Exam Code: CAP

Exam Name: Certified Authorization Professional

Certification Provider: ISC

Corresponding Certification: CAP

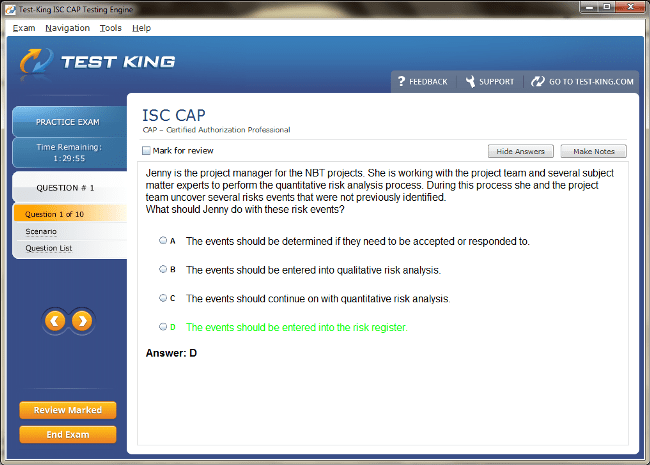

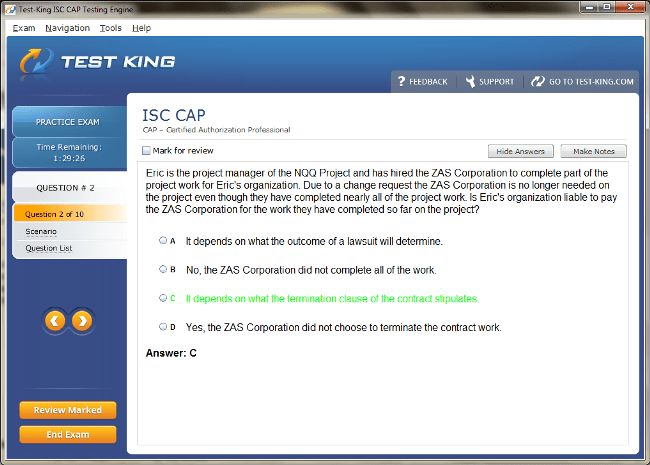

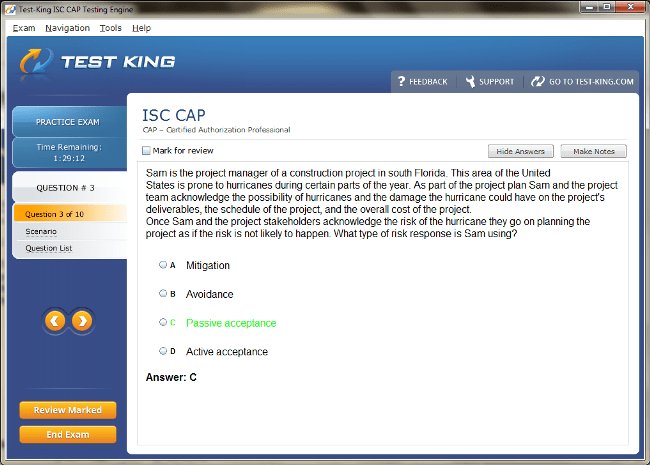

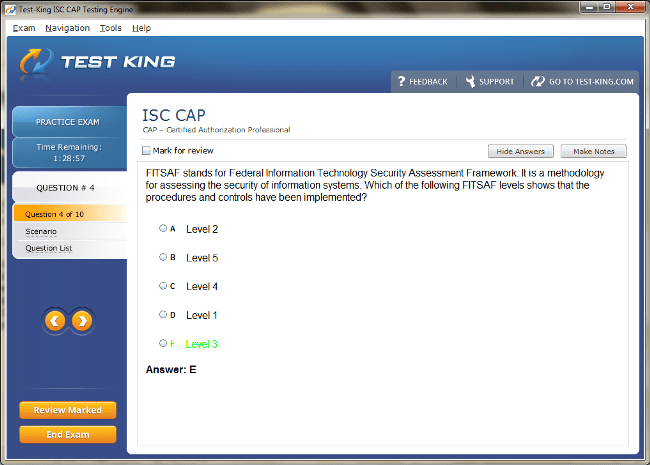

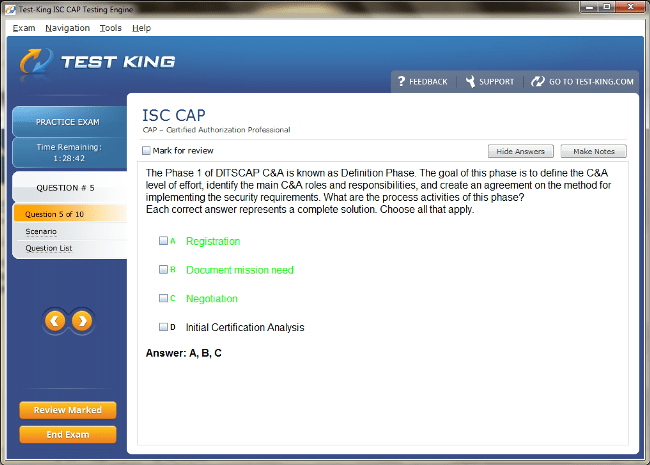

CAP Exam Product Screenshots

Product Reviews

Passed my dream test today and scored 965

"hey

Today I have passed CAP exam by scoring 965 marks. Though actual ISC CAP test was very much difficult but I attempted it easily because my preparations were really good. I would have failed in CAP CAP exam without good preparations, thanks to test-king CAP CAP study guide.

Wayne Parker"

Test-king is an ideal product for self study

"Before appearing for CAP exam I was a believer of joining an institute for regular preparations but I was wrong. My dad suggested me test-king test-engine for online preparations of ISC CAP exam. I was nervous in the beginning but as soon I started off my preparations I began to believe in my self. I would like to say thank you to test-king for the CAP CAP certification and also for the self confidence that test-king has given me.

Sincerely

Julia Campbell."

A Wonderful Product

"Test-king is efficient as the way it makes me use the knowledge it its real sense. It saves studying time and helps passing the CAP exam on the first try. Its methods are proven and efficient that it allowed me to overcome my weaknesses in ISC CAP exam. And I passed my CAP CAP exam in my first attempt.

A. Miller"

Always advantageous

"The day I bought test king CAP exam engine I have always been successful. Test king ISC CAP exam engine gives you maximum advantages by providing all the knowledge about every hardware and software we use every day. The biggest advantage I get from test king CAP CAP exam engine is obviously my increased learning level.

Tom Belau"

Brighten your life with test king

"Life is for once and don`t lose your strength in some unnecessary measures that you use to take during exams. Get yourself the most affordable product that is test king CAP exam engine. Test king ISC CAP exam engine will enlighten your life with the glow of its unlimited knowledge power. Test king CAP CAP exam engine is working marvelous for me, do try it yourself.

Sarah laureate"

Test King You Are Simply Fantastic.

"I thank dearest Test King for making me so confident and extremely sure of my CAP examination this time. After failing ISC CAP examination 4 times I lost all hope of ever clearing the examination and upgrading my qualifications but my mother really supported me and asked me to give it a try after using Test King’s exam preparation pack as many of the candidates produced marvelous results under its guidance. It was only after facing tremendous disappointment I came to realize the worth of Test King regarding CAP CAP exam preparation. I am certainly going to use Test King for all my future exam preparations as something as important as your career needs a lot of importance and caution and there is no way I am going to take any chances now. I say it from my personal experience that once you have your hands on Test King’s products there will be no need to use any other form of reference book as it is all sufficient and covers all the aspects of the subject in much detail. Trust me Test King is amazing!

Sarah Hillman."

needed technical knowledge; got at test-kings

"I always wanted better opportunities and options in order to promote my self at my working place. I was good at technical subjects so my boyfriend suggested me to appear for CAP exam. He also suggested me to prepare at test-king with ISC CAP study guide. Test-king CAP CAP exam study guide is truly an awesome product which has not only increased my knowledge but helped me in getting CAP certified.

Serena David"

Thumbs up test-king you are the best

"Hey test-king and entire team

I have no words to thank you for providing me with CAP training materials. I could have asked for no better help because most of the questions in ISC CAP real exam came from your training materials. I just not want to say thank you but also want to congratulate you and your entire team for designing such an outclass training material due to which I have passed with 91 percent in CAP CAP exam.

Thanks

Aaron Travis"

3 reasons to choose test-king study pack

"Hi to all the candidates of CAP exam

I took the ISC CAP exam last week, scored 945 out of 1000 and did my preparations by using test-king CAP CAP study pack.

I selected test-king CAP study guide because of perfect practice questions with explanations, great examples and perfect delivery. I will recommend you all test-king and will suggest you to look for these 3 qualities no matter whatever you choose.

Sarah Kevin"

Test king exam engine

"I have very tight schedule for my office as well as for the family. But I wanted to take CAP exam. For that matter I approached many exam guides for my exam preparation but I couldn’t find any from which I can prepare for my CAP CAP exam with the shortest possible time. One day, I landed on test king website and found their exam material very suitable for those who do not have much time for exam preparation. I bought their exam engine for my exam preparation and met with success.

Dan Park"

hi test king

"I used to take my own test every week. The good thing about those tests was that I was able to sharpen my skills. The bad thing was I used to loose the sheets in which I attempted the test. My worry is now over because test king CAP exam engine enables you to check the history of your exams. You just need to visit the home page of ISC CAP exam engine and click on details. You can also choose to delete history of specific exams. Test king CAP CAP exam engine is really one of its kinds. Great going guys. Warm wishes

Sara Glass"

A Remarkable Product

"I have been looking for a product line that would work for my CAP exam. Test-king is exactly what I've been looking for. This is just a wonderful product for ISC CAP exam. I’ve had a tough time trying to prepare myself for CAP CAP exam. And I must say, I really worked for me as it truly is a remarkable product.

Alex Chavarin"

No point in making things complicated

"I knew that getting a certificate on Cisco Sales expert test will add feather to my cap and help me get a jump in the office. But, getting it done made me worried as topics appeared very hard to me. Tried to crack it from the books, but the elaborate explanations didn't help much. Finally, came across with a test-king dump and it changed my perception about exam preparation. I could manage it well in time and felt elated to answer all the questions correctly. Great experience, test-king.

Kiara Mugabi

Kampala, Uganda"

CAP CAP Passed

"Test king exam products enhanced my abilities so that I passed the CAP CAP Exam in my first attempt. Test King Study Questions were right to the point. Material was covering the complete exam course and made me fully prepared. Thanks Again. Testking you are worth investing.Keep it up

Andrei Vicente"

I did it!

"If you have trust in Test king then failing CAP CAP exam is totally out of question. I can say this because I have used Test king's products myself and they proved to be a blast! I could not believe my eyes when I saw a perfect 1000 score in CAP CAP exam. I mean getting a perfect 1000 and that too in CAP CAP exam is next to impossible. Thanks Test king. I am really indebted to you!

John Truce"

My Score is 952

"I was amazed when i purchased Testking for the CAP CAP exam. The exam guide so relevant and helpful that i got all the questions in my exam. I was very glad to pass the exam in first attempt .All credit goes to test king team who impart their knowledge and experience to students by assissting them.

Sarah Michaels."

Frequently Asked Questions

How can I get the products after purchase?

All products are available for download immediately from your Member's Area. Once you have made the payment, you will be transferred to Member's Area where you can login and download the products you have purchased to your computer.

How long can I use my product? Will it be valid forever?

Test-King products have a validity of 90 days from the date of purchase. This means that any updates to the products, including but not limited to new questions, or updates and changes by our editing team, will be automatically downloaded on to computer to make sure that you get latest exam prep materials during those 90 days.

Can I renew my product if when it's expired?

Yes, when the 90 days of your product validity are over, you have the option of renewing your expired products with a 30% discount. This can be done in your Member's Area.

Please note that you will not be able to use the product after it has expired if you don't renew it.

How often are the questions updated?

We always try to provide the latest pool of questions, Updates in the questions depend on the changes in actual pool of questions by different vendors. As soon as we know about the change in the exam question pool we try our best to update the products as fast as possible.

How many computers I can download Test-King software on?

You can download the Test-King products on the maximum number of 2 (two) computers or devices. If you need to use the software on more than two machines, you can purchase this option separately. Please email support@test-king.com if you need to use more than 5 (five) computers.

What is a PDF Version?

PDF Version is a pdf document of Questions & Answers product. The document file has standart .pdf format, which can be easily read by any pdf reader application like Adobe Acrobat Reader, Foxit Reader, OpenOffice, Google Docs and many others.

Can I purchase PDF Version without the Testing Engine?

PDF Version cannot be purchased separately. It is only available as an add-on to main Question & Answer Testing Engine product.

What operating systems are supported by your Testing Engine software?

Our testing engine is supported by Windows. Andriod and IOS software is currently under development.

Top ISC Exams

- CISSP - Certified Information Systems Security Professional

- CCSP - Certified Cloud Security Professional (CCSP)

- SSCP - System Security Certified Practitioner (SSCP)

- CISSP-ISSAP - Information Systems Security Architecture Professional

- CISSP-ISSEP - Information Systems Security Engineering Professional

- CAP - Certified Authorization Professional

- CSSLP - Certified Secure Software Lifecycle Professional

- CISSP-ISSMP - Information Systems Security Management Professional

Understanding CAP Exam Scoring and Candidate Performance

Passing theCAP Exam demands a minimum score of seventy-five in each component. Many candidates often wonder how their performance is evaluated and what the reported numbers truly signify. The American Institute of Certified Public Accountants utilizes a scoring system ranging from zero to ninety-nine. It is crucial to understand that this number does not represent the percentage of correct answers, nor is it subject to any curving mechanism. Each answer is assessed meticulously to ensure fairness, consistency, and accuracy across all examinations administered throughout the year.

How CAP Exam Scores Are Calculated

When a candidate does not achieve a passing score, a Candidate Performance Report is issued. This report provides a comprehensive analysis of the candidate’s performance in the respective domain. It highlights areas of strength, areas needing improvement, and provides guidance on which topics require further focus. This evaluation is not merely a reflection of correct answers but is a detailed assessment that factors in the complexity and difficulty of each question.

The total score for the examination is derived from a combination of multiple-choice questions and task-based simulations. These components are weighted differently depending on the type of examination taken. The Core examinations, including Auditing and Attestation, Financial Accounting and Reporting, and Regulation, calculate the total score with fifty percent coming from multiple-choice questions and fifty percent from task-based simulations. In the case of Information Systems and Controls, the weighting is slightly different, with sixty percent of the score based on multiple-choice questions and forty percent on task-based simulations. This approach ensures that candidates are evaluated both for their conceptual understanding and their ability to apply knowledge in practical scenarios.

The process of computing the score is rigorous. Each response is evaluated not only for correctness but also for the relative difficulty of the question. Scaled scores are then calculated for multiple-choice questions and task-based simulations. These scaled scores are combined according to their respective weights to arrive at the reported score. This methodology ensures that performance is evaluated consistently, regardless of the specific exam form or testing period. Candidates are assessed based on their demonstrated competence rather than the randomness of question difficulty or the timing of their examination.

Candidate Performance Reports provide invaluable insight into performance patterns. They allow candidates to identify topics where they excel and those where additional preparation is necessary. The reports also give a clear picture of how each component contributed to the overall score. This information can be strategically used to improve preparation, focus study efforts, and increase the likelihood of success in subsequent attempts.

Candidate Performance Trends

The releases performance data on a quarterly basis. Although the examination is administered throughout the year, pass rates are reviewed periodically to provide insight into candidate preparedness and trends in achievement. These rates are not influenced by the difficulty of the exam at any given time but reflect the overall competence of candidates relative to an established standard. An increase in pass rates indicates that candidates are more effectively prepared rather than suggesting that the examination has become easier.

For the first quarter of the year 2025, the pass rate for the Auditing domain was forty-four point three percent. In the second quarter, it rose to forty-nine point zero five percent, resulting in a cumulative average of forty-six point nine two percent. The Financial Accounting and Reporting domain had a first-quarter pass rate of forty-one point six seven percent and a second-quarter rate of forty-three point five two percent, culminating in a cumulative average of forty-two point six six percent. Regulation saw slightly higher performance with sixty-two point zero three percent in the first quarter and sixty-three point five eight percent in the second, averaging sixty-two point eight nine percent. Candidates undertaking Business Environment and Concepts recorded a first-quarter pass rate of thirty-seven point six four percent and a second-quarter rate of forty-seven point two six percent, averaging forty-three point three two percent. Information Systems and Controls achieved sixty-one point two three percent in the first quarter and seventy-one point nine six percent in the second, resulting in an average of sixty-eight point six nine percent. Tax Compliance and Planning consistently showed the highest pass rates, with seventy-four point nine four percent in the first quarter and eighty point six three percent in the second quarter, leading to a cumulative seventy-eight point five seven percent.

Looking back at the preceding year, 2024, Auditing had quarterly pass rates starting at forty-four point six three percent in the first quarter and dipping slightly to forty-three point five four percent by the fourth quarter, averaging forty-five point seven nine percent across the year. Financial Accounting and Reporting began with forty-one point nine two percent and decreased to thirty-six point eight percent in the final quarter, averaging thirty-nine point five nine percent. Regulation maintained relatively high and stable performance, fluctuating from sixty-three point four three percent to sixty point five two percent, with a cumulative rate of sixty-two point six one percent. Business Environment and Concepts showed greater variation, ranging from forty-two point nine four percent in the first quarter to thirty-three point six eight percent in the last quarter, culminating in a cumulative thirty-eight point zero eight percent. Information Systems and Controls demonstrated progressive improvement from fifty point nine three percent in the first quarter to fifty-six point four percent in the fourth, averaging fifty-eight percent. Tax Compliance and Planning maintained consistently strong results, with quarterly rates from seventy-two point nine one percent to eighty-two point three six percent, for a cumulative seventy-three point nine one percent.

These statistics are not merely numbers but reflections of the evolving landscape of candidate preparation and readiness. They reveal how candidates respond to increasingly complex material, the effectiveness of study strategies, and the alignment between educational resources and examination expectations. Trends over time show the value of sustained preparation, strategic review of prior results, and careful attention to the nuances of exam content.

Insights from Candidate Performance Reports

When candidates fail to achieve the minimum passing score, the Candidate Performance Report becomes a vital tool for self-assessment. This document provides detailed feedback on strengths and weaknesses, offering guidance on which areas require further study. It emphasizes critical skills, analytical reasoning, and practical application. Candidates can track patterns across multiple attempts, helping to refine study techniques and target weaker areas more efficiently.

The reports also highlight how each component—multiple-choice questions and task-based simulations—impacted the overall score. By understanding the scoring breakdown, candidates can better allocate study time, practice under realistic conditions, and build competence in weaker domains. These insights foster a more methodical and evidence-based approach to preparation, improving both efficiency and effectiveness in learning.

The combination of quarterly pass rate data and detailed Candidate Performance Reports provides a comprehensive view of performance expectations. Candidates gain insight into the broader trends affecting success and can benchmark their progress against national standards of competence. Over time, this information cultivates a more sophisticated understanding of the examination’s structure, scoring methodology, and performance metrics.

The Weighting of Multiple-Choice Questions and Task-Based Simulations

The total reported score for each examination is calculated using a weighted combination of multiple-choice questions and task-based simulations. For most domains, these weights are evenly split, ensuring that both theoretical understanding and practical application are equally valued. In Information Systems and Controls, however, the weight is adjusted to reflect the nature of the content, with a greater emphasis on multiple-choice questions.

Multiple-choice questions are scaled based on correctness and the relative difficulty of each item, ensuring consistency across different examination forms. Task-based simulations assess the candidate’s ability to apply knowledge to realistic scenarios, requiring analytical thinking, problem-solving, and effective time management. The scaled scores from both components are then combined to produce the final reported score. This methodology guarantees that candidates are evaluated holistically, reflecting both knowledge mastery and practical competence.

By carefully considering the contribution of each component, candidates can develop a more nuanced understanding of their own performance and focus their preparation more effectively. The weighted scoring system underscores the importance of comprehensive study and reinforces the need to balance conceptual knowledge with applied skills.

Analyzing Performance Across Time

The performance of candidates in theCAP Exam provides a wealth of insight into preparation strategies, mastery of material, and the overall difficulty of the examinations. The American Institute of Certified Public Accountants releases pass rates on a quarterly basis, reflecting the proportion of candidates who successfully achieve the minimum score of seventy-five in each evaluated domain. It is crucial to note that these pass rates are not indicative of variable exam difficulty at different times; rather, they demonstrate how effectively candidates are prepared relative to a consistent benchmark of competence. Higher pass rates over time signify that candidates are more strategically prepared, rather than suggesting that the examinations have become inherently easier.

For instance, in the first quarter of the year 2025, candidates attempting the Auditing domain achieved a pass rate of forty-four point three percent. By the second quarter, this rate increased to forty-nine point zero five percent, resulting in a cumulative average of forty-six point nine two percent. Financial Accounting and Reporting, which often challenges candidates with intricate accounting principles and technical computations, began with a pass rate of forty-one point six seven percent in the first quarter and improved to forty-three point five two percent in the second, averaging forty-two point six six percent cumulatively. Regulation, encompassing taxation and compliance rules, saw a first-quarter pass rate of sixty-two point zero three percent, slightly increasing to sixty-three point five eight percent in the second quarter, yielding an overall average of sixty-two point eight nine percent.

Candidates exploring Business Environment and Concepts demonstrated variable outcomes, with a first-quarter pass rate of thirty-seven point six four percent and a second-quarter performance of forty-seven point two six percent, giving a cumulative rate of forty-three point three two percent. Information Systems and Controls, which tests both conceptual knowledge and practical analytical application, recorded sixty-one point two three percent in the first quarter and seventy-one point nine six percent in the second quarter, leading to a cumulative sixty-eight point six nine percent. Tax Compliance and Planning consistently exhibited the highest rates of success, with seventy-four point nine four percent of candidates passing in the first quarter and eighty point six three percent in the second quarter, culminating in an average of seventy-eight point five seven percent.

Reflecting on the prior year, 2024, reveals similar trends with more granular quarterly variation. Auditing pass rates began at forty-four point six three percent in the first quarter, peaked at forty-seven point eight percent in the third quarter, and slightly decreased to forty-three point five four percent in the fourth quarter, producing a cumulative forty-five point seven nine percent. Financial Accounting and Reporting exhibited a gradual decline, starting at forty-one point nine two percent and descending to thirty-six point eight percent in the final quarter, for a cumulative average of thirty-nine point five nine percent. Regulation maintained stability, with quarterly rates ranging from sixty-three point four three percent to sixty point five two percent, resulting in a cumulative sixty-two point six one percent. Business Environment and Concepts showed wider variation, with a high of forty-two point nine four percent in the first quarter and a low of thirty-three point six eight percent in the fourth, producing a cumulative average of thirty-eight point zero eight percent. Information Systems and Controls experienced steady improvement, rising from fifty point nine three percent in the first quarter to fifty-six point four percent in the last, for an annual average of fifty-eight percent. Tax Compliance and Planning exhibited remarkable consistency, with quarterly pass rates between seventy-two point nine one percent and eighty-two point three six percent, resulting in an overall cumulative of seventy-three point nine one percent.

These figures illustrate not only the challenges inherent in each domain but also the evolving preparation methods employed by candidates. Trends over multiple years highlight the importance of sustained study, adaptive strategies, and engagement with diverse learning materials. Candidates who methodically analyze past performance data are better able to anticipate the conceptual and practical demands of the examinations, enabling targeted preparation and improved outcomes.

The Role of Candidate Performance Reports

Candidate Performance Reports provide a detailed evaluation of an individual’s strengths and weaknesses. When a candidate does not achieve a passing score, the report offers a breakdown of the relative success across different areas, highlighting topics that require additional focus. These insights extend beyond mere correctness, revealing competencies in analytical reasoning, practical application, and time management.

The report elucidates how both multiple-choice questions and task-based simulations contribute to the final score. By understanding the weighting of each component, candidates can develop a strategic approach to studying. Multiple-choice questions often test knowledge recall, comprehension, and application of concepts, while task-based simulations assess the candidate’s ability to interpret complex information, make decisions, and execute processes under realistic scenarios. The scaled combination of these two components ensures that the reported score reflects a holistic measure of proficiency.

Candidates benefit from reviewing trends identified in their performance reports. Patterns that appear across multiple attempts can reveal recurring challenges, indicating areas where further conceptual reinforcement or practical practice is necessary. These insights allow candidates to tailor their preparation, allocate time efficiently, and improve both confidence and capability in future examinations.

Historical and Contextual Observations

The quarterly and annual pass rates offer a broader context for understanding examination trends. For example, consistent high pass rates in Tax Compliance and Planning suggest that candidates have developed effective methods for mastering procedural knowledge and problem-solving techniques. Conversely, lower pass rates in domains such as Business Environment and Concepts highlight the complexity and nuance involved in understanding organizational frameworks, risk management, and governance principles.

Historical trends also provide valuable guidance for educators and training providers. By examining how pass rates fluctuate across quarters and years, instructors can adjust curricula, emphasize particularly challenging topics, and implement innovative teaching methodologies. These data-driven approaches enhance the alignment between instruction and examination expectations, ultimately contributing to higher candidate success rates.

The steady rise in Information Systems and Controls pass rates over several years demonstrates the increasing familiarity of candidates with technology-driven applications, controls, and analytical processes. As digitalization transforms accounting and finance practices, candidates who develop competencies in systems analysis, data interpretation, and cybersecurity considerations are better positioned to achieve high performance.

Interpreting Cumulative Performance

Cumulative performance averages offer a lens through which the broader landscape of candidate preparedness can be viewed. They account for the variations across quarters, providing an overall measure of competence. Candidates who examine these cumulative averages gain perspective on typical performance benchmarks, enabling realistic goal-setting and expectation management.

For example, a cumulative average of forty-six point nine two percent in Auditing in 2025 suggests that nearly half of the candidates successfully met the minimum competence threshold. In contrast, the cumulative seventy-eight point five seven percent in Tax Compliance and Planning indicates that a significant majority of candidates are able to master the procedural and analytical requirements of the domain. Understanding these distinctions helps candidates prioritize their preparation focus, anticipate difficulty levels, and approach each examination with informed strategies.

Candidate performance reports, when combined with cumulative pass rate data, create a comprehensive picture of individual and collective performance. They serve as both a diagnostic tool and a predictive guide. Candidates who integrate these insights into their study plans are more likely to allocate resources effectively, practice under realistic conditions, and cultivate the analytical acumen necessary for success.

Preparing for Fluctuations in Performance

Although theCAP Exam maintains consistent standards, individual candidate experiences may vary due to factors such as background knowledge, prior experience, study methodology, and exam-taking strategies. Understanding the fluctuations reflected in quarterly data empowers candidates to develop adaptive study plans. By recognizing that a dip in pass rates may occur despite consistent preparation, candidates can focus on incremental improvement rather than be discouraged by temporal variations.

Preparation strategies must be multifaceted. Engaging with practice questions, reviewing candidate performance reports, and analyzing historical trends allow for a layered understanding of both content and context. Effective time management, comprehension of exam objectives, and the ability to apply theoretical knowledge in practical scenarios are all critical to achieving a passing score.

Candidates who proactively study historical trends and past performance reports gain a significant advantage. They are able to anticipate challenging areas, practice targeted exercises, and simulate examination conditions to build confidence. This strategic approach, combined with disciplined study habits, greatly enhances the likelihood of achieving high scores across all domains of theCAP Exam.

The Importance of Holistic Evaluation

TheCAP Exam evaluates candidates through both multiple-choice questions and task-based simulations, which together provide a holistic measure of professional competence. The interplay between conceptual understanding and practical application ensures that passing candidates demonstrate the ability to not only recall information but also to apply it effectively in professional scenarios.

By analyzing candidate performance data alongside cumulative averages and performance reports, aspirants can appreciate the breadth of skills required. They learn to navigate complex problems, integrate knowledge from various domains, and demonstrate decision-making skills under time constraints. This holistic evaluation underscores the importance of comprehensive preparation and continual refinement of both theoretical and practical capabilities.

Detailed Analysis of Candidate Outcomes

The evaluation of candidate performance in theCAP Exam offers profound insight into preparation strategies, competence levels, and trends in mastery of professional knowledge. The American Institute of Certified Public Accountants provides performance metrics on a quarterly basis, reflecting the proportion of candidates who attain a passing score of seventy-five or higher in each evaluated domain. These performance metrics are not influenced by changes in exam difficulty but rather provide a measure of how effectively candidates are prepared relative to a standardized benchmark of competence. Fluctuations in pass rates over time primarily indicate improvements in candidate preparation or alterations in study methods, rather than any inherent easing or intensification of the examinations.

During the first quarter of 2025, candidates undertaking the Auditing domain achieved a pass rate of forty-four point three percent. This improved to forty-nine point zero five percent in the second quarter, resulting in a cumulative performance average of forty-six point nine two percent. Financial Accounting and Reporting, known for its complexity in principles, rules, and computation, started with a pass rate of forty-one point six seven percent and rose to forty-three point five two percent in the second quarter, culminating in a cumulative average of forty-two point six six percent. Regulation, which encompasses taxation, legal compliance, and professional standards, maintained strong outcomes, beginning at sixty-two point zero three percent in the first quarter and slightly increasing to sixty-three point five eight percent in the second, yielding an overall cumulative of sixty-two point eight nine percent.

Candidates engaging with Business Environment and Concepts demonstrated varying outcomes, achieving thirty-seven point six four percent in the first quarter and forty-seven point two six percent in the second, for a cumulative average of forty-three point three two percent. Information Systems and Controls, which tests both conceptual understanding and practical analytical abilities, recorded sixty-one point two three percent in the first quarter and seventy-one point nine six percent in the second, resulting in a cumulative sixty-eight point six nine percent. Tax Compliance and Planning exhibited the highest success rates, with seventy-four point nine four percent of candidates passing in the first quarter and eighty point six three percent in the second, averaging seventy-eight point five seven percent.

A review of 2024 data illustrates similar trends with a broader range of quarterly fluctuations. Auditing began with forty-four point six three percent in the first quarter, peaking at forty-seven point eight percent in the third, and declining slightly to forty-three point five four percent in the fourth, resulting in a cumulative forty-five point seven nine percent. Financial Accounting and Reporting displayed a gradual decline from forty-one point nine two percent to thirty-six point eight percent, yielding a cumulative average of thirty-nine point five nine percent. Regulation demonstrated relative stability with quarterly outcomes between sixty-three point four three percent and sixty point five two percent, producing a cumulative sixty-two point six one percent. Business Environment and Concepts ranged from forty-two point nine four percent in the first quarter to thirty-three point six eight percent in the fourth quarter, with a cumulative average of thirty-eight point zero eight percent. Information Systems and Controls steadily improved from fifty point nine three percent to fifty-six point four percent, averaging fifty-eight percent over the year. Tax Compliance and Planning maintained consistency and excellence, fluctuating between seventy-two point nine one percent and eighty-two point three six percent, resulting in a cumulative seventy-three point nine one percent.

These performance outcomes reveal not only the rigor and complexity of the examinations but also the adaptive strategies of candidates. Trends indicate that candidates who employ methodical study routines, integrate feedback from prior performance, and balance conceptual comprehension with practical application demonstrate higher rates of success. Over multiple years, these patterns underscore the importance of continuous engagement with learning materials, refinement of analytical skills, and strategic preparation approaches.

Understanding Candidate Performance Reports

Candidate Performance Reports provide a granular analysis of individual performance, especially when a passing score is not attained. These reports delineate strengths, weaknesses, and areas necessitating additional study. Rather than merely presenting the number of correct answers, the reports offer insight into conceptual understanding, analytical reasoning, and applied knowledge. They also indicate the contribution of multiple-choice questions and task-based simulations to the total reported score.

Multiple-choice questions evaluate comprehension, recall, and conceptual application, while task-based simulations measure the ability to interpret complex information, make judgments, and implement processes in realistic scenarios. The scaled scores of these components are then combined based on predetermined weightings to determine the final score. By reviewing the Candidate Performance Reports, candidates gain clarity on which areas require intensified focus and which skills are already well-developed, enabling strategic allocation of study efforts.

Repeated analysis of performance reports across multiple attempts helps candidates detect recurring challenges. Identifying patterns in performance allows for targeted practice, refinement of weak skills, and enhancement of test-taking strategies. These insights are invaluable in cultivating both confidence and competence, ensuring a more comprehensive mastery of professional knowledge.

Historical and Longitudinal Trends

Examining historical trends reveals not only fluctuations in pass rates but also the evolution of candidate preparedness and pedagogical approaches. For instance, consistent high pass rates in Tax Compliance and Planning demonstrate the increasing effectiveness of study strategies for procedural knowledge, legal application, and analytical reasoning. Conversely, lower pass rates in Business Environment and Concepts highlight the intricacies involved in understanding governance frameworks, organizational strategy, and risk assessment.

Historical pass rates also serve as valuable feedback for instructors, training providers, and educational institutions. By understanding how outcomes vary across quarters and years, educators can adjust instructional methodologies, emphasize challenging topics, and employ innovative teaching techniques. Such data-driven approaches contribute to more effective learning, better alignment with exam expectations, and improved candidate performance over time.

Information Systems and Controls demonstrates the impact of technological evolution on examination performance. Candidates increasingly encounter complex systems, control environments, and digital analytical tools, requiring proficiency in areas such as cybersecurity, system evaluation, and data interpretation. The gradual improvement in pass rates over several years reflects both growing familiarity with technology-based applications and enhanced instructional resources addressing these competencies.

Interpreting Cumulative Performance Averages

Cumulative averages provide a lens through which the overall performance landscape can be assessed. They account for variations across quarters and offer insight into typical success rates among candidates. For example, a cumulative average of forty-six point nine two percent in Auditing in 2025 indicates that nearly half of the candidates successfully met the competence threshold. In contrast, the cumulative seventy-eight point five seven percent in Tax Compliance and Planning reveals that a significant majority of candidates were able to master both conceptual and procedural requirements effectively.

Understanding these cumulative averages assists candidates in setting realistic expectations and structuring preparation strategies. By comparing individual performance against broader trends, aspirants can identify realistic benchmarks for success, focus their study on domains where performance historically lags, and adopt evidence-based strategies for improvement.

Strategies for Navigating Performance Fluctuations

Even though the examination maintains consistent standards, individual candidate experiences may vary due to background knowledge, prior exposure, study methodology, and exam-taking techniques. Awareness of historical fluctuations empowers candidates to adopt adaptive strategies. A temporary decline in pass rates does not necessarily indicate a lack of preparation; rather, it underscores the importance of continuous, targeted, and strategic study.

Successful preparation encompasses multiple approaches. Practice with real-world problem scenarios, review of Candidate Performance Reports, and analysis of historical trends allow candidates to refine both conceptual understanding and practical application. Time management, comprehension of objectives, and the ability to navigate complex tasks are critical for achieving a passing score. Candidates who integrate historical trends and individualized feedback into their preparation gain a strategic advantage, enabling more confident and effective performance.

The Importance of Holistic Evaluation

TheCAP Exam’s structure emphasizes a comprehensive assessment of candidate competence. Multiple-choice questions test foundational knowledge and conceptual understanding, while task-based simulations evaluate the practical application of skills in realistic contexts. This holistic evaluation ensures that passing candidates demonstrate both theoretical mastery and applied proficiency, essential for professional practice.

By integrating performance reports, historical trends, and cumulative averages, candidates can cultivate a comprehensive understanding of their strengths, weaknesses, and areas requiring focus. This holistic perspective facilitates targeted preparation, strategic prioritization of study efforts, and development of critical analytical skills necessary for success in professional practice.

Candidate Performance Metrics and Trends

TheCAP Exam, administered throughout the year, evaluates professional competence across multiple domains. Candidates must achieve a minimum score of seventy-five to pass, and their performance is measured with meticulous precision. Pass rates, released quarterly, reflect the proportion of candidates meeting the required standard of competence. These figures are not influenced by changes in difficulty but are indicators of preparedness, study effectiveness, and the ability to apply knowledge in practical contexts.

In the first quarter of 2025, candidates taking the Auditing domain achieved a pass rate of forty-four point three percent. By the second quarter, this improved to forty-nine point zero five percent, resulting in a cumulative average of forty-six point nine two percent. Financial Accounting and Reporting started at forty-one point six seven percent and increased to forty-three point five two percent in the second quarter, with a cumulative performance of forty-two point six six percent. Regulation, encompassing taxation, legal compliance, and professional standards, recorded sixty-two point zero three percent in the first quarter and sixty-three point five eight percent in the second quarter, culminating in a cumulative sixty-two point eight nine percent.

Candidates exploring Business Environment and Concepts faced more variable outcomes. In the first quarter, thirty-seven point six four percent of candidates passed, improving to forty-seven point two six percent in the second quarter, producing a cumulative average of forty-three point three two percent. Information Systems and Controls, which evaluates both conceptual understanding and practical analysis, showed a pass rate of sixty-one point two three percent in the first quarter and seventy-one point nine six percent in the second, with a cumulative sixty-eight point six nine percent. Tax Compliance and Planning consistently demonstrated the highest success rates, with seventy-four point nine four percent in the first quarter and eighty point six three percent in the second, leading to a cumulative seventy-eight point five seven percent.

Reviewing 2024 provides additional context. Auditing began with forty-four point six three percent in the first quarter, peaked at forty-seven point eight percent in the third, and declined to forty-three point five four percent in the fourth quarter, yielding a cumulative forty-five point seven nine percent. Financial Accounting and Reporting declined steadily from forty-one point nine two percent to thirty-six point eight percent, resulting in a cumulative thirty-nine point five nine percent. Regulation maintained stability with quarterly outcomes ranging from sixty-three point four three percent to sixty point five two percent, producing a cumulative sixty-two point six one percent. Business Environment and Concepts fluctuated between forty-two point nine four percent in the first quarter and thirty-three point six eight percent in the fourth, culminating in a cumulative thirty-eight point zero eight percent. Information Systems and Controls increased from fifty point nine three percent to fifty-six point four percent, averaging fifty-eight percent for the year. Tax Compliance and Planning remained strong, with rates varying from seventy-two point nine one percent to eighty-two point three six percent, resulting in a cumulative seventy-three point nine one percent.

These statistics highlight the rigorous nature of the examinations and the importance of comprehensive preparation. Candidates who demonstrate sustained study, strategic planning, and a balanced approach between theoretical comprehension and practical application tend to achieve higher success rates. Trends across multiple years indicate that preparation methods evolve, reflecting improvements in candidate resources, study strategies, and familiarity with exam content.

Candidate Performance Reports and Their Role

Candidate Performance Reports provide essential feedback for individuals who do not achieve the minimum passing score. These reports offer detailed insights into strengths, weaknesses, and areas requiring additional focus. They extend beyond the tally of correct answers, evaluating analytical reasoning, conceptual understanding, and the ability to apply knowledge in realistic scenarios.

The reports explain the contribution of multiple-choice questions and task-based simulations to the total score. Multiple-choice questions test knowledge recall, comprehension, and application of theoretical principles, while task-based simulations assess decision-making, problem-solving, and practical application of accounting and financial knowledge. The combination of scaled scores from these two components, weighted according to exam design, results in the final reported score.

Repeated review of performance reports allows candidates to identify recurring challenges and patterns across multiple attempts. This analysis supports targeted practice, more effective allocation of study time, and refinement of test-taking strategies. Candidates who integrate these insights into their preparation gain a distinct advantage, as they can focus on areas of weakness while reinforcing existing strengths.

Historical Perspectives and Longitudinal Insights

Examining historical data provides insight into broader trends in candidate performance. Pass rates in Tax Compliance and Planning consistently rank highest, indicating effective preparation strategies and familiarity with procedural and analytical requirements. Conversely, domains such as Business Environment and Concepts reveal the complexities involved in mastering organizational strategy, governance, and risk assessment principles.

Educators and training providers also benefit from analyzing longitudinal trends. By understanding how candidate performance evolves across quarters and years, instructors can adapt curriculum design, highlight challenging topics, and develop innovative teaching methodologies. Data-driven instruction ensures alignment with exam expectations and fosters better candidate outcomes.

Information Systems and Controls illustrates the impact of technological advancement on examination performance. The steady improvement in pass rates over time reflects increasing candidate competence in analyzing system environments, implementing control measures, and interpreting digital data. As the profession continues to integrate technology into accounting and finance, candidates equipped with both conceptual understanding and applied technical skills perform more successfully.

Interpreting Cumulative Averages

Cumulative averages provide a comprehensive view of candidate success over a given year. They account for variations across quarters and offer perspective on overall trends. For example, a cumulative average of forty-six point nine two percent in Auditing in 2025 indicates that nearly half of the candidates met the required competence threshold. In contrast, the cumulative seventy-eight point five seven percent in Tax Compliance and Planning demonstrates that the majority of candidates consistently achieve high levels of mastery in this domain.

Cumulative averages help candidates set realistic goals and benchmark their progress against national performance standards. By understanding these averages, aspirants can focus on areas that historically exhibit lower success rates and prioritize their study time accordingly. These insights also enable candidates to approach examination preparation strategically, emphasizing both efficiency and depth of understanding.

Strategies for Navigating Performance Variability

While theCAP Exam maintains consistent standards, individual candidate experiences can vary due to prior knowledge, study methodology, and exam-taking techniques. Awareness of performance trends allows candidates to develop adaptive strategies and maintain motivation despite temporary fluctuations in pass rates. A decline in outcomes does not necessarily indicate poor preparation; rather, it highlights the importance of continuous refinement and targeted study.

Effective preparation requires multifaceted strategies. Candidates benefit from practicing realistic scenarios, analyzing performance reports, and reviewing historical trends to anticipate areas of challenge. Mastery of time management, conceptual understanding, and application skills is essential to achieving the minimum passing score. Candidates who combine historical analysis with individualized feedback gain a strategic advantage, enabling them to approach examinations with confidence and clarity.

Holistic Evaluation of Candidate Competence

TheCAP Exam evaluates both conceptual understanding and practical application through multiple-choice questions and task-based simulations. This holistic approach ensures that candidates demonstrate professional competence in a comprehensive manner. Multiple-choice questions assess knowledge, comprehension, and theoretical application, while task-based simulations evaluate problem-solving, analytical reasoning, and decision-making in realistic professional contexts.

By integrating insights from performance reports, cumulative averages, and historical trends, candidates develop a nuanced understanding of their capabilities. This approach supports strategic study planning, effective allocation of preparation time, and refinement of analytical skills. Ultimately, it enables candidates to achieve balanced proficiency across all evaluated domains, ensuring readiness for professional practice.

Candidate Performance Metrics and Historical Trends

TheCAP Exam serves as a definitive measure of professional competence for accounting and finance professionals. Success requires attaining a minimum score of seventy-five, and candidates are evaluated with meticulous precision to ensure consistency and fairness. Quarterly pass rates reflect the proportion of candidates who meet or exceed this threshold, providing valuable insight into preparation strategies and overall readiness. These rates are independent of variations in exam difficulty and instead indicate the effectiveness of study methods, familiarity with content, and the ability to apply knowledge in practical scenarios.

In the first quarter of 2025, the Auditing domain saw a pass rate of forty-four point three percent. By the second quarter, this improved to forty-nine point zero five percent, resulting in a cumulative average of forty-six point nine two percent. Financial Accounting and Reporting, which is often considered one of the most technically demanding domains due to its complex accounting principles and computations, began with a pass rate of forty-one point six seven percent and rose to forty-three point five two percent in the second quarter, giving a cumulative performance of forty-two point six six percent. Regulation, encompassing taxation, compliance, and professional standards, recorded sixty-two point zero three percent in the first quarter and sixty-three point five eight percent in the second quarter, leading to a cumulative sixty-two point eight nine percent.

Business Environment and Concepts exhibited variability, with thirty-seven point six four percent of candidates passing in the first quarter and forty-seven point two six percent in the second, resulting in a cumulative average of forty-three point three two percent. Information Systems and Controls, which tests both conceptual understanding and practical application of technology-driven processes, had a first-quarter pass rate of sixty-one point two three percent and a second-quarter rate of seventy-one point nine six percent, resulting in a cumulative sixty-eight point six nine percent. Tax Compliance and Planning consistently achieved the highest success rates, with seventy-four point nine four percent in the first quarter and eighty point six three percent in the second, yielding a cumulative seventy-eight point five seven percent.

Examining the prior year, 2024, further illustrates historical trends. Auditing began at forty-four point six three percent, peaked at forty-seven point eight percent in the third quarter, and slightly declined to forty-three point five four percent in the fourth, producing a cumulative forty-five point seven nine percent. Financial Accounting and Reporting showed a steady decline from forty-one point nine two percent to thirty-six point eight percent, resulting in a cumulative thirty-nine point five nine percent. Regulation remained relatively stable, ranging between sixty-three point four three percent and sixty point five two percent, yielding a cumulative sixty-two point six one percent. Business Environment and Concepts fluctuated from forty-two point nine four percent to thirty-three point six eight percent, producing a cumulative thirty-eight point zero eight percent. Information Systems and Controls rose from fifty point nine three percent to fifty-six point four percent, averaging fifty-eight percent. Tax Compliance and Planning consistently maintained strong outcomes, varying between seventy-two point nine one percent and eighty-two point three six percent, with a cumulative seventy-three point nine one percent.

These data demonstrate the rigorous nature of theCAP Exam and underscore the importance of methodical preparation, strategic study plans, and balancing theoretical understanding with practical application. Candidates who engage in sustained study, refine their test-taking strategies, and address both conceptual and applied components of the Exam tend to achieve higher success rates over time.

Candidate Performance Reports and Their Importance

Candidate Performance Reports provide an in-depth evaluation of performance, particularly for those who do not meet the passing threshold. These reports detail strengths, weaknesses, and areas requiring additional focus, extending beyond simple metrics of correct answers to examine analytical reasoning, conceptual understanding, and the ability to apply knowledge to realistic professional scenarios.

Multiple-choice questions are designed to assess comprehension, knowledge recall, and the ability to apply principles accurately. Task-based simulations evaluate decision-making, problem-solving, and the application of accounting, auditing, and compliance concepts in practical contexts. The final reported score is derived from a weighted combination of these components, ensuring a fair and comprehensive measure of candidate competence.

By analyzing these reports across multiple attempts, candidates can identify recurring challenges, monitor improvement, and refine their strategies. Patterns revealed through this analysis highlight areas requiring further study, allowing candidates to allocate preparation time efficiently and strengthen both theoretical knowledge and practical application skills. Candidates who integrate insights from performance reports into their study approach are more likely to develop confidence and achieve passing scores across all domains.

Historical and Longitudinal Perspectives

Analyzing historical data provides context for understanding broader trends in candidate performance. Tax Compliance and Planning consistently demonstrates high pass rates, reflecting effective study methods and mastery of procedural knowledge. In contrast, Business Environment and Concepts often exhibits lower pass rates, emphasizing the complexities of governance, organizational strategy, and risk management concepts.

Longitudinal analysis benefits educators and training providers by revealing trends that inform instructional methods. Understanding how pass rates evolve over time allows instructors to adjust curricula, emphasize difficult topics, and implement innovative teaching techniques. This evidence-based approach ensures alignment between instruction and exam expectations, ultimately supporting higher candidate achievement.

Information Systems and Controls highlights the growing significance of technology and analytical skills in professional practice. The steady improvement in pass rates over time indicates increased candidate familiarity with digital systems, control frameworks, and data interpretation. As the profession increasingly relies on technology-driven processes, candidates proficient in both conceptual understanding and applied technical skills demonstrate greater examination success.

Interpreting Cumulative Averages

Cumulative averages provide insight into overall performance and serve as a benchmark for candidate readiness. For example, the cumulative forty-six point nine two percent in Auditing in 2025 reflects that nearly half of candidates achieved the minimum competence threshold, whereas the cumulative seventy-eight point five seven percent in Tax Compliance and Planning demonstrates widespread mastery among candidates. These averages allow aspirants to gauge their progress relative to national standards and identify domains that require focused study.

Candidates can use cumulative averages to set realistic goals and develop strategic study plans. By understanding national performance trends, they can allocate time and resources to domains with historically lower pass rates, improving their likelihood of success and enhancing overall competence. This approach fosters a balanced preparation strategy, integrating both conceptual comprehension and applied skills.

Strategies for Navigating Performance Variability

While the CAP Exam maintains consistent standards, individual candidate outcomes may vary due to prior knowledge, study methods, and test-taking techniques. Awareness of historical trends enables candidates to adopt adaptive strategies, maintaining motivation despite fluctuations in pass rates. Temporary dips in performance do not indicate a lack of preparedness but underscore the importance of continuous refinement, targeted practice, and strategic review.

Effective preparation requires a multifaceted approach. Candidates benefit from practicing realistic scenarios, analyzing performance reports, and reviewing historical trends to anticipate challenges. Mastery of time management, conceptual understanding, and practical application is essential for achieving the passing score. Candidates who integrate historical data, individualized feedback, and disciplined study techniques gain a distinct advantage, approaching each examination with confidence and preparedness.

Holistic Evaluation of Candidate Competence

The CAP Exam evaluates both conceptual knowledge and practical application through multiple-choice questions and task-based simulations. Multiple-choice questions test foundational knowledge and comprehension, while task-based simulations assess analytical reasoning, decision-making, and professional judgment in realistic contexts. This holistic approach ensures that candidates demonstrate comprehensive professional competence.

By synthesizing insights from performance reports, cumulative averages, and historical trends, candidates gain a nuanced understanding of their strengths and weaknesses. This perspective allows for strategic planning, effective allocation of study time, and refinement of analytical skills. Holistic evaluation ensures that candidates not only understand theoretical principles but can also apply them effectively in professional scenarios, preparing them for the demands of real-world practice.

The Elijah Watt Sells Award

The Elijah Watt Sells Award, established in 1923, honors candidates who demonstrate exceptional performance on the CAP Exam. Named after one of the firstCAPs and a prominent advocate for professional education, the award recognizes outstanding achievement and dedication to mastery of the profession.

To qualify for this award, candidates must achieve a cumulative average above ninety-five point five on the three core domains and one elective domain, and must pass all domains on the first attempt. Any failed attempt disqualifies eligibility. Candidates do not apply for this award; eligible individuals are automatically notified in the spring following the year of examination completion.

This recognition exemplifies the highest standard of achievement and highlights the dedication, skill, and strategic preparation required to excel across all evaluated domains. Candidates who achieve this distinction demonstrate not only mastery of content but also exemplary professionalism, discipline, and commitment to excellence in the field.

Conclusion

The CAP Exam is a rigorous and comprehensive measure of professional competence, requiring both conceptual understanding and practical application. Historical trends, cumulative averages, and performance reports provide invaluable insights into candidate preparation, success rates, and areas requiring targeted focus. By analyzing these metrics, candidates can develop strategic study plans, refine analytical skills, and approach examinations with confidence.

Consistent success across domains reflects methodical preparation, effective study strategies, and mastery of both theoretical principles and practical application. Recognition through the Elijah Watt Sells Award further exemplifies the highest levels of achievement, honoring those who demonstrate exceptional competence and dedication. Ultimately, thorough preparation, strategic insight, and disciplined practice remain the key drivers of success in the CAP Exam, preparing candidates for the professional challenges and opportunities that lie ahead.