Certification: Certified Fraud Examiner - Investigation

Certification Full Name: Certified Fraud Examiner - Investigation

Certification Provider: ACFE

Exam Code: CFE - Investigation

Exam Name: Certified Fraud Examiner - Investigation

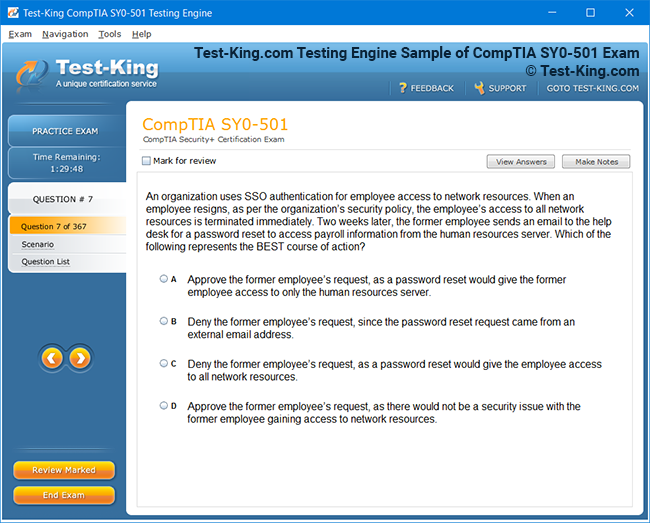

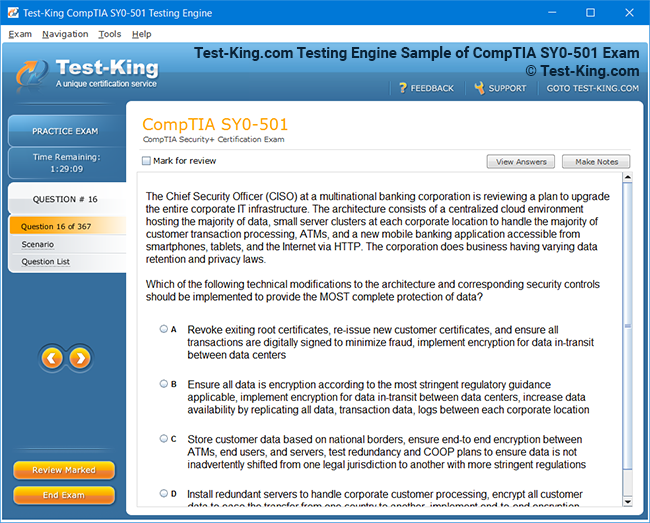

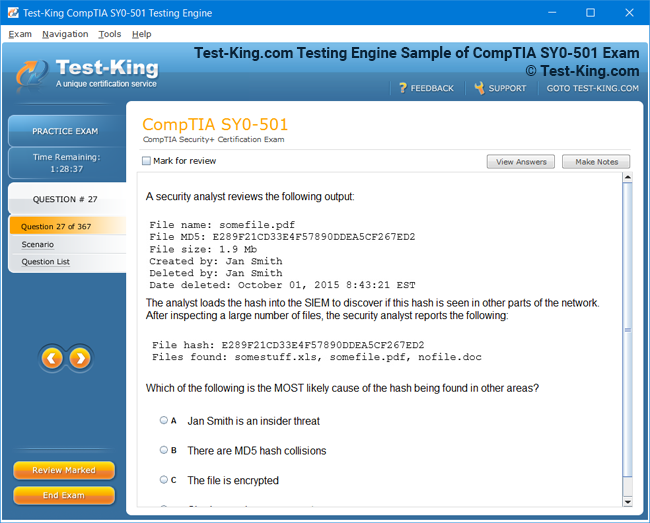

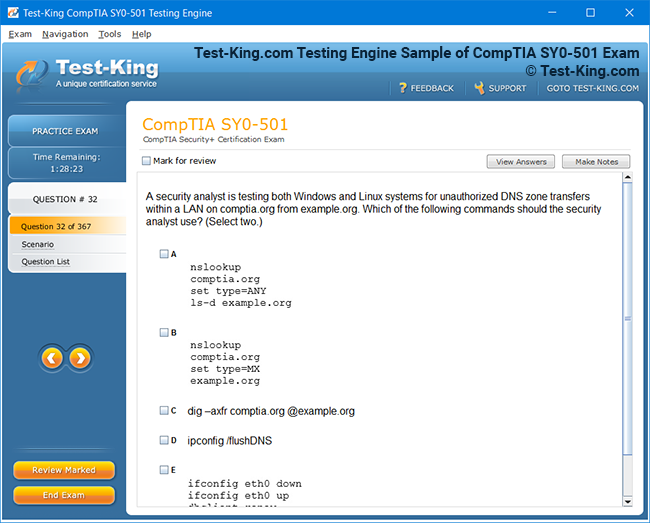

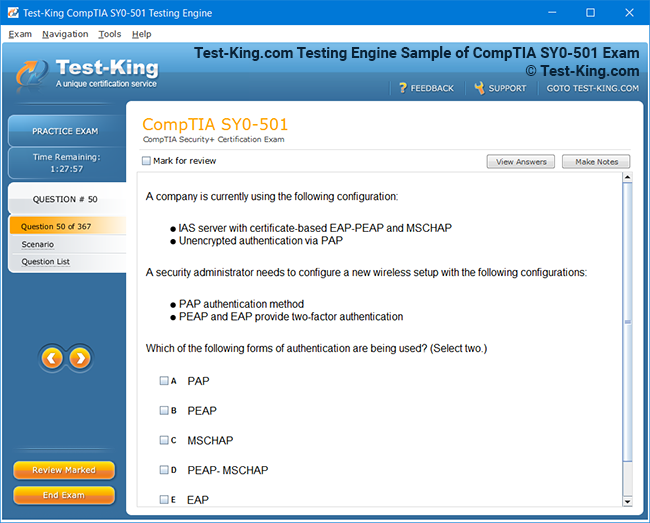

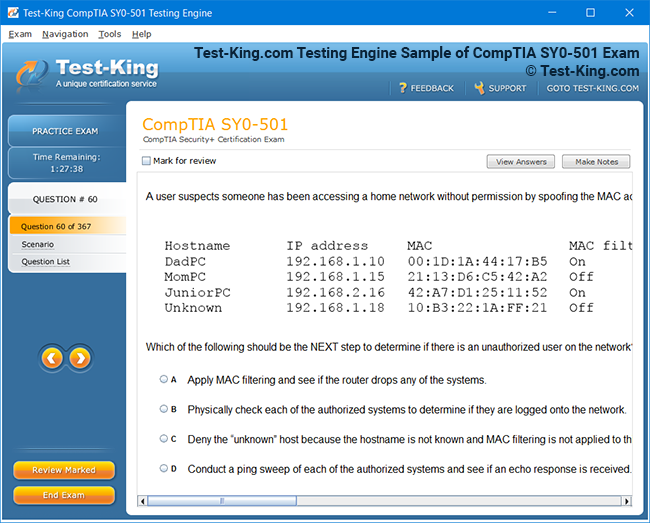

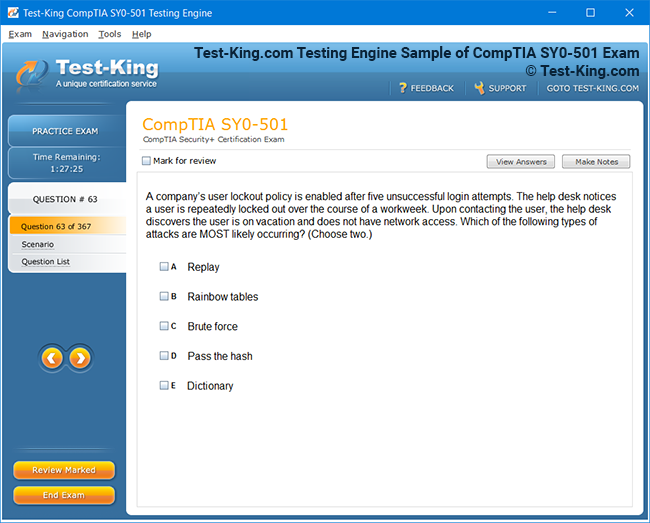

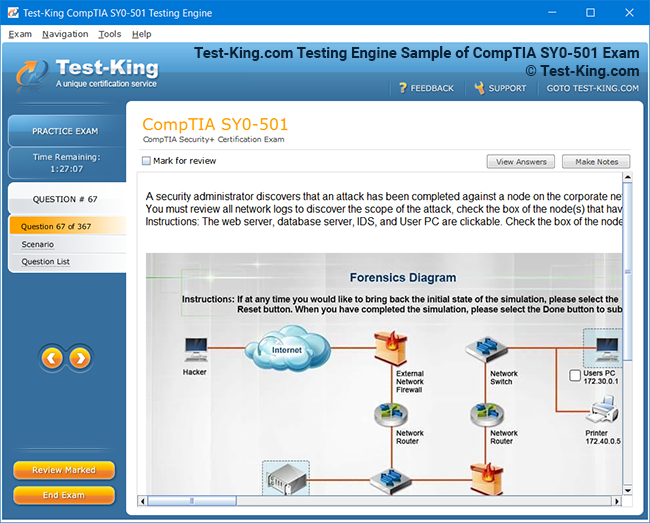

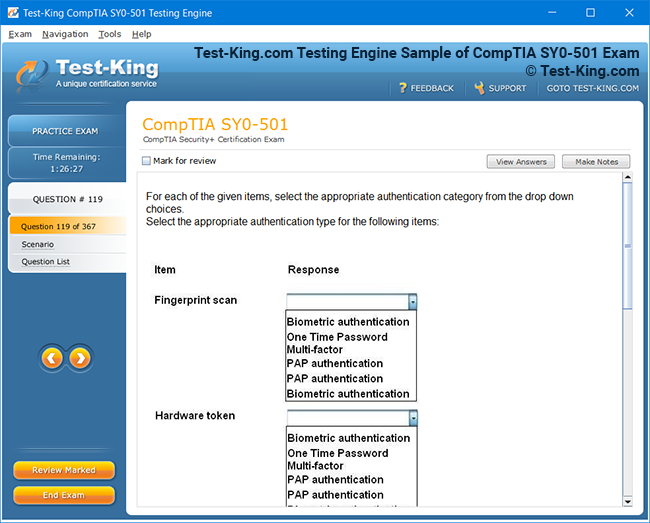

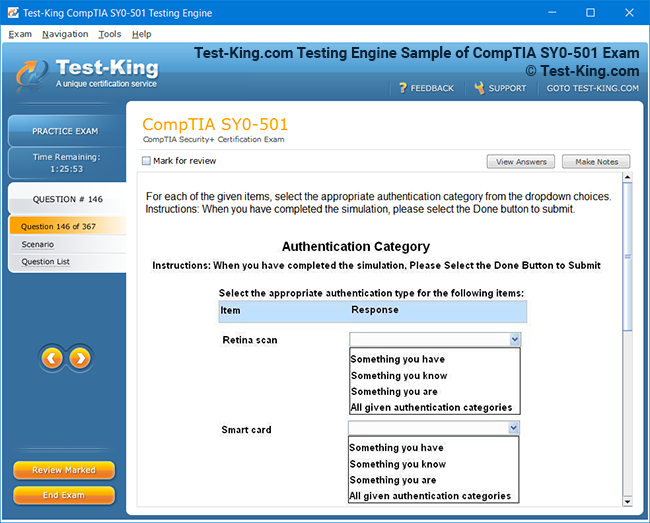

Product Screenshots

How the Certified Fraud Examiner - Investigation (CFE) Certification Enhances Your Career in Fraud Detection

In today’s increasingly complex financial landscape, the demand for professionals equipped to detect, investigate, and prevent fraudulent activities has never been higher. The Certified Fraud Examiner credential, offered by the Association of Certified Fraud Examiners, represents a distinguished standard in the domain of fraud detection. This credential is not merely a title; it embodies a comprehensive mastery of investigative techniques, analytical acumen, and ethical integrity, positioning professionals to excel in a field where precision and discretion are paramount. Attaining this certification requires a profound understanding of diverse investigative frameworks, as well as the ability to navigate multifaceted financial transactions and uncover malfeasance that might elude conventional scrutiny. Professionals who embark on this journey immerse themselves in a rigorous curriculum that cultivates both theoretical knowledge and practical prowess, ensuring they are prepared to confront the myriad manifestations of fraud in contemporary organizations.

Understanding the Value of the Certified Fraud Examiner Credential

The Certified Fraud Examiner credential is predicated on four primary domains: fraud prevention, financial transactions analysis, investigation, and legal elements. These domains collectively provide a holistic understanding of how fraudulent schemes originate, propagate, and ultimately affect organizational integrity. In the realm of fraud prevention, certified professionals are trained to anticipate vulnerabilities and implement strategic controls that mitigate risk. This involves a sophisticated comprehension of internal control systems, corporate governance mechanisms, and the behavioral indicators that often presage fraudulent conduct. By developing these preventative measures, professionals not only protect assets but also cultivate an organizational culture that prioritizes transparency and accountability, elevating their strategic value to employers and clients alike.

Equally critical is the analysis of complex financial transactions. The CFE credential equips individuals with the ability to dissect intricate accounting records, trace anomalous flows of capital, and identify discrepancies that may indicate illicit activities. Mastery of forensic accounting principles allows professionals to uncover hidden patterns of asset misappropriation, embezzlement, and financial statement manipulation. This analytical skill set extends beyond mere numerical proficiency; it encompasses the capacity to interpret contextual cues, recognize subtleties in transactional behavior, and synthesize disparate pieces of information into coherent investigative narratives. Such capabilities distinguish certified professionals from their peers, granting them the authority to influence strategic decision-making and safeguard organizational integrity on multiple fronts.

The investigative component of the certification emphasizes the meticulous processes and methodologies necessary to conduct comprehensive fraud examinations. Professionals are trained to approach investigations systematically, employing techniques that range from interviews and interrogations to digital forensics and data analytics. The investigative paradigm instills a discipline of critical thinking, whereby practitioners evaluate evidence with meticulous scrutiny and draw conclusions grounded in verifiable facts. This methodological rigor is essential in a field where errors can have profound financial and reputational consequences. Moreover, the investigative training promotes adaptability, enabling professionals to navigate diverse organizational environments, varying degrees of resistance, and the complex interplay of human behavior and financial malfeasance.

Legal knowledge forms the fourth pillar of the Certified Fraud Examiner credential, underpinning the ethical and regulatory frameworks within which fraud investigations are conducted. Understanding relevant laws, regulations, and procedural standards ensures that investigative activities are not only effective but also compliant with legal mandates. Certified professionals are adept at preparing documentation suitable for litigation, collaborating with law enforcement agencies, and presenting evidence in judicial proceedings when necessary. The integration of legal acumen with investigative skill distinguishes these practitioners as authoritative figures capable of bridging the gap between corporate governance, regulatory compliance, and criminal accountability.

Beyond technical expertise, the credential fosters an ethical sensibility essential for navigating the moral complexities inherent in fraud detection. Professionals are imbued with principles that emphasize integrity, objectivity, and discretion, ensuring that their actions are guided by both professional standards and ethical imperatives. This commitment to ethical conduct is particularly salient given the sensitive nature of financial investigations, where personal reputations, corporate trust, and public confidence are at stake. By adhering to these principles, certified fraud examiners enhance their credibility and cultivate a professional identity characterized by trustworthiness and intellectual rigor.

The attainment of the Certified Fraud Examiner credential also carries profound implications for career advancement. Professionals equipped with this designation are recognized as experts in fraud detection, a distinction that can accelerate promotion opportunities, open doors to specialized roles, and confer a competitive advantage in the job market. Organizations increasingly seek certified practitioners for positions in internal audit, forensic accounting, corporate investigation units, and risk management teams. The credential signals to employers that an individual possesses a refined analytical skill set, advanced investigative techniques, and the ethical fortitude necessary to navigate complex and sensitive operational environments. Moreover, CFEs often assume advisory roles, providing strategic insights to senior management and contributing to the development of organizational policies that fortify operational resilience.

A nuanced appreciation of the credential reveals that its value extends beyond individual career growth. Organizations benefit from the presence of certified professionals who enhance the robustness of internal controls, mitigate exposure to fraudulent activity, and cultivate a culture of compliance. The integration of CFEs into corporate structures serves as a deterrent to potential fraudsters, reinforcing the notion that illicit conduct will be rigorously investigated and addressed. This dual impact—personal career enhancement and organizational fortification—underscores the transformative potential of the certification within the broader financial and corporate ecosystem.

In addition, the CFE credential promotes continuous learning and professional development. Candidates are required to engage with ongoing education programs to maintain their certification, ensuring that they remain conversant with emerging threats, regulatory developments, and innovative investigative methodologies. This commitment to lifelong learning imbues professionals with the capacity to adapt to evolving challenges, whether they arise from sophisticated cyber fraud schemes, complex financial instruments, or international regulatory changes. The credential thus represents not only a recognition of current expertise but also a framework for sustained professional growth and intellectual agility.

The global recognition of the Certified Fraud Examiner designation further amplifies its value. Professionals holding this credential are acknowledged as capable practitioners not only within their domestic jurisdiction but also on an international scale. This recognition enables cross-border collaboration in fraud investigations, facilitates the mobility of talent across organizations, and reinforces the credibility of practitioners operating in multinational contexts. The international dimension of the credential reflects the universality of fraud challenges and highlights the need for standardized professional competencies that transcend geographic and regulatory boundaries.

In summary, the Certified Fraud Examiner credential embodies a multifaceted synthesis of knowledge, skill, and ethical rigor. It equips professionals with a comprehensive toolkit for detecting, investigating, and preventing fraudulent activities while fostering strategic value within organizations. The credential’s emphasis on financial acumen, investigative methodology, legal comprehension, and ethical fortitude positions its holders as indispensable assets in a landscape characterized by complexity, risk, and uncertainty. Attaining this designation signifies a profound commitment to professional excellence, intellectual diligence, and principled action, all of which contribute to an enhanced career trajectory and a sustained impact in the domain of fraud detection.

Core Competencies Developed Through the CFE Program

The journey toward becoming a Certified Fraud Examiner is both rigorous and transformative, cultivating a constellation of competencies that are indispensable in the field of fraud detection. The credential from the Association of Certified Fraud Examiners is not merely an affirmation of knowledge; it is a testament to a professional's ability to navigate the intricate lattice of financial deception, investigative rigor, and ethical integrity. The competencies developed through this program span analytical acumen, forensic accounting proficiency, investigative methodology, legal knowledge, and ethical discernment, all of which coalesce to create professionals capable of unraveling complex fraud schemes that would confound ordinary examination.

Analytical skill forms the bedrock of the Certified Fraud Examiner's toolkit. Professionals are trained to dissect and interpret voluminous financial records, identify anomalies, and detect patterns that may suggest fraudulent conduct. This analytical acuity extends beyond numerical manipulation; it involves an intuitive grasp of subtle irregularities, the capacity to synthesize data from disparate sources, and the application of probabilistic reasoning to assess the likelihood of malfeasance. By honing these abilities, CFEs are able to perceive irregularities that are invisible to untrained eyes, uncover hidden financial subterfuge, and construct coherent narratives from fragmented or obfuscated evidence.

Forensic accounting is a critical competency emphasized within the certification curriculum. It entails the meticulous examination of financial statements, the tracing of asset movements, and the identification of misappropriation or financial statement distortions. Certified professionals employ advanced techniques to uncover embezzlement, fraudulently manipulated revenue, and other insidious financial malpractices. The mastery of forensic accounting extends to sophisticated areas such as auditing intricate transactions, reconstructing incomplete records, and leveraging data analytics tools to elucidate patterns of fraudulent behavior. These skills are particularly valuable in environments where conventional accounting scrutiny might fail to detect complex schemes engineered by cunning perpetrators.

Investigation methodology represents another pillar of the Certified Fraud Examiner’s competency framework. Professionals are trained in systematic approaches to examining potential fraud, including planning investigative procedures, collecting and preserving evidence, interviewing witnesses, and documenting findings with meticulous precision. The program emphasizes strategic thinking, ensuring that investigations are conducted efficiently while minimizing risk to both the examiner and the organization. Investigative methodology also encompasses the deployment of technology to enhance efficiency and accuracy, such as utilizing digital forensics to recover electronic evidence, employing data mining techniques to identify anomalies, and analyzing communication patterns for signs of collusion or deception.

Legal knowledge is integral to the effectiveness of a Certified Fraud Examiner. Understanding regulatory frameworks, corporate law, and criminal statutes ensures that investigations are conducted within appropriate legal boundaries and that evidence gathered is admissible in judicial proceedings. Professionals are trained to navigate the delicate interplay between investigative rigor and legal compliance, preparing reports that can withstand judicial scrutiny and collaborating with law enforcement and regulatory agencies when necessary. The integration of legal insight into investigative practice enhances the credibility of the examiner and ensures that interventions are both effective and procedurally sound.

Ethical discernment is perhaps the most subtle yet essential competency developed through the certification program. Fraud investigations often traverse morally complex landscapes, where decisions can have profound financial, professional, and personal consequences. The curriculum instills a steadfast adherence to principles of integrity, objectivity, and confidentiality, equipping professionals to make judicious choices under pressure. Ethical discernment enables CFEs to resist external pressures that may compromise investigative rigor, to prioritize the pursuit of truth over expediency, and to maintain professional decorum in sensitive organizational contexts. The cultivation of this competency ensures that certified professionals operate not only with technical excellence but also with moral fortitude, reinforcing trust in their judgments and actions.

Communication skill, though often understated, is a critical competency emphasized in the Certified Fraud Examiner program. Professionals are trained to articulate complex findings clearly and persuasively, whether in written reports, presentations, or testimony before regulatory or judicial bodies. The ability to translate intricate financial analyses into comprehensible narratives is essential for influencing decision-makers, facilitating organizational interventions, and ensuring that investigative outcomes are actionable. Effective communication also encompasses interpersonal skills, including the ability to conduct interviews with tact, manage stakeholder expectations, and navigate organizational sensitivities without compromising investigative integrity.

Risk assessment is another integral aspect of the competencies developed through the program. Certified Fraud Examiners are adept at identifying vulnerabilities within organizational structures, evaluating the potential impact of fraudulent activities, and recommending preventative measures. This competency involves both qualitative and quantitative assessment techniques, allowing professionals to prioritize investigative resources, anticipate potential threats, and design controls that mitigate exposure. By applying a disciplined risk management perspective, CFEs enhance the resilience of organizations against internal and external threats while demonstrating their strategic value to leadership teams.

Technological literacy has become increasingly central to the professional competencies of a Certified Fraud Examiner. In an era where digital transactions dominate financial landscapes, CFEs are trained to harness information technology for investigative purposes. This includes analyzing electronic records, leveraging data analytics to detect anomalies, and understanding cyber threats that can facilitate fraudulent activity. The integration of technological literacy with traditional investigative skills allows professionals to operate effectively in a digitally interconnected environment, ensuring that emerging fraud schemes are met with sophisticated and adaptive responses.

The Certified Fraud Examiner credential also fosters adaptability and problem-solving acumen. Fraudulent schemes are rarely static; perpetrators continuously innovate to exploit weaknesses in controls and evade detection. Certified professionals develop the capacity to think laterally, anticipate novel tactics, and devise investigative approaches that are both creative and methodical. This adaptability, coupled with a disciplined analytical framework, allows CFEs to respond to dynamic challenges with agility, ensuring that investigations remain effective even in unpredictable circumstances.

Networking and professional collaboration are additional competencies nurtured through the certification. The program connects professionals to a global community of peers, facilitating the exchange of insights, methodologies, and case experiences. Collaboration enhances investigative effectiveness by enabling the sharing of best practices, access to specialized expertise, and cooperative approaches to complex cross-border fraud investigations. The community aspect also reinforces professional development by exposing practitioners to diverse perspectives and innovative problem-solving strategies, thereby enhancing their capacity to address multifaceted challenges.

Finally, strategic thinking is interwoven throughout the competencies developed by the Certified Fraud Examiner program. Professionals are trained to align investigative activities with organizational objectives, anticipate systemic risks, and contribute to the formulation of policies that enhance governance and control environments. Strategic thinking transforms the CFE from a reactive investigator into a proactive advisor, capable of influencing organizational decisions, mitigating risk, and fostering sustainable practices that deter fraudulent behavior.

The amalgamation of these competencies results in a professional who is not merely technically proficient but intellectually agile, ethically grounded, and strategically positioned to add tangible value to any organization. The Certified Fraud Examiner credential thus represents a comprehensive cultivation of skills that are critical in the detection, investigation, and prevention of fraud. It empowers individuals to operate with authority and discernment in complex environments, providing a framework for both personal career advancement and the fortification of organizational integrity. Professionals who hold this designation are recognized for their ability to navigate the intricate interplay of finance, law, and ethics, demonstrating a level of expertise that elevates the standard of practice in the field of fraud detection.

Career Advancement and Opportunities with a CFE Credential

Obtaining the Certified Fraud Examiner credential from the Association of Certified Fraud Examiners provides professionals with a formidable advantage in the realm of fraud detection, offering pathways to advanced career opportunities that extend across corporate, governmental, and investigative landscapes. The designation is a marker of expertise, signaling to employers, clients, and colleagues that the holder possesses an intricate understanding of fraudulent schemes, advanced investigative methodologies, and the ethical fortitude necessary to navigate sensitive and complex financial environments. This credential not only validates technical proficiency but also enhances professional credibility, fostering confidence in decision-making roles and creating a platform for accelerated career progression.

One of the most immediate effects of acquiring the CFE credential is the expansion of career trajectories in multiple organizational contexts. Certified professionals are sought after in internal audit departments, where their ability to scrutinize financial records, detect irregularities, and strengthen internal controls contributes directly to organizational resilience. Their presence can enhance the sophistication of audit functions, enabling companies to proactively identify vulnerabilities and implement preventive strategies that safeguard assets. This expertise often positions CFEs for managerial or leadership roles, where they oversee audit teams, design risk mitigation protocols, and advise executive boards on matters of governance and compliance.

The CFE credential also opens doors to specialized positions in forensic accounting, a field where the detection and documentation of fraud require both analytical rigor and investigative acumen. Professionals equipped with the certification are capable of examining complex financial statements, tracing asset movements, and reconstructing transactions that may have been intentionally obfuscated. Their proficiency in forensic techniques, combined with the ethical and legal knowledge developed through the certification, makes them invaluable in litigation support, dispute resolution, and corporate investigations. Such roles often involve collaboration with legal counsel, regulatory authorities, and law enforcement, emphasizing the CFE’s versatility and strategic importance across multiple sectors.

Beyond corporate environments, the credential provides opportunities in governmental and law enforcement agencies tasked with investigating economic crimes. Certified Fraud Examiners are uniquely qualified to participate in complex investigations involving embezzlement, financial statement fraud, bribery, corruption, and other illicit activities that impact public institutions. Their training equips them to work alongside investigative bodies, employing techniques ranging from document analysis and digital forensics to witness interviews and undercover operations. The credential enhances credibility in these settings, as professionals are recognized for their methodical approach, attention to detail, and capacity to produce evidence that withstands scrutiny in administrative or judicial proceedings.

Consulting and advisory roles represent another avenue for career advancement facilitated by the CFE designation. Organizations often seek external experts to evaluate internal controls, conduct risk assessments, or investigate allegations of misconduct. Certified Fraud Examiners are ideally suited to provide these services due to their comprehensive skill set, which combines financial analysis, investigative methodology, and legal insight. In this capacity, professionals not only address immediate concerns but also guide organizations in the development of sustainable fraud prevention strategies. Their involvement can influence corporate policy, governance structures, and employee education programs, amplifying the long-term impact of their expertise.

Globalization has also increased the demand for certified professionals capable of operating across international boundaries. Fraud schemes today often transcend national jurisdictions, involving complex transactions, digital currencies, and multinational corporate structures. CFEs, armed with a combination of investigative skill, legal knowledge, and technological literacy, are well-positioned to address these challenges. Their certification signals to international employers and regulatory agencies that they possess a standardized level of expertise recognized across borders, facilitating collaboration in multinational investigations and enhancing mobility within global organizations.

Professional recognition associated with the credential often translates into tangible career benefits such as promotions, salary increases, and leadership responsibilities. Employers value the designation because it demonstrates a commitment to professional development, ethical conduct, and specialized expertise that cannot be easily replicated. Certified professionals are frequently entrusted with high-stakes investigations, advisory projects, and strategic decision-making responsibilities, reflecting the trust and respect they command within their organizations. This combination of recognition, responsibility, and remuneration underscores the practical career advantages of achieving the CFE credential.

The credential also cultivates an aura of intellectual authority that extends into networking and professional influence. Certified Fraud Examiners are often sought for their insights on emerging fraud trends, investigative best practices, and regulatory compliance. Their opinions carry weight in professional forums, conferences, and industry publications, amplifying their visibility and positioning them as thought leaders. This influence can further enhance career opportunities, as organizations prefer to engage professionals whose expertise is both recognized and respected, reinforcing the strategic value of the designation.

Specialization within the field of fraud detection is another career dimension unlocked by the CFE credential. Professionals may focus on areas such as cyber fraud, financial statement manipulation, procurement fraud, healthcare fraud, or anti-bribery and corruption compliance. By concentrating on a specific domain, CFEs deepen their expertise and differentiate themselves in the job market. This specialization enhances employability and allows professionals to command higher fees or salaries in consulting engagements, demonstrating the tangible economic advantages of advanced competence in targeted investigative areas.

Mentorship and leadership development are additional benefits linked to the CFE credential. Certified professionals frequently assume roles as trainers, advisors, and mentors, guiding junior investigators and internal teams through complex investigative processes. This not only contributes to the cultivation of new talent but also reinforces the professional stature of the mentor, establishing them as an authoritative presence within the field. Organizations benefit from this transfer of knowledge, as it strengthens institutional capability and ensures continuity in fraud detection expertise.

The enduring value of the certification is amplified by the requirement for continuing professional education. Certified Fraud Examiners are obligated to maintain and expand their knowledge through ongoing training, exposure to emerging investigative techniques, and engagement with contemporary fraud trends. This continuous development ensures that their skills remain relevant in a rapidly evolving financial and technological environment. By demonstrating adaptability and a commitment to staying at the forefront of professional practice, CFEs sustain long-term career growth and reinforce their standing as indispensable resources within any organizational structure.

The CFE credential also facilitates access to professional networks, including local chapters, online forums, and international gatherings organized by the Association of Certified Fraud Examiners. These networks provide opportunities for collaboration, knowledge sharing, and engagement with peers confronting similar challenges. Participation in these communities enhances problem-solving capacity, exposes professionals to diverse investigative methodologies, and allows them to remain informed about evolving risks, regulatory shifts, and innovative practices in fraud detection.

Strategic advisory roles further illustrate the career advantages conferred by the certification. Certified Fraud Examiners are often involved in evaluating organizational vulnerabilities, designing fraud prevention frameworks, and guiding senior management in risk mitigation strategies. Their insights influence policy decisions, resource allocation, and operational priorities, underscoring the strategic impact of their expertise. This capacity to shape organizational direction elevates the professional from an operational investigator to a strategic advisor, expanding both influence and career potential.

Entrepreneurial opportunities are also accessible to certified professionals, as the credential confers credibility that facilitates the establishment of independent investigative or consulting practices. By leveraging their specialized knowledge, network connections, and professional recognition, CFEs can offer services in risk assessment, forensic accounting, fraud investigation, and regulatory compliance to multiple clients. This entrepreneurial pathway allows for career autonomy, flexible professional engagement, and the potential for significant financial rewards, demonstrating the versatility and enduring value of the designation.

In summary, the Certified Fraud Examiner credential serves as a catalyst for career advancement, opening doors to diverse roles in corporate, governmental, and investigative contexts. Its value is multidimensional, encompassing increased professional credibility, access to specialized opportunities, recognition of expertise, leadership development, and the ability to influence organizational strategy. By equipping professionals with a sophisticated skill set, a global network, and a commitment to continuous learning, the credential positions them to excel in complex and evolving environments, solidifying their status as indispensable actors in the field of fraud detection.

Real-World Applications: How CFEs Solve Complex Fraud Cases

The Certified Fraud Examiner credential equips professionals with a profound understanding of fraud detection, investigative methodologies, and forensic analysis, which translates into real-world efficacy in uncovering and resolving complex fraudulent schemes. The practical applications of this credential extend far beyond theoretical knowledge, as CFEs are trained to confront sophisticated financial deceptions that permeate corporate, governmental, and nonprofit sectors. Their expertise enables them to systematically dissect intricate transactions, analyze behavioral indicators, and apply investigative techniques that are both methodical and adaptive, ensuring that fraudulent activity is identified and addressed with precision.

A central aspect of the CFE’s role in real-world investigations is the meticulous examination of financial records. Professionals are trained to scrutinize balance sheets, income statements, cash flow reports, and other accounting documents to identify discrepancies that may indicate irregularities. This process involves detecting subtle inconsistencies, tracing unaccounted-for funds, and uncovering patterns of misappropriation or manipulation. By employing both conventional auditing techniques and advanced analytical methods, CFEs can reveal the underlying mechanisms of complex fraud schemes, transforming seemingly mundane financial data into actionable intelligence. This skill is particularly critical in cases involving embezzlement, where perpetrators often employ intricate methods to obscure the diversion of assets.

Forensic accounting plays a pivotal role in the investigative process. Certified professionals leverage their knowledge of accounting principles, transaction tracing, and investigative frameworks to reconstruct financial events with meticulous accuracy. This enables the identification of illicit activities that may have been deliberately concealed through layered transactions, shell entities, or falsified documentation. The ability to reconstruct complex financial sequences allows CFEs to establish clear evidence trails, facilitating both internal remediation and potential legal proceedings. Such expertise is indispensable in high-stakes investigations where organizational stability, reputational integrity, and regulatory compliance are at risk.

Investigative methodology is another cornerstone of real-world application. CFEs are trained to approach investigations systematically, developing strategic plans that prioritize efficiency, accuracy, and legal compliance. This includes gathering and preserving evidence, conducting interviews with tact and discernment, and documenting findings in a manner that withstands scrutiny. Professionals employ a combination of qualitative and quantitative techniques, integrating observational insights with numerical analysis to form comprehensive investigative narratives. Their approach is disciplined yet adaptable, allowing them to navigate complex organizational structures, conflicting accounts, and dynamic operational environments without compromising investigative rigor.

The integration of technology enhances the efficacy of modern fraud investigations. Certified Fraud Examiners utilize digital forensics, data analytics, and pattern recognition software to identify anomalies within large datasets. Electronic records, email communications, and transactional databases become critical sources of insight when examined with expertise in digital investigative techniques. These technological competencies enable CFEs to detect cyber fraud, trace digital asset transfers, and uncover sophisticated schemes that would otherwise evade detection. In an era of increasing digitalization, the ability to combine traditional investigative acumen with technological proficiency is essential for effective fraud resolution.

Behavioral analysis is also a significant dimension of real-world fraud investigation. Certified professionals are trained to interpret human behavior, recognizing signs of deception, collusion, and concealment. This involves observing inconsistencies in testimony, evaluating nonverbal cues, and understanding the psychological mechanisms that underpin fraudulent activity. By integrating behavioral insights with financial analysis, CFEs can identify potential perpetrators, anticipate evasive strategies, and construct investigations that are both comprehensive and anticipatory. The combination of analytical, forensic, and behavioral competencies allows CFEs to approach investigations with multidimensional insight.

Case studies and practical examples illustrate the transformative impact of CFEs in diverse organizational contexts. In corporate environments, professionals may uncover embezzlement schemes orchestrated through fraudulent expense reports, unauthorized fund transfers, or manipulation of vendor accounts. Through meticulous document examination, interviews with relevant personnel, and analysis of financial patterns, CFEs can trace the flow of misappropriated funds and identify those responsible. Their findings not only facilitate disciplinary or legal action but also inform the design of preventive measures, such as enhanced internal controls, policy revisions, and employee training programs, thereby mitigating the risk of future occurrences.

Governmental investigations similarly benefit from the expertise of certified professionals. Fraudulent activities within public institutions often involve intricate financial arrangements, misallocation of resources, or corruption schemes. CFEs bring a disciplined, methodical approach to these investigations, analyzing procurement processes, budget allocations, and transactional anomalies. By combining forensic accounting, investigative methodology, and legal knowledge, professionals can expose systemic vulnerabilities, establish accountability, and support law enforcement or regulatory interventions. Their ability to present findings in a legally defensible manner ensures that investigations lead to actionable outcomes that uphold public trust.

In nonprofit and charitable organizations, CFEs address fraudulent activities that may undermine donor confidence and organizational sustainability. These may include misappropriation of funds, falsification of donation records, or misuse of grants. Certified professionals apply the same rigorous investigative techniques, tracing financial flows, examining supporting documentation, and evaluating internal controls. Their work not only restores integrity but also helps organizations implement robust policies that prevent recurrence. In such contexts, the CFE’s expertise contributes directly to maintaining stakeholder confidence and safeguarding the mission of the organization.

Cross-border and multinational investigations exemplify the global applicability of the CFE credential. Fraud schemes that span jurisdictions often involve complex financial instruments, international banking networks, and multi-layered corporate structures. Certified professionals leverage their knowledge of international regulations, investigative techniques, and cross-cultural considerations to coordinate inquiries that transcend national boundaries. By collaborating with local authorities, legal experts, and corporate partners, CFEs ensure that investigations are both comprehensive and compliant with varying legal frameworks. This global perspective underscores the versatility and strategic significance of the credential in contemporary fraud detection.

The CFE credential also empowers professionals to engage in preventive initiatives that reduce the likelihood of fraud before it occurs. By conducting risk assessments, evaluating organizational controls, and advising on governance structures, certified examiners proactively identify vulnerabilities. These preventive measures are informed by insights gained from investigative experience, allowing professionals to anticipate potential schemes and implement strategies that deter fraudulent behavior. The combination of investigative acumen and proactive advisory capability enhances both the immediate and long-term resilience of organizations.

Communication of findings is an essential aspect of the CFE’s real-world function. Professionals are trained to convey complex investigative outcomes in clear, persuasive narratives suitable for diverse audiences, including executive leadership, regulatory agencies, and judicial bodies. Reports integrate financial analysis, forensic evidence, and behavioral observations into coherent recommendations, ensuring that findings are actionable and understandable. The ability to communicate with precision and authority reinforces the credibility of the investigation and facilitates timely organizational response.

Ethical discernment permeates all investigative activities undertaken by Certified Fraud Examiners. In navigating sensitive or high-stakes situations, professionals maintain confidentiality, exercise objectivity, and adhere to regulatory and professional standards. Ethical rigor ensures that investigative processes are not compromised by personal bias or external pressures, enhancing the legitimacy and defensibility of findings. This ethical foundation is critical in fostering trust with stakeholders and in maintaining the integrity of the investigative process.

Professional development and continued education further enhance the real-world effectiveness of CFEs. The requirement for ongoing learning ensures that certified professionals remain abreast of emerging fraud trends, technological innovations, and regulatory developments. This dynamic knowledge base allows CFEs to adapt investigative approaches to evolving threats, maintain technical proficiency, and provide contemporary, evidence-based insights that are relevant across industries. The combination of experience, continuous learning, and credentialed expertise solidifies the CFE’s role as a pivotal actor in fraud resolution.

The practical application of CFE skills extends beyond individual cases to influence organizational culture and governance. By identifying vulnerabilities, recommending control improvements, and advising leadership on best practices, certified professionals contribute to a culture of integrity and accountability. Their influence enhances the strategic resilience of organizations, reduces exposure to financial and reputational risk, and establishes internal frameworks that are resistant to future fraudulent activity. In this way, the CFE’s impact is both immediate and enduring, affecting not only the resolution of specific cases but also the broader operational environment.

Certified Fraud Examiners also participate in specialized investigations involving emerging forms of fraud, such as cybercrime, cryptocurrency manipulation, and sophisticated financial instruments. These contemporary challenges require a blend of technological literacy, analytical reasoning, and investigative creativity. Professionals employ advanced techniques to detect digital anomalies, trace electronic asset transfers, and uncover collusion or deception in complex virtual environments. The credential equips them to address these evolving threats with authority and precision, underscoring the enduring relevance of their skills in an increasingly digitized financial landscape.

Ethical and Legal Dimensions in Fraud Investigation

Navigating the intricate landscape of fraud investigation requires more than technical acumen and analytical skill; it demands a profound understanding of ethical principles and legal frameworks that govern investigative practice. The Certified Fraud Examiner credential, offered by the Association of Certified Fraud Examiners, equips professionals with the expertise to operate with both precision and integrity in complex environments where financial malfeasance intersects with organizational governance and legal obligations. The ethical and legal dimensions of fraud detection are indispensable, ensuring that investigations are conducted responsibly, that evidence is gathered lawfully, and that the rights of all parties are respected throughout the investigative process.

Ethical discernment is a cornerstone of the Certified Fraud Examiner’s professional identity. Fraud investigations often involve high-stakes situations, sensitive financial data, and individuals whose reputations and careers may be impacted by the outcomes. Professionals are trained to maintain objectivity, exercise discretion, and adhere to the highest standards of professional conduct. This ethical grounding prevents conflicts of interest, mitigates personal bias, and ensures that investigative decisions are guided by principles rather than expedience. Maintaining integrity in all investigative actions fosters trust with organizational stakeholders, regulatory authorities, and the public, reinforcing the credibility of both the examiner and the organization.

The ethical framework cultivated through the certification emphasizes confidentiality, impartiality, and accountability. Certified professionals handle information that is often confidential, including employee records, financial statements, and internal communications. Safeguarding this information while conducting thorough examinations requires vigilance and a deep appreciation for privacy considerations. Impartiality ensures that investigations are conducted fairly, without prejudice toward any party, while accountability reinforces the examiner’s responsibility to conduct inquiries that are accurate, complete, and defensible. These principles collectively establish a foundation of ethical practice that underpins all aspects of fraud detection.

Legal knowledge is equally critical in shaping the efficacy and defensibility of fraud investigations. Certified Fraud Examiners are trained in the nuances of laws and regulations that pertain to financial misconduct, corporate governance, and criminal accountability. Understanding these legal parameters ensures that investigative procedures are compliant with statutory requirements and that evidence collected is admissible in court or regulatory proceedings. Professionals are adept at interpreting complex legislation, evaluating its implications for organizational policy, and applying legal principles to investigative strategy. This combination of legal literacy and investigative skill enhances both the accuracy and legitimacy of findings.

The intersection of ethics and law becomes particularly salient in the collection and handling of evidence. Certified professionals are instructed in the proper methods for securing documents, digital records, and testimonial information while maintaining chain of custody and avoiding procedural errors. Legal knowledge informs the examiner’s ability to distinguish between permissible investigative techniques and those that could jeopardize the admissibility of evidence or violate statutory protections. Ethical considerations guide the manner in which sensitive information is managed, ensuring respect for privacy and minimizing the risk of harm to innocent parties. Together, these dimensions create a framework that balances investigative efficacy with adherence to professional and legal standards.

In practical terms, ethical and legal competencies influence decision-making throughout the course of an investigation. Certified Fraud Examiners are trained to evaluate potential conflicts, navigate organizational hierarchies, and make determinations that align with both the law and ethical imperatives. This involves exercising judgment in situations where information may be incomplete, evidence may be ambiguous, or stakeholders may exert pressure for rapid conclusions. Professionals are equipped to weigh competing considerations, prioritize integrity, and implement strategies that uphold both procedural and moral rigor. Their training ensures that actions taken during investigations are defensible, transparent, and aligned with professional standards.

The role of ethics extends to interactions with colleagues, witnesses, and external parties. Certified professionals are adept at conducting interviews and gathering statements in a manner that is respectful, unbiased, and legally sound. They navigate complex interpersonal dynamics, ensuring that questioning techniques do not coerce or intimidate, while still eliciting information critical to the investigation. By adhering to ethical interviewing protocols, CFEs protect the rights of individuals, enhance the reliability of testimony, and maintain the credibility of the investigative process.

Legal acumen also supports the preparation of reports and documentation that may be presented to regulatory bodies, law enforcement, or judicial authorities. Certified Fraud Examiners are trained to compile evidence and articulate findings in a manner that meets procedural standards, demonstrates clarity of reasoning, and withstands legal scrutiny. This requires a comprehensive understanding of evidentiary rules, statutory obligations, and procedural protocols. Accurate and legally compliant reporting is essential for facilitating corrective action, securing organizational accountability, and supporting potential litigation or enforcement measures.

Ethical and legal considerations are particularly significant in investigations that involve complex financial instruments, multi-jurisdictional transactions, or high-level corporate governance issues. Professionals must navigate intricate legal frameworks, assess compliance with regulatory obligations, and consider the broader ethical implications of their findings. This complexity necessitates a deep integration of knowledge and judgment, ensuring that investigations are both methodically sound and morally defensible. Certified Fraud Examiners are uniquely prepared to operate in these environments, leveraging their training to reconcile technical, legal, and ethical dimensions in pursuit of reliable conclusions.

Risk assessment within the context of ethics and law is another critical application of the CFE credential. Professionals are able to identify areas where organizational policies or procedures may create vulnerabilities to fraud, evaluate the potential consequences of various investigative approaches, and recommend measures that mitigate both operational and reputational risk. Their insights inform strategic decisions, helping organizations maintain compliance, strengthen internal controls, and uphold ethical standards. The integration of risk management, legal awareness, and ethical judgment enhances the overall resilience of the organization against fraudulent activity.

Ethics also influence the ongoing professional conduct and development of Certified Fraud Examiners. The certification requires adherence to a code of professional standards, which encompasses principles such as diligence, integrity, objectivity, and continuous improvement. By maintaining these standards, professionals ensure that their investigative practices evolve in alignment with emerging threats, regulatory changes, and technological advancements. This commitment to ethical excellence fosters professional credibility, enhances stakeholder confidence, and contributes to the sustained efficacy of fraud detection efforts across industries.

The CFE credential further cultivates sensitivity to cultural, organizational, and interpersonal considerations that bear on ethical and legal decision-making. Certified professionals are trained to recognize the influence of organizational culture, leadership dynamics, and social norms on both the manifestation of fraud and the conduct of investigations. Ethical and legal competencies allow them to navigate these factors judiciously, ensuring that investigative actions are contextually appropriate, legally compliant, and ethically sound. This multidimensional awareness enhances the credibility and effectiveness of investigations in complex environments.

Ethical and legal frameworks also underpin the strategic advisory function of Certified Fraud Examiners. Beyond individual investigations, professionals are frequently called upon to provide guidance on policy development, compliance programs, and organizational governance structures. Their recommendations are informed by both the practical experience of conducting investigations and the principles of ethical and legal integrity. By advising organizations on preventive strategies, regulatory compliance, and risk mitigation, CFEs contribute to the creation of environments that are resilient to fraud and committed to principled operational conduct.

The integration of ethics and law is essential when dealing with emerging forms of fraud, including cybercrime, digital financial manipulation, and sophisticated international schemes. Certified Fraud Examiners leverage their understanding of applicable regulations, ethical guidelines, and investigative best practices to address these complex challenges. Their expertise ensures that investigative methodologies remain compliant with statutory requirements, that data privacy and confidentiality are preserved, and that outcomes are defensible both legally and morally. This adaptability positions CFEs to respond effectively to the evolving landscape of fraud while maintaining professional integrity.

Ethical and legal competencies also enhance collaboration with external stakeholders, including law enforcement, regulatory agencies, and other investigative bodies. Certified professionals navigate these relationships with an awareness of statutory responsibilities, confidentiality obligations, and ethical imperatives. Their ability to coordinate effectively while maintaining professional standards ensures that investigations are credible, comprehensive, and legally sound. By bridging internal organizational priorities with external legal requirements, CFEs enhance the legitimacy and impact of investigative outcomes.

Finally, ethical and legal dimensions reinforce the public trust in both the profession and the organizations served. Certified Fraud Examiners operate in a realm where transparency, accountability, and credibility are paramount. By adhering to rigorous ethical standards and navigating legal frameworks with expertise, CFEs ensure that investigations contribute to organizational integrity, regulatory compliance, and societal confidence in financial systems. Their work exemplifies the interplay of technical skill, ethical judgment, and legal knowledge, demonstrating the holistic competence required for effective fraud detection and prevention.

Future Trends in Fraud Detection and the Enduring Relevance of CFE Certification

The landscape of fraud detection is undergoing a transformative evolution, propelled by technological innovation, globalization of financial systems, and the increasing sophistication of illicit actors. In this dynamic environment, the Certified Fraud Examiner credential from the Association of Certified Fraud Examiners provides professionals with the expertise, adaptability, and credibility necessary to navigate emerging threats and maintain a competitive advantage. The enduring relevance of the certification is rooted not only in its rigorous curriculum, which encompasses financial acumen, investigative methodology, legal comprehension, and ethical discernment, but also in its capacity to prepare professionals for the challenges posed by rapidly evolving fraudulent schemes.

Emerging trends in fraud detection are increasingly shaped by technological disruption. The proliferation of digital financial instruments, blockchain transactions, and cryptocurrency ecosystems has expanded the avenues through which fraud can be perpetrated. Certified Fraud Examiners are trained to address these innovations by leveraging technological literacy, digital forensics, and data analytics to detect anomalies, trace illicit flows of value, and interpret complex electronic records. Their expertise enables them to uncover schemes that blend traditional financial manipulation with sophisticated digital mechanisms, ensuring that organizations remain resilient in the face of technological complexity.

Cyber fraud has emerged as a particularly pressing challenge, encompassing activities such as phishing, ransomware attacks, identity theft, and unauthorized digital asset transfers. Certified professionals apply a combination of investigative skill, technological insight, and behavioral analysis to identify vulnerabilities, trace perpetrators, and implement controls that mitigate exposure. The integration of cyber awareness with traditional investigative techniques ensures that CFEs remain relevant and effective, addressing threats that transcend conventional financial boundaries and require a multidimensional approach.

Globalization has further complicated fraud detection by creating cross-border opportunities for illicit activity. Multinational corporations, international banking systems, and global supply chains introduce layers of complexity in terms of regulatory compliance, financial oversight, and jurisdictional coordination. Certified Fraud Examiners, armed with knowledge of international regulations, investigative methodologies, and ethical imperatives, are uniquely positioned to manage these challenges. Their expertise allows for the coordination of multinational investigations, the assessment of legal variances across jurisdictions, and the synthesis of evidence in a manner that supports global organizational integrity.

Artificial intelligence and machine learning are beginning to reshape fraud detection by enabling predictive analysis, anomaly detection, and automated monitoring of vast financial datasets. CFEs are trained to incorporate these technological tools into investigative workflows, enhancing the speed, precision, and comprehensiveness of their analyses. By integrating algorithmic insights with human judgment, professional experience, and ethical oversight, certified examiners can anticipate fraudulent behaviors, identify early warning signs, and design interventions that preemptively mitigate risk. This symbiosis of technology and expertise exemplifies the forward-looking dimension of the CFE credential.

Behavioral analysis remains a critical component of contemporary fraud detection, particularly as perpetrators employ increasingly sophisticated strategies to mask intentions and evade detection. Certified professionals are adept at interpreting subtle behavioral cues, patterns of communication, and inconsistencies in testimony to uncover hidden schemes. This expertise is essential in complex investigations where quantitative analysis alone may not reveal the full scope of fraudulent activity. By combining behavioral insight with forensic accounting, digital forensics, and legal knowledge, CFEs deliver a multidimensional approach to investigation that is both comprehensive and adaptive.

Regulatory evolution continues to impact the domain of fraud prevention and investigation. Changes in anti-money laundering laws, corporate governance standards, and financial reporting requirements create new responsibilities for organizations and necessitate updated investigative frameworks. Certified Fraud Examiners are trained to remain conversant with regulatory developments, interpret their implications, and advise organizations on compliance strategies. This proactive engagement ensures that investigations are conducted in alignment with current legal standards and that organizations benefit from guidance grounded in authoritative expertise.

The application of predictive analytics in fraud detection further highlights the enduring relevance of the CFE credential. Professionals use statistical modeling, trend analysis, and anomaly detection techniques to identify patterns indicative of fraudulent activity. By integrating these methods with traditional auditing, investigative procedures, and behavioral observation, CFEs can develop nuanced understandings of organizational vulnerabilities and perpetrator behavior. Predictive capabilities enhance the preventive dimension of fraud detection, enabling organizations to allocate resources strategically and intervene before schemes reach critical impact.

Organizational culture is increasingly recognized as a determinant of susceptibility to fraud. Certified Fraud Examiners play a vital role in shaping ethical environments by advising on governance practices, employee education, and internal controls. Their interventions foster cultures of accountability and transparency, reducing the likelihood of internal misconduct and enhancing stakeholder confidence. The combination of technical expertise, ethical insight, and strategic advisory capacity enables CFEs to influence organizational behavior at both operational and strategic levels, reinforcing the preventive dimension of their work.

Emerging trends also underscore the need for continuous professional development. Certified Fraud Examiners are required to engage in ongoing education to maintain their credentials, ensuring that their skills evolve alongside changes in financial systems, regulatory frameworks, and investigative methodologies. This commitment to lifelong learning enhances adaptability, fortifies expertise, and sustains professional credibility in an environment characterized by rapid change. Continuous engagement with contemporary developments allows CFEs to remain effective in identifying and mitigating emerging forms of fraud.

Collaboration across organizational and jurisdictional boundaries has become increasingly critical. Fraud schemes often involve multiple entities, complex networks of individuals, and international financial mechanisms. Certified professionals facilitate cooperative investigations, coordinating efforts between legal authorities, corporate stakeholders, and regulatory bodies. Their training ensures that collaborative processes are structured, legally compliant, and ethically sound, enabling multi-faceted investigations that yield actionable insights. The ability to navigate such collaborations reinforces the strategic importance of the CFE credential in the modern investigative landscape.

The intersection of technology, regulation, and behavioral analysis positions Certified Fraud Examiners as indispensable agents in the prevention and mitigation of financial malfeasance. Their capacity to integrate diverse investigative tools, anticipate emerging threats, and apply ethical and legal frameworks ensures that organizations can respond effectively to both conventional and novel fraud schemes. The credential’s emphasis on holistic expertise, adaptability, and credibility ensures that CFEs are equipped to lead investigations, advise organizational leadership, and contribute to the broader resilience of financial and operational systems.

Strategic advisory roles are increasingly critical in the context of future fraud challenges. Certified professionals guide organizations in designing governance structures, implementing risk management frameworks, and developing policies that anticipate evolving threats. Their influence extends beyond investigation to encompass organizational strategy, cultural development, and operational resilience. By aligning investigative insight with organizational objectives, CFEs provide value that transcends reactive detection, fostering proactive strategies that reduce vulnerability and enhance long-term integrity.

Ethical stewardship remains central to the application of advanced investigative tools. Certified Fraud Examiners navigate the complexities of emerging technologies, regulatory environments, and human behavior with a principled approach that ensures compliance, protects stakeholder interests, and maintains public trust. This ethical foundation is critical as organizations face increasing scrutiny, heightened regulatory expectations, and more sophisticated threats that require judicious balancing of investigative rigor with moral responsibility.

The enduring relevance of the Certified Fraud Examiner credential is reflected in its capacity to adapt to future challenges while maintaining foundational standards of professional excellence. By equipping professionals with analytical, technological, legal, and ethical competencies, the credential ensures that CFEs remain effective across evolving environments. Their expertise allows organizations to anticipate risks, respond decisively to incidents, and cultivate cultures of integrity, thereby safeguarding both assets and reputational capital. In an era of rapid change and escalating complexity, the CFE credential continues to represent a benchmark of excellence in fraud detection and investigation.

Conclusion

In the evolving landscape of fraud detection underscores the enduring significance of the Certified Fraud Examiner credential. Emerging technologies, globalized financial networks, cyber threats, and complex regulatory requirements have transformed the challenges faced by investigators. The CFE certification equips professionals with the tools, knowledge, and ethical grounding necessary to address these challenges effectively. By integrating advanced investigative techniques, behavioral insight, legal acumen, and strategic advisory capabilities, certified professionals enhance organizational resilience, anticipate emerging risks, and maintain the integrity of financial systems. The credential’s emphasis on continuous learning, technological adaptation, and ethical conduct ensures that CFEs remain indispensable assets in the prevention, detection, and resolution of fraud, securing both professional advancement and lasting organizational impact.

Frequently Asked Questions

How can I get the products after purchase?

All products are available for download immediately from your Member's Area. Once you have made the payment, you will be transferred to Member's Area where you can login and download the products you have purchased to your computer.

How long can I use my product? Will it be valid forever?

Test-King products have a validity of 90 days from the date of purchase. This means that any updates to the products, including but not limited to new questions, or updates and changes by our editing team, will be automatically downloaded on to computer to make sure that you get latest exam prep materials during those 90 days.

Can I renew my product if when it's expired?

Yes, when the 90 days of your product validity are over, you have the option of renewing your expired products with a 30% discount. This can be done in your Member's Area.

Please note that you will not be able to use the product after it has expired if you don't renew it.

How often are the questions updated?

We always try to provide the latest pool of questions, Updates in the questions depend on the changes in actual pool of questions by different vendors. As soon as we know about the change in the exam question pool we try our best to update the products as fast as possible.

How many computers I can download Test-King software on?

You can download the Test-King products on the maximum number of 2 (two) computers or devices. If you need to use the software on more than two machines, you can purchase this option separately. Please email support@test-king.com if you need to use more than 5 (five) computers.

What is a PDF Version?

PDF Version is a pdf document of Questions & Answers product. The document file has standart .pdf format, which can be easily read by any pdf reader application like Adobe Acrobat Reader, Foxit Reader, OpenOffice, Google Docs and many others.

Can I purchase PDF Version without the Testing Engine?

PDF Version cannot be purchased separately. It is only available as an add-on to main Question & Answer Testing Engine product.

What operating systems are supported by your Testing Engine software?

Our testing engine is supported by Windows. Andriod and IOS software is currently under development.