity. Supporting tools, including Financial Data Quality Management and extended analytics, reinforce these functions by validating data accuracy, monitoring input quality, and providing enhanced analytical frameworks for interpreting results.

Preparing for the Oracle 1Z0-532 certification requires a deliberate combination of education, practice, and practical application. Training programs focused on Hyperion Financial Management provide foundational knowledge, while simulated exercises and on-the-job practice cultivate the ability to apply concepts in complex operational contexts. Practitioners are encouraged to experiment with diverse scenarios, exploring application creation, metadata manipulation, calculation rules, and reporting strategies to reinforce learning. This iterative process, combining theoretical understanding with applied experience, ensures that candidates are not only knowledgeable but also adept at translating their expertise into effective financial management practices.

The certification itself serves as a benchmark of professional excellence, signaling to employers and peers the holder’s comprehensive understanding of Hyperion Financial Management 11. Mastery of application creation, metadata governance, EPMA deployment, data loading, calculation logic, member lists, shared services, administrative functions, end-user operations, intercompany reporting, and financial reporting tools positions professionals as valuable assets in complex organizational environments. The integration of technical proficiency with analytical insight allows certified practitioners to optimize financial processes, ensure compliance, and contribute meaningfully to strategic decision-making.

Real-world application of these competencies often involves intricate scenarios, such as configuring applications for multi-entity corporations, orchestrating EPMA deployments across several environments, and managing large-scale data imports while preserving dimensional hierarchies. Practitioners develop expertise in troubleshooting anomalies, reconciling discrepancies, and implementing calculation rules that reflect both regulatory mandates and internal business policies. The combination of meticulous planning, analytical reasoning, and operational execution defines the high level of skill validated by the Oracle 1Z0-532 certification.

The advanced capabilities of Hyperion Financial Management enable organizations to respond dynamically to evolving business landscapes. By leveraging calculation automation, intercompany reconciliation, and sophisticated reporting techniques, professionals ensure that financial insights are both timely and accurate. This responsiveness supports decision-making at executive levels, enhances the credibility of financial reports, and underpins strategic initiatives. Certification attests to the professional’s ability to harness these tools effectively, translating theoretical knowledge into actionable intelligence that drives organizational success.

Data quality management remains an underpinning concern throughout the application lifecycle. Ensuring that inputs are accurate, consistent, and validated prevents errors from propagating into critical calculations and reporting outputs. Practitioners employ verification procedures, cross-checking mechanisms, and reconciliation techniques to safeguard the integrity of financial information. Extended analytics further empowers users to detect trends, anomalies, and insights that inform operational adjustments, risk assessment, and strategic planning. This analytical depth distinguishes professionals who can combine technical mastery with insightful interpretation, enhancing the overall value delivered to their organizations.

Mastering Hyperion Financial Management 11 also encompasses understanding the interplay between technology and business processes. Effective practitioners recognize that application configuration, metadata structures, and calculation logic must align with organizational goals, regulatory frameworks, and reporting obligations. They cultivate a nuanced appreciation of operational workflows, ensuring that financial management systems not only function correctly but also support strategic imperatives. This holistic approach, blending technical, analytical, and operational perspectives, is central to the competencies validated by the Oracle 1Z0-532 examination.

The exam preparation journey emphasizes experiential learning, challenging candidates to apply knowledge in realistic contexts. Simulations involving application deployment, data import scenarios, calculation rule implementation, intercompany reconciliations, and report generation enable practitioners to consolidate their understanding while honing problem-solving skills. This experiential focus ensures that certified professionals are equipped to navigate the complexities of modern financial management, bridging the gap between theoretical instruction and practical execution.

Developing Expertise in Shared Services, Administration, and End-User Operations

The Oracle 1Z0-532 certification examines a professional's comprehensive understanding of Hyperion Financial Management, emphasizing both technical mastery and analytical acuity. Candidates preparing for this credential must develop the capability to navigate complex financial structures, optimize operational workflows, and deliver precise reporting outcomes. Advanced proficiency requires an integrated understanding of shared services, administration, data loading, calculation management, intercompany reporting, and financial reporting tools, all of which collectively underpin the functional depth of Hyperion Financial Management 11.

Shared services encompass the critical aspects of security and lifecycle management, forming the framework that protects sensitive financial data while enabling operational continuity. Within Hyperion Financial Management, security structures consist of users, groups, roles, and classes, each defined to manage access and maintain accountability across multiple functional areas. Practitioners must provision users and groups thoughtfully, assign appropriate classes, and configure permissions meticulously to prevent unauthorized access while allowing essential operational activities to proceed unhindered. Lifecycle management further augments these capabilities, enabling the seamless migration of artifacts, applications, and configurations between development, testing, and production environments. This continuous oversight ensures that organizational updates, system enhancements, and deployment processes are executed with precision, maintaining both functional integrity and operational reliability.

Application administration within Hyperion Financial Management integrates multiple responsibilities, ranging from system maintenance to performance optimization. Practitioners copy applications to facilitate testing, recovery, or deployment in new environments, ensuring that each iteration maintains alignment with operational standards and organizational policies. Process control mechanisms govern the execution of financial operations, supporting consistency and compliance. Tuning and optimization of applications demand both analytical insight and technical proficiency, requiring administrators to monitor system performance, identify potential bottlenecks, and implement corrective measures that enhance responsiveness and reliability. The ability to anticipate operational challenges and proactively adjust configurations reflects the advanced skills required for the Oracle 1Z0-532 certification.

End-user operations focus on the daily interface with financial data, encompassing task lists, data grids, data entry forms, and journals. Task lists guide users through routine operational activities, ensuring that transactions are recorded systematically and that workflow efficiency is maintained. Data grids provide dynamic views of financial data, allowing for quick entry, manipulation, and validation across multiple dimensions. Data entry forms facilitate structured recording of transactions, aligning with organizational hierarchies and reporting requirements. Journals document adjustments, reconciliations, and exceptional transactions, forming a critical audit trail and supporting financial transparency. Mastery of these tools enables end-users to contribute effectively to organizational reporting cycles while maintaining data integrity and operational precision.

Intercompany reporting presents an additional layer of complexity within Hyperion Financial Management. Organizations often consist of multiple entities engaging in internal transactions that must be reconciled and eliminated to produce consolidated financial statements. Practitioners skilled in intercompany reporting navigate this intricate landscape by applying calculation rules, analyzing transactional hierarchies, and ensuring alignment between related entities. The process involves careful monitoring of balances, elimination of redundant entries, and verification of resulting consolidation figures. The accuracy of intercompany reporting is vital to organizational transparency and compliance, underscoring the professional significance of proficiency in this area.

Financial Reporting Studio expands the analytical capabilities of Hyperion Financial Management by providing advanced report creation and customization features. Users employ relationship functions to generate reports that illuminate performance metrics, trends, and organizational insights. The reporting process involves translating raw financial data into structured narratives, ensuring clarity and coherence for managerial review. Practitioners leverage end-user customization to tailor reports to specific requirements, facilitating operational decisions and strategic planning. Supporting tools, including Financial Data Quality Management and extended analytics, enhance these functions by ensuring input data is validated, trends are identified, and potential anomalies are flagged, providing a comprehensive view of organizational financial health.

Data loading strategies within Hyperion Financial Management require both precision and adaptability. Native file formats facilitate structured imports, while alternative approaches accommodate diverse data sources and operational requirements. Practitioners perform data copying and clearing with meticulous attention to dimensional alignment and data integrity, ensuring that imported information adheres to system conventions and reporting hierarchies. These activities support testing, scenario modeling, and routine consolidation processes, highlighting the importance of methodical data management in sustaining accurate and reliable financial operations.

Calculation management, orchestrated through the Rules and Calculation Manager, is fundamental to automating complex financial operations. Practitioners define variables, subroutines, and functions that ensure consistency across dimensions and reporting cycles. These calculations encompass currency conversions, allocations, intercompany eliminations, and other essential processes. By invoking reusable functions and applying logic with precision, professionals maintain the integrity of financial results while optimizing efficiency. Advanced calculation strategies also facilitate scenario-based modeling, allowing organizations to simulate outcomes, evaluate strategic options, and respond to dynamic business conditions.

Constructing and managing member lists remains a critical component of Hyperion Financial Management proficiency. Members, representing accounts, entities, or reporting dimensions, must be defined, maintained, and extracted with accuracy. Each member's properties and relationships influence calculations, reporting, and data aggregation, underscoring the necessity for rigorous oversight. Practitioners develop expertise in aligning member lists with organizational hierarchies and reporting standards, ensuring that consolidated results reflect both operational realities and regulatory compliance.

Application deployment through EPM Architect introduces an additional dimension of operational sophistication. Unlike classic methodologies, EPMA provides a unified framework for defining dimensions, deploying applications, and maintaining consistency across multiple systems. Practitioners leverage EPMA to synchronize metadata, propagate changes across applications, and manage deployment schedules. This approach reduces redundancy, minimizes the risk of errors, and supports consistent governance across the enterprise. Understanding the interplay between EPMA and classic administration strategies equips professionals to optimize deployment processes, streamline application maintenance, and enhance overall system reliability.

End-user proficiency extends beyond basic interactions to encompass advanced reporting and interactivity. Users navigate task lists, data grids, and entry forms to capture operational transactions, while utilizing reporting tools to analyze and interpret financial outcomes. Journals document critical adjustments and reconciliations, providing transparency and audit readiness. Skilled users employ these tools to identify trends, detect anomalies, and contribute actionable insights to organizational decision-making. The capacity to integrate these functions with calculation logic, intercompany reporting, and data quality validation defines the advanced capabilities assessed by the Oracle 1Z0-532 certification.

Preparing for this certification involves a deliberate combination of structured training, experiential learning, and practical application. Training programs provide foundational knowledge of Hyperion Financial Management, while hands-on exercises and simulated scenarios cultivate the ability to apply concepts in complex environments. Practitioners engage with application creation, metadata management, data loading, calculation logic, member list construction, shared services, administration, end-user operations, intercompany reporting, and reporting studio capabilities. Iterative practice reinforces understanding, hones problem-solving skills, and ensures readiness for examination scenarios that assess both theoretical knowledge and practical application.

The Oracle Hyperion Financial Management Essentials credential validates a professional’s capacity to manage intricate financial operations with precision and insight. Mastery of shared services, administration, end-user operations, intercompany reporting, calculation strategies, and reporting tools enables practitioners to deliver accurate, timely, and insightful financial information. Certification signals to employers and colleagues that the individual possesses comprehensive knowledge, practical proficiency, and strategic understanding of Hyperion Financial Management 11. This expertise supports organizational decision-making, operational efficiency, regulatory compliance, and analytical rigor, reinforcing the value of certified professionals in complex financial landscapes.

Real-world application of these competencies often involves orchestrating multi-entity consolidations, deploying applications through EPMA, validating data integrity, and executing calculation rules across diverse scenarios. Practitioners encounter challenges such as reconciling intercompany balances, aligning dimensional hierarchies, optimizing performance, and generating insightful reports. The ability to navigate these complexities demonstrates advanced proficiency, highlighting the strategic significance of the Oracle 1Z0-532 certification and its role in establishing professional credibility.

Mastering the interrelationship between application configuration, data management, calculation logic, and reporting workflows is essential for professionals seeking to optimize Hyperion Financial Management environments. This integration ensures that operational processes are efficient, reporting outputs are accurate, and organizational insights are reliable. Professionals who excel in these areas possess the capacity to enhance financial transparency, support executive decision-making, and contribute meaningfully to strategic initiatives, illustrating the depth and breadth of expertise validated by the certification.

Advanced Practices in Data Quality, Reporting, and Application Optimization

The Oracle 1Z0-532 certification represents the pinnacle of professional validation for individuals seeking to demonstrate comprehensive expertise in Hyperion Financial Management 11. Beyond foundational application creation and metadata management, this credential examines the practitioner’s capability to implement, manage, and optimize sophisticated financial structures while ensuring data integrity, operational efficiency, and analytical precision. Achieving mastery in this environment requires an intricate understanding of shared services, administration, advanced calculation logic, intercompany reporting, and the extensive capabilities of Financial Reporting Studio.

Data quality management serves as the bedrock of effective financial operations within Hyperion Financial Management. Ensuring that inputs are consistent, accurate, and validated is critical for producing reliable results, particularly in multi-dimensional environments where calculations and consolidations depend on the integrity of hierarchical structures. Practitioners engage in rigorous validation procedures, cross-verifying data across entities, accounts, and reporting periods, while also leveraging automated reconciliation tools to detect anomalies. The discipline of maintaining clean, dependable data not only supports accurate reporting but also enhances strategic decision-making, enabling organizations to respond confidently to financial challenges and regulatory requirements.

Advanced calculation strategies are pivotal in managing complex financial scenarios. Through the Rules and Calculation Manager, practitioners define subroutines, variables, and functions that automate processes across multiple dimensions, including accounts, entities, time periods, and scenarios. Currency conversions, intercompany eliminations, allocations, and other intricate operations are orchestrated through precise logic, ensuring that consolidation and reporting cycles produce consistent and accurate outputs. Professionals develop the ability to design reusable functions and scalable calculation frameworks, allowing organizations to execute scenario-based modeling and simulate financial outcomes efficiently. Mastery of these calculations is essential not only for operational accuracy but also for providing insights that influence strategic decision-making and organizational planning.

Constructing and maintaining member lists constitutes another critical aspect of Hyperion Financial Management proficiency. Each member represents an account, entity, or reporting dimension and must be defined, updated, and extracted with meticulous attention to hierarchy and properties. The relationships among members affect both calculation results and reporting outputs, highlighting the importance of accuracy in every aspect of list management. Professionals adept in this area ensure that consolidated statements, financial analyses, and multidimensional reporting maintain structural coherence and reflect operational realities, thereby reducing errors and increasing confidence in organizational decision-making.

Shared services introduce an essential layer of operational governance within Hyperion Financial Management. Practitioners configure security structures encompassing users, groups, roles, and classes to ensure that sensitive data is protected while maintaining operational accessibility. Lifecycle management services complement these capabilities, facilitating the seamless migration of applications, metadata, and configuration artifacts between environments. By mastering these tools, professionals maintain organizational continuity, support system updates, and enable efficient deployment strategies. The integration of security and lifecycle management ensures that operational processes remain resilient, adaptable, and compliant with regulatory and corporate governance standards.

Administration in Hyperion Financial Management involves both operational oversight and performance optimization. Copying applications, tuning systems, and managing process controls are essential for maintaining responsiveness and stability. Experienced administrators anticipate potential bottlenecks, monitor system health, and implement adjustments to optimize performance. This proactive approach not only ensures smooth daily operations but also establishes the platform’s reliability for strategic financial planning, regulatory reporting, and organizational analytics. Expertise in this domain is validated through scenarios requiring comprehensive understanding of system architecture, operational constraints, and best practices for application management.

End-user operations represent the interface between financial management systems and organizational processes. Users interact with task lists, data grids, data entry forms, and journals to record, track, and reconcile financial transactions. Mastery of these tools ensures accuracy, completeness, and timeliness of data entry, supporting effective operational control and reporting. Journals provide a historical record of adjustments and exceptional transactions, contributing to audit readiness and transparency. Professionals capable of guiding and optimizing end-user operations enhance organizational efficiency, reducing errors while enabling decision-makers to rely on precise and actionable financial information.

Intercompany reporting introduces complexities that require careful attention to detail. Organizations with multiple entities must reconcile internal transactions, eliminate redundant entries, and ensure that consolidated financial statements accurately reflect overall performance. Practitioners leverage advanced calculation rules, dimensional hierarchies, and reporting frameworks to achieve this, demonstrating an ability to manage intricate financial relationships and produce results that align with both organizational goals and regulatory standards. The precision and efficiency of intercompany reporting are crucial for organizational credibility and operational cohesion.

Financial Reporting Studio amplifies the analytical power of Hyperion Financial Management, enabling professionals to create advanced reports that provide insight into organizational performance. Users employ relationship functions, customized layouts, and interactive reporting tools to produce coherent narratives from complex financial data. These reports serve multiple purposes, from operational monitoring to strategic planning, allowing leaders to make informed decisions based on accurate and timely information. The supporting tools, including Financial Data Quality Management and extended analytics, enhance report integrity, identify trends, and highlight potential anomalies, enabling deeper analysis and informed decision-making across the enterprise.

Application deployment through EPM Architect further strengthens operational capability. By defining dimensions, synchronizing metadata, and propagating changes across applications, practitioners ensure consistency, reduce redundancy, and maintain governance across multiple systems. EPMA supports both development and production environments, facilitating smooth transitions, updates, and expansions. Professionals skilled in EPMA manage these deployments with precision, coordinating updates and validating results to maintain system integrity and operational efficiency.

Preparation for the Oracle 1Z0-532 examination demands a comprehensive approach combining formal training, hands-on exercises, and practical experience. Candidates engage with scenarios that mirror real-world challenges, such as configuring applications, managing metadata, orchestrating data loads, implementing calculation rules, reconciling intercompany transactions, and generating advanced reports. This immersive practice ensures that candidates not only understand theoretical concepts but can apply them in operational contexts, reinforcing their readiness for the examination and subsequent professional responsibilities.

Practical experience in Hyperion Financial Management fosters the development of nuanced judgment and analytical capability. Professionals learn to anticipate potential data anomalies, optimize calculation frameworks, streamline reporting processes, and enhance system performance. They cultivate the capacity to analyze multidimensional data, identify operational inefficiencies, and propose solutions that improve both accuracy and efficiency. This depth of skill underscores the strategic value of certification, enabling professionals to contribute meaningfully to organizational success while distinguishing themselves in competitive professional environments.

The Oracle 1Z0-532 certification validates the individual’s ability to manage comprehensive financial systems, ensuring operational reliability, analytical accuracy, and regulatory compliance. Professionals who achieve this credential are recognized for their expertise in application creation, metadata management, calculation orchestration, shared services, administration, end-user operations, intercompany reporting, and advanced reporting. Their skills enable organizations to achieve transparency, operational efficiency, and strategic insight, transforming complex financial data into actionable intelligence. Certification signifies mastery of both the technical and functional aspects of Hyperion Financial Management 11, affirming the professional’s capacity to navigate intricate financial environments and deliver value through informed financial management practices.

Real-world application of these competencies includes configuring multi-entity consolidations, deploying applications using EPMA, managing extensive data imports, executing calculation frameworks, and producing sophisticated reports. Professionals face challenges such as reconciling intercompany balances, optimizing dimensional hierarchies, ensuring data quality, and validating outcomes against organizational objectives. Mastery of these challenges demonstrates the high level of proficiency assessed by the Oracle 1Z0-532 certification, reflecting both technical aptitude and strategic insight.

Conclusion

The certification journey reinforces the integration of technical mastery with operational and analytical skills. By managing application configurations, optimizing data workflows, applying calculation logic, and producing actionable reports, certified professionals enable organizations to respond to dynamic business environments with confidence. Their expertise supports compliance, transparency, and operational excellence, highlighting the strategic advantage of Hyperion Financial Management certification in a competitive professional landscape.

Achieving Oracle 1Z0-532 certification represents a culmination of rigorous preparation, practical application, and strategic insight. Professionals who earn this credential are well-equipped to manage complex financial systems, optimize operational processes, and generate actionable intelligence from multidimensional data. This mastery not only enhances individual career prospects but also delivers tangible benefits to organizations, including improved reporting accuracy, operational efficiency, and informed decision-making. The credential stands as a testament to expertise, dedication, and the capacity to excel in advanced financial management environments.