Exam Code: 3I0-008

Exam Name: ACI Dealing Certificate

Certification Provider: ACI

Corresponding Certification: ACI Dealing Certificate

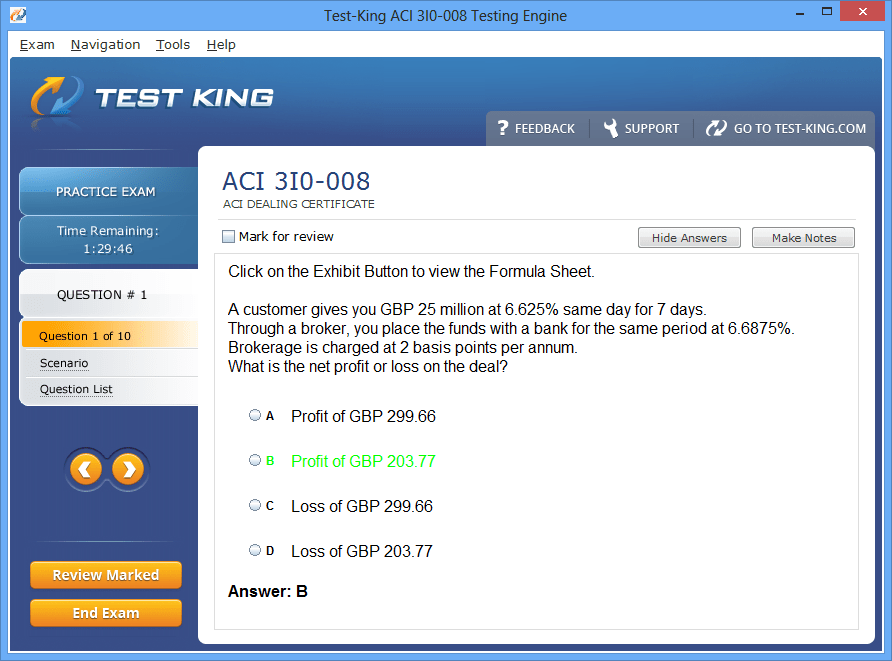

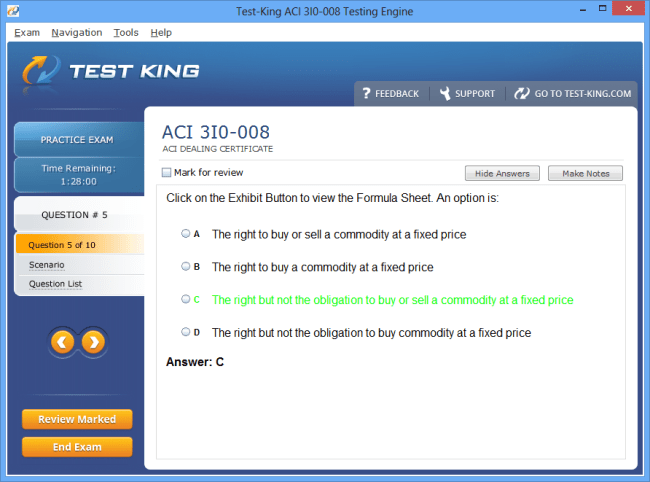

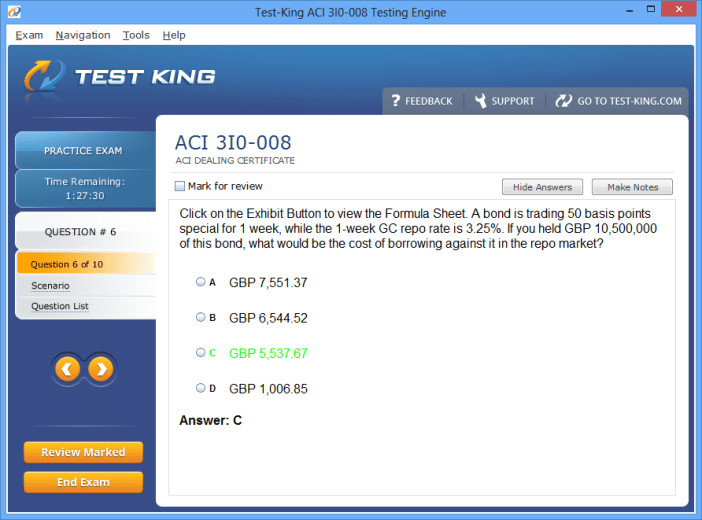

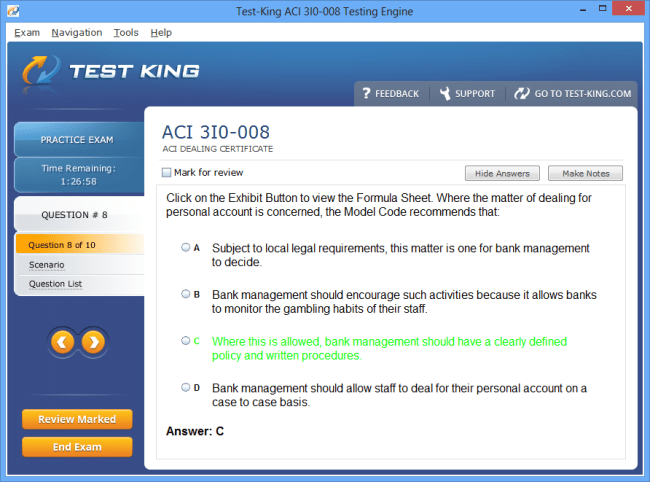

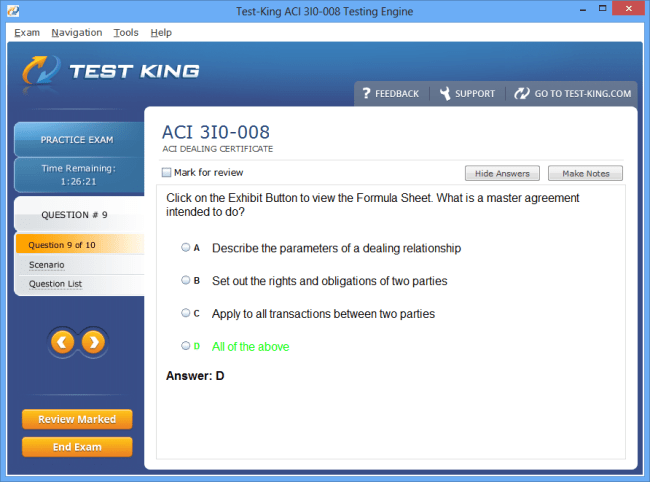

3I0-008 Exam Product Screenshots

Product Reviews

Morale booster

"Previously when I had attempted the 3I0-008exam, I could not pass it. In fact I had failed in the exam with very poor result. I became quite low because I had failed in second attempt as well. My morale was totally lost. But then my teacher asked me to only refer to test-king. Preparing from test-king was making me confident of myself. I was prepared in just three weeks time. I attempted a fair number of questions in 120 minutes and passed the exam successfully. My morale boosted because of test-king. Thanks test-king.

Sean Mcgowell

London, UK"

We all studied together and passed

"We were a group of seven to eight candidate who had all enrolled for 3I0-008exam. Initially we were referring to different books but we were not able to do group study. We all wanted some book that could ease in preparin and revisin. Test- king was the answer to our question. The relevant question and answers were ideal for us. It was easy to prepare in the group with test-king. We were able to attempt almost all the questions in 120 minutes and passed successfully.

Sri Bhushani Padmini

Ceylon, Sri Lanka"

You got me fame

"I was preparing for the 3I0-008exam when I was working as a money market specialist. I wanted to grow professionally and hence wanted to achieve this certification. Almost all my colleagues were preparing for it. My goal was to pass the exam and score the highest. Test-king was my real partner in exam preparation. The question and answers were so well explained that I got good time to revise as well. I attempted all the questions in 120 minutes and passed with 70 marks. I was not able to believe that I had actually scored the highest. Test-king made me famous. Test-king is great.

Shakina Begum

Lahore, Pakistan"

I feel on the top of the world

"While I had enrolled for the 3I0-008exam, I was also competing with my friends at the same time. There was a bet for scoring the highest marks. I wanted to do so. Test-king was my savior. I prepared from test-king completely. I was sure of my passing. I had prepared two three times from test-king. I passed the exam successfully by attempting all the questions in 120 minutes with 70 marks. Thanks test-king. I had won the bet. I am just feeling on the top of the world because of test-king.

Sanjana Malhotra

Mumbai, India"

All my hopes are accomplished

"I was working as a full time employee. Due to month end there was a lot of pressure on me. It had brief answers which made me easy in preparing. I was thoroughly prepared and ready for my exam. I wanted to prepare for the 3I0-008exam. I was looking for a book through which I can study in office only. I got to know of test-king. Test-king made me achieve my goals. I was successful in passing the exam with 75 marks. Thanks test-king for fulfilling my hopes.

Tao Nu Hun

North Korea"

Guaranteed chances of success

"I was working as a foreign exchange specialist. Then through my manager, I came to know about test-king. He made his career growth only by referring test-king in his exams. I worked hard and prepared in just three weeks time. I successfully attempted the paper and passed the exam with 70 marks. I finally made my mind to appear for the 3I0-008exam. I was not aware of any study guide for this exam. Thanks test-king.

Natasha Brejneva,

Russia."

Frequently Asked Questions

How can I get the products after purchase?

All products are available for download immediately from your Member's Area. Once you have made the payment, you will be transferred to Member's Area where you can login and download the products you have purchased to your computer.

How long can I use my product? Will it be valid forever?

Test-King products have a validity of 90 days from the date of purchase. This means that any updates to the products, including but not limited to new questions, or updates and changes by our editing team, will be automatically downloaded on to computer to make sure that you get latest exam prep materials during those 90 days.

Can I renew my product if when it's expired?

Yes, when the 90 days of your product validity are over, you have the option of renewing your expired products with a 30% discount. This can be done in your Member's Area.

Please note that you will not be able to use the product after it has expired if you don't renew it.

How often are the questions updated?

We always try to provide the latest pool of questions, Updates in the questions depend on the changes in actual pool of questions by different vendors. As soon as we know about the change in the exam question pool we try our best to update the products as fast as possible.

How many computers I can download Test-King software on?

You can download the Test-King products on the maximum number of 2 (two) computers or devices. If you need to use the software on more than two machines, you can purchase this option separately. Please email support@test-king.com if you need to use more than 5 (five) computers.

What is a PDF Version?

PDF Version is a pdf document of Questions & Answers product. The document file has standart .pdf format, which can be easily read by any pdf reader application like Adobe Acrobat Reader, Foxit Reader, OpenOffice, Google Docs and many others.

Can I purchase PDF Version without the Testing Engine?

PDF Version cannot be purchased separately. It is only available as an add-on to main Question & Answer Testing Engine product.

What operating systems are supported by your Testing Engine software?

Our testing engine is supported by Windows. Andriod and IOS software is currently under development.

Top ACI Exams

3I0-008: Understanding the ACI Dealing Certificate and Its Importance

The ACI Dealing Certificate represents a cornerstone of professional recognition in the intricate world of financial markets. Designed for individuals who aspire to demonstrate proficiency in money markets, foreign exchange, and derivatives, this certification carries both credibility and practical relevance. Unlike general financial qualifications, it is specifically tailored to cultivate operational expertise that can be directly applied in trading and treasury functions. Attaining this certificate signals to employers and colleagues that the holder possesses a robust comprehension of market conventions, risk management strategies, and the subtle nuances that govern interbank and institutional transactions.

The Evolution and Relevance of the Certification

Financial markets are not static; they are an evolving tapestry of instruments, conventions, and global interactions. The ACI Dealing Certificate emerged from the need to standardize knowledge and operational competency across financial institutions worldwide. Initially, financial training was fragmented and heavily reliant on on-the-job mentoring, leading to inconsistencies in knowledge application. Over time, it became apparent that a formalized framework could provide both aspiring professionals and established practitioners with a reliable benchmark for skills and understanding. By equipping candidates with rigorous knowledge of instruments such as treasury bills, certificates of deposit, foreign exchange forwards, and interest rate swaps, the certificate ensures that participants are prepared to navigate market fluctuations with dexterity.

The relevance of this qualification extends beyond technical know-how. It underscores the ability to interpret market signals, assess counterparty risk, and make informed decisions in high-pressure environments. For instance, understanding the implications of contango and backwardation in the commodities or currency markets allows professionals to anticipate price movements and devise hedging strategies with precision. The certificate serves as an emblem of competence, signaling that the holder is well-versed in both theoretical frameworks and operational practice.

The Structure of the Exam

The exam for the ACI Dealing Certificate, commonly recognized by the code 3I0-008, is designed to assess both conceptual understanding and practical application. Candidates encounter questions that test knowledge of money market instruments, foreign exchange operations, and derivatives. While the syllabus covers a wide spectrum of topics, the questions are often framed to reflect real-world scenarios. For example, an exam question might present a hypothetical trading situation where a treasury manager must determine the optimal hedge against currency risk. Instead of merely testing definitions, such questions require candidates to integrate multiple concepts, such as interest rate differentials, settlement conventions, and counterparty exposures, into a coherent strategy. This methodology ensures that certified professionals can translate theoretical knowledge into actionable decisions.

A distinctive feature of the exam is its emphasis on comprehension of market conventions. Candidates must grasp the subtleties of spot and forward settlements, understand the impact of liquidity on pricing, and be able to calculate key metrics such as yield curves and forward rates. These concepts, though technical, are interwoven with practical decision-making scenarios, reinforcing the idea that proficiency in financial markets is not solely about memorization but also about analytical and operational aptitude.

Key Knowledge Areas

Candidates preparing for the ACI Dealing Certificate must develop a deep understanding of several critical domains. Money markets form the foundation, encompassing instruments like treasury bills, certificates of deposit, commercial paper, and repurchase agreements. Understanding the functioning, pricing, and risk factors associated with these instruments is essential. In addition, the certificate emphasizes foreign exchange operations, including spot transactions, forward contracts, swaps, and options. Knowledge of exchange rate determinants, such as interest rate parity and market liquidity, is indispensable.

Derivatives constitute another pivotal area. The exam evaluates the candidate’s ability to understand futures, options, and swaps, not only in terms of pricing and mechanics but also in terms of practical application for hedging and speculation. For instance, a candidate may be asked how an institution can use interest rate swaps to manage exposure to fluctuating rates, requiring both theoretical insight and operational reasoning. Risk management is woven throughout the syllabus, highlighting the importance of assessing credit risk, market risk, and operational risk in day-to-day dealing activities.

The Benefits of Certification

Obtaining the ACI Dealing Certificate conveys multiple advantages for a professional career in finance. Beyond recognition, it provides a structured approach to mastering complex market instruments and conventions. Employers value certified candidates for their ability to operate with minimal supervision, interpret market signals accurately, and apply sophisticated risk mitigation strategies. The certification also opens avenues for career progression in treasury management, trading, and risk advisory roles. In addition, it enhances credibility in client-facing interactions, as stakeholders often prefer to engage with professionals who have demonstrated validated competence.

The certification also fosters intellectual versatility. Candidates gain exposure to analytical frameworks, scenario evaluation, and decision-making heuristics, which are applicable in a wide array of financial contexts. Understanding the interconnectedness of global markets, for instance, allows professionals to anticipate the ripple effects of policy changes, interest rate adjustments, and macroeconomic trends on both domestic and international portfolios. This holistic comprehension sets the certified professional apart in environments where rapid, informed decision-making is critical.

Transforming Question-and-Answer Formats into Practical Understanding

Exam preparation is often approached through sample questions and model answers. For the ACI Dealing Certificate, a common question may involve assessing the impact of a shift in LIBOR rates on a forward contract position. Rather than memorizing the answer, successful candidates convert the question into a practical narrative: a trader observes a rise in interest rates and evaluates how it alters the present value of future cash flows, considering both the contractual terms and market liquidity. This approach transforms rote memorization into applied intelligence, allowing candidates to navigate real-world market conditions with confidence.

Similarly, scenarios may involve managing foreign exchange exposure for a multinational corporation. Instead of responding to the question abstractly, candidates learn to simulate the treasury management process: identifying exposures, selecting appropriate hedging instruments, calculating cost implications, and evaluating residual risks. By integrating these analytical steps, aspirants build a repertoire of operational knowledge that extends beyond the confines of the exam and into professional practice.

The Global Recognition and Operational Impact

The ACI Dealing Certificate is recognized internationally, reflecting the standardization of financial practices across jurisdictions. Its value is not confined to any single market but extends to global institutions seeking professionals capable of managing cross-border transactions. This universality reinforces the importance of mastering not only the mechanics of instruments but also the principles of market conduct, ethical dealing, and regulatory compliance.

Certified professionals often report enhanced confidence in operational roles. They are better equipped to handle high-pressure situations, execute complex trades, and provide informed advice to management or clients. The credential also supports a deeper understanding of macroeconomic interdependencies, enabling candidates to anticipate the effects of monetary policy changes, geopolitical events, and market sentiment on asset prices and liquidity.

Knowledge and Preparation Value

While this article does not aim to summarize or close the discussion, it is evident that the ACI Dealing Certificate is much more than an exam. It represents a structured journey into the intricacies of financial markets, offering candidates an opportunity to combine technical knowledge, analytical reasoning, and practical application. Mastery of money markets, foreign exchange, derivatives, and risk management, coupled with the ability to convert hypothetical scenarios into operational strategies, provides a lasting foundation for professional excellence in global financial operations.

Understanding the Syllabus of the ACI Dealing Certificate

The ACI Dealing Certificate, recognized by the exam code 3I0-008, is structured to assess a candidate's practical and theoretical understanding of financial markets, including money markets, foreign exchange, and derivatives. The syllabus is meticulously designed to ensure aspirants develop both operational competency and conceptual clarity, allowing them to navigate real-world market scenarios with confidence. Unlike generic financial qualifications, this certification emphasizes the interplay between instruments, risk management, and market conventions, creating a holistic framework for trading and treasury operations.

Candidates preparing for the examination encounter a broad spectrum of topics, ranging from fundamental principles to complex derivative strategies. Understanding the relative weighting of these topics is essential to optimize preparation. For instance, money market instruments and foreign exchange operations are heavily emphasized, reflecting their centrality in daily dealing activities. Derivatives, though sometimes perceived as abstruse, form a critical component, especially in hedging and risk mitigation strategies. By internalizing these concepts, candidates are equipped to translate theoretical knowledge into precise and actionable decision-making.

Money Market Instruments

The money market forms the bedrock of the syllabus, covering instruments such as treasury bills, commercial paper, certificates of deposit, and repurchase agreements. These instruments are vital for short-term funding and liquidity management, and understanding their characteristics, pricing, and settlement conventions is indispensable for any candidate.

For example, an exam question may describe a scenario where a bank is considering investing surplus funds in a short-term instrument. Instead of seeking a simple definition of treasury bills or commercial paper, candidates are expected to evaluate yield calculations, settlement cycles, and counterparty risk. A nuanced understanding of market conventions, including day count conventions, bid-offer spreads, and accrued interest computation, allows candidates to approach such questions with operational insight rather than rote memorization.

Liquidity is a recurring theme within money markets, as it directly influences pricing and risk exposure. Aspirants are often asked to analyze how changes in liquidity conditions, such as central bank interventions or interbank lending fluctuations, impact instrument valuations. These questions encourage candidates to synthesize macroeconomic awareness with technical knowledge, fostering a deeper appreciation of the market’s interdependent mechanisms.

Foreign Exchange Operations

Foreign exchange operations constitute a significant portion of the examination, reflecting the critical role of currency markets in global finance. Candidates are expected to understand spot and forward transactions, swaps, options, and the factors influencing exchange rates. This includes interest rate differentials, purchasing power parity, market sentiment, and geopolitical influences.

Exam scenarios frequently involve assessing currency exposure for an organization. For instance, a multinational corporation might be exposed to fluctuations in multiple currency pairs, and the candidate may be required to determine the optimal hedging strategy using forwards or currency swaps. Rather than memorizing formulae, successful candidates approach these questions by visualizing the operational process: identifying exposures, selecting suitable instruments, evaluating cost implications, and considering residual risk. This narrative-based comprehension enhances decision-making agility and ensures preparedness for real-life trading responsibilities.

Understanding market conventions is also crucial in foreign exchange. Questions often probe the mechanics of settlement dates, spot-next trades, and the calculation of forward points. By internalizing these conventions, candidates gain the ability to anticipate operational requirements and avoid common pitfalls that could arise in high-pressure trading environments.

Derivatives and Their Applications

Derivatives are another core component of the ACI Dealing Certificate syllabus. The examination requires candidates to understand futures, options, and swaps, along with their pricing, valuation, and practical applications in hedging and speculation. Exam questions frequently present hypothetical trading scenarios in which candidates must determine the most suitable derivative instrument to mitigate risk or enhance returns.

For example, a question may describe a scenario where a company anticipates interest rate volatility affecting its loan portfolio. The candidate would need to evaluate interest rate swaps or options, considering factors such as notional principal, duration, and payment schedules. This type of analysis demands both conceptual understanding and operational acuity, as candidates must reconcile theoretical pricing models with practical market conditions.

The exam also tests comprehension of complex derivative structures, including exotic options and cross-currency swaps. Candidates are often required to calculate the impact of market shifts, such as changes in interest rates or currency valuations, on these instruments. By converting numerical problems into operational narratives, candidates can demonstrate applied intelligence rather than mere memorization, which is the hallmark of a proficient ACI-certified professional.

Risk Management Principles

Risk management is interwoven throughout the syllabus, emphasizing the need to identify, assess, and mitigate various forms of market, credit, and operational risk. Candidates are often presented with scenarios involving potential exposures, and the task is to evaluate risk and implement appropriate control measures.

For example, a typical scenario might involve a treasury managing foreign exchange exposure for a client with international transactions. The candidate must consider potential volatility, counterparty reliability, and settlement timing, formulating strategies to minimize adverse impact. Similarly, questions may probe the assessment of liquidity risk in money market investments or the hedging of interest rate risk through derivatives. By approaching these problems as operational exercises rather than abstract calculations, aspirants develop both analytical acuity and practical readiness.

Regulatory and Ethical Considerations

A subtle but critical aspect of the syllabus involves regulatory frameworks and ethical dealing principles. Candidates must understand the conventions and guidelines governing interbank transactions, reporting requirements, and compliance standards. Exam questions may present hypothetical breaches of protocol, asking candidates to evaluate the implications and corrective actions.

For instance, a question could describe an unauthorized position taken by a trader and prompt candidates to identify breaches of conduct, assess potential financial and reputational consequences, and propose remedial measures. By embedding regulatory awareness into their preparation, candidates cultivate a sense of professional responsibility and operational prudence, which are essential attributes for dealing professionals operating in high-stakes markets.

Integrating Knowledge Through Scenario-Based Learning

A distinctive feature of the examination is its reliance on scenario-based questions that demand integration of multiple knowledge areas. Candidates may be required to analyze a situation involving money market investments, foreign exchange exposure, derivative instruments, and risk assessment simultaneously. This approach mirrors the complexity of real-world financial operations, where decisions are rarely isolated and often involve interconnected considerations.

For example, a scenario might involve a bank evaluating short-term funding options while hedging currency risk and monitoring interest rate exposure. Rather than approaching each aspect independently, the candidate synthesizes information, calculates potential impacts, and devises a coherent strategy that balances risk, return, and operational feasibility. This holistic approach reinforces the value of comprehensive preparation and mirrors the skill set required in professional dealing roles.

Converting Question and Answer Formats into Practical Understanding

Candidates often prepare for the examination using question-answer formats, but success depends on transforming these into practical narratives. A question asking about calculating forward points for a currency pair is better approached by visualizing a treasury manager assessing a client’s exposure, applying the calculation, and determining the forward contract terms. This method bridges theory and practice, ensuring that learning translates into actionable knowledge.

Similarly, questions regarding derivatives and hedging strategies are best understood through operational storytelling. Candidates imagine themselves in the role of a treasury professional evaluating risk and constructing solutions, rather than simply recalling formulas. This narrative method fosters deeper comprehension, enhances retention, and equips candidates with the intuition necessary for real-world decision-making.

Practical Tips for Syllabus Mastery

Mastery of the syllabus requires structured and disciplined preparation. Candidates should prioritize topics based on weighting and difficulty, allocate sufficient time to complex areas like derivatives, and reinforce understanding through scenario-based exercises. Active recall, spaced repetition, and mnemonic devices can aid in retention of key formulas, conventions, and risk assessment frameworks.

Collaborative learning can also enhance understanding, as discussing scenarios with peers exposes candidates to alternative approaches and interpretations. By continuously integrating theory with simulated practical exercises, aspirants not only prepare for the examination but also develop a mindset aligned with operational excellence in financial markets.

Connecting Syllabus Knowledge to Professional Competency

Ultimately, the ACI Dealing Certificate syllabus is designed to cultivate a combination of technical proficiency, analytical reasoning, and practical decision-making. Understanding money market instruments, foreign exchange operations, derivatives, and risk management is not merely academic; it directly enhances operational capability and professional credibility. Candidates who internalize the syllabus emerge with a sophisticated understanding of market dynamics, capable of executing trades, assessing risk, and providing informed advice in professional contexts.

Introduction to Study Techniques for the ACI Dealing Certificate

Preparation for the ACI Dealing Certificate requires more than just reading textbooks or memorizing formulas. The exam, known by the code 3I0-008, assesses both conceptual understanding and practical application across money markets, foreign exchange, derivatives, and risk management. Aspiring candidates must develop study techniques that reinforce knowledge retention, analytical reasoning, and operational competency. Effective preparation involves cognitive strategies, structured planning, scenario-based learning, and continuous self-assessment, all of which enable candidates to internalize complex concepts and navigate exam challenges with confidence.

The application of advanced learning techniques, such as spaced repetition and active recall, allows candidates to retain critical concepts over long periods. Spaced repetition, in particular, ensures that knowledge of money market instruments, currency operations, and derivative mechanics is revisited at optimal intervals, reducing cognitive decay. Active recall encourages retrieval of information in a practical context, reinforcing the ability to apply knowledge in scenario-based questions. Integrating these techniques with real-world examples creates a learning experience that is both durable and operationally meaningful.

Structuring a Study Plan

Creating a structured study plan is indispensable for candidates aiming to succeed in the ACI Dealing Certificate examination. A systematic approach involves dividing the syllabus into manageable modules, allocating time based on topic complexity, and incorporating regular review periods. For example, aspirants may dedicate initial weeks to understanding foundational concepts in money markets and foreign exchange, followed by intensive focus on derivatives and risk management. Allocating sufficient time to scenario-based exercises ensures that theoretical knowledge is consistently translated into practical application.

An effective study plan also integrates flexibility, allowing candidates to adjust focus areas based on self-assessment results. Weekly progress reviews, mock exam performance, and concept quizzes help identify weak points that require additional attention. By continually recalibrating their approach, candidates can avoid overemphasis on familiar topics and ensure balanced mastery across all examination domains.

Active Recall and Spaced Repetition

Active recall is a cornerstone of effective preparation for the ACI Dealing Certificate. This technique involves attempting to retrieve information without reference materials, simulating exam conditions and reinforcing memory consolidation. For instance, candidates may challenge themselves to explain the mechanics of a forward contract or interest rate swap in their own words, without consulting textbooks. This exercise not only strengthens memory but also enhances comprehension of practical applications, ensuring readiness for scenario-based questions.

Spaced repetition complements active recall by strategically revisiting topics at increasing intervals. Candidates may review money market instruments on alternate days, foreign exchange conventions weekly, and derivative applications bi-weekly. This deliberate spacing counteracts cognitive decay and reinforces long-term retention. Combining these techniques creates a robust framework for retaining both conceptual knowledge and operational procedures, which is essential for success in high-pressure exam environments.

Scenario-Based Learning

Scenario-based learning is particularly effective for the ACI Dealing Certificate, as it mirrors the real-world challenges faced by financial professionals. Candidates are often presented with hypothetical situations involving treasury management, currency exposure, or derivative hedging, requiring the integration of multiple concepts. For example, a question may describe a corporation seeking to hedge against interest rate fluctuations while simultaneously managing foreign exchange risk. Rather than treating each topic independently, candidates must synthesize knowledge of swaps, forwards, and money market instruments to devise a coherent operational strategy.

By consistently practicing scenario-based exercises, aspirants develop the ability to translate theoretical understanding into practical problem-solving. This approach also cultivates cognitive agility, enabling candidates to analyze new situations with confidence and apply previously learned concepts in novel contexts. Scenario-based learning therefore reinforces both comprehension and operational intuition, critical attributes for dealing professionals.

Using Mnemonics and Cognitive Scaffolding

Memorizing conventions, formulas, and procedural steps can be challenging due to the volume and complexity of the syllabus. Mnemonics offer an effective way to retain intricate information, such as settlement conventions, yield calculation methods, and risk assessment frameworks. For instance, a mnemonic can simplify the sequence of steps involved in pricing a forward contract or calculating accrued interest.

Cognitive scaffolding is another valuable technique, wherein complex concepts are broken down into smaller, more manageable subcomponents. Candidates may first focus on understanding the mechanics of treasury bills before integrating them with broader concepts in money markets and liquidity management. This progressive approach allows aspirants to build conceptual hierarchies, ensuring that advanced topics are grounded in a solid foundational understanding. Cognitive scaffolding also aids in problem-solving, as it encourages candidates to approach multifaceted scenarios systematically rather than being overwhelmed by complexity.

Mock Exams and Practice Questions

Regular practice through mock exams and sample questions is indispensable for reinforcing preparation. Mock exams simulate the timing, structure, and complexity of the actual 3I0-008 examination, providing candidates with insights into pacing, question sequencing, and time allocation. For example, practicing questions on currency swaps, interest rate derivatives, or liquidity management allows candidates to identify areas of strength and weakness.

Questions often require candidates to perform calculations, evaluate risk exposure, or propose hedging strategies. By converting these questions into narrative explanations, candidates strengthen both conceptual understanding and operational reasoning. For instance, a question about calculating forward points for a currency pair can be approached by visualizing the treasury process, assessing exposure, and determining appropriate forward contract terms. This method bridges theory and practice, enhancing both comprehension and exam readiness.

Collaborative Learning and Peer Discussion

Studying collaboratively can significantly enhance understanding of complex topics. Engaging in peer discussions, group problem-solving, and knowledge exchange allows candidates to encounter alternative perspectives and methodologies. For example, one candidate may explain the nuances of an interest rate swap differently from another, revealing subtle considerations in pricing, duration, or settlement conventions.

Collaborative learning also promotes critical thinking, as candidates are encouraged to justify their reasoning and challenge assumptions. This active engagement deepens comprehension, reinforces retention, and cultivates the professional communication skills necessary for dealing roles. It also mirrors the collaborative nature of financial institutions, where team-based analysis and decision-making are essential.

Time Management Techniques

Time management is crucial during both preparation and examination. Candidates must allocate sufficient time for reading, practice, and review, while also ensuring regular breaks to prevent cognitive fatigue. Techniques such as the Pomodoro method, which involves focused study intervals followed by short breaks, can enhance concentration and retention.

During the examination, time management remains equally important. Candidates should prioritize questions based on complexity and marks, addressing simpler or high-confidence questions first to secure marks, and then focusing on more challenging scenarios. This disciplined approach reduces anxiety, improves accuracy, and ensures comprehensive coverage of all topics within the allotted time.

Integrating Knowledge Across Topics

Effective preparation requires the integration of knowledge across money markets, foreign exchange, derivatives, and risk management. Many exam questions present multifaceted scenarios that draw upon multiple domains simultaneously. For instance, a question may require calculating the impact of interest rate changes on a portfolio of foreign currency investments and derivative contracts.

Candidates who have practiced integrated learning are better equipped to approach such questions holistically. By connecting concepts, understanding interdependencies, and visualizing operational applications, candidates develop a cohesive framework that supports both exam performance and real-world professional competency.

Maintaining Focus and Mental Resilience

Preparation for the ACI Dealing Certificate can be intellectually demanding, requiring sustained focus and mental resilience. Techniques such as mindfulness, meditation, and mental visualization can help candidates maintain concentration and manage stress. For example, visualizing the process of executing a swap or hedging a currency exposure can reinforce understanding while promoting cognitive calm.

Equanimity is particularly important during scenario-based exercises and mock exams, where complexity and time pressure can induce anxiety. Maintaining a balanced mindset allows candidates to analyze problems methodically, apply learned concepts, and avoid impulsive decisions that could undermine performance. Mental resilience thus complements technical preparation, ensuring readiness for both the examination and professional practice.

Translating Study Techniques into Operational Competency

Ultimately, the study techniques employed for the ACI Dealing Certificate serve not only to pass the examination but also to cultivate operational competence. Active recall, spaced repetition, scenario-based learning, cognitive scaffolding, and collaborative practice collectively reinforce knowledge retention, analytical reasoning, and practical application. Candidates who internalize these techniques emerge with the ability to navigate complex financial markets, assess risk, and implement strategies with confidence.

By continuously connecting study methods to real-world applications, aspirants develop both intellectual agility and professional intuition. This dual capability distinguishes certified professionals, enabling them to operate with precision, anticipate market dynamics, and provide informed advice in treasury and trading roles.

Real-World Applications of ACI Knowledge

The ACI Dealing Certificate equips candidates with operational skills that extend far beyond theoretical understanding. Money markets, foreign exchange, derivatives, and risk management are not merely abstract concepts; they form the backbone of daily treasury and trading operations. Understanding these instruments allows professionals to manage liquidity, hedge exposure, and optimize returns in dynamic financial environments. The practical application of ACI knowledge is essential for success in roles that demand precise execution and strategic foresight.

For instance, money market instruments such as treasury bills, certificates of deposit, and repurchase agreements are often used for short-term funding and liquidity management. A candidate familiar with these instruments can analyze interest rates, assess creditworthiness, and select the most appropriate investment or borrowing options. This operational insight ensures that organizations maintain optimal liquidity while minimizing risk. Questions on exams may simulate such scenarios, asking candidates to evaluate returns and risks, thereby fostering a mindset that combines analytical rigor with practical reasoning.

Managing Foreign Exchange Exposure

Foreign exchange operations are central to global finance, and the ACI Dealing Certificate prepares candidates to manage currency risks effectively. Organizations with international operations often face fluctuations in currency values, which can significantly impact profit margins. Certified professionals are trained to use instruments such as spot contracts, forwards, swaps, and options to mitigate these risks.

An illustrative scenario might involve a multinational company that expects to receive payments in multiple foreign currencies over the next quarter. The treasury team must determine how to hedge against potential depreciation of one currency while optimizing returns from another. Exam-style questions often present such situations, requiring candidates to evaluate forward contracts and currency swaps. By translating the problem into operational terms, candidates can calculate potential outcomes, decide on appropriate hedging instruments, and anticipate residual exposure, which mirrors the complexity of real-world treasury management.

Derivatives in Operational Strategy

Derivatives, including futures, options, and swaps, are critical tools for hedging and speculative strategies. The ACI syllabus emphasizes understanding not only the mechanics of these instruments but also their practical applications in risk mitigation. For example, an interest rate swap can be employed to transform floating-rate liabilities into fixed-rate obligations, reducing exposure to market fluctuations. Similarly, options provide flexibility in managing potential adverse movements without obligating the organization to a fixed course of action.

Scenario-based questions on derivatives often challenge candidates to construct hedging strategies under changing market conditions. For instance, a bank might face volatility in interest rates that affects both its asset portfolio and client obligations. Candidates must determine the appropriate combination of swaps and options to neutralize risk, considering factors such as notional principal, duration, and counterparty reliability. Converting such questions into narrative explanations reinforces operational understanding and prepares candidates for real-world decision-making.

Liquidity Management in Practice

Liquidity management is a recurring theme in both the ACI syllabus and financial operations. Institutions must balance short-term funding needs with investment opportunities, ensuring that cash flow requirements are met without incurring unnecessary costs. Money market instruments are often employed to achieve this balance, and certified professionals are adept at selecting instruments that optimize yield while maintaining liquidity.

A practical example could involve a bank evaluating various instruments to invest surplus funds while retaining access for unexpected withdrawals. The candidate may be asked to compare treasury bills, commercial paper, and certificates of deposit, taking into account maturity dates, yields, and counterparty creditworthiness. By framing the question as a real-world operational task, candidates develop the ability to apply theoretical knowledge in a structured, analytical manner.

Risk Assessment and Mitigation

Risk management permeates all aspects of dealing operations. Candidates are trained to identify, assess, and mitigate market, credit, and operational risks. Exam scenarios often present complex situations that require integrating multiple concepts to arrive at optimal solutions.

For example, a question might describe a treasury managing a portfolio of foreign currency investments, derivatives, and money market instruments, asking the candidate to evaluate overall exposure. By approaching this scenario as an operational exercise, candidates consider potential market volatility, counterparty reliability, liquidity constraints, and residual risks. This holistic perspective mirrors the decision-making required in professional treasury and trading environments.

Case Study: Hedging Currency Risk

Consider a hypothetical multinational corporation that imports raw materials from several countries and invoices clients in multiple currencies. The treasury team must protect the company from adverse currency movements while optimizing operational efficiency. Certified professionals would analyze the timing and magnitude of exposures, select appropriate forward contracts or swaps, calculate forward points, and implement hedging strategies that minimize cost and residual risk.

Exam questions often simulate this scenario, requiring candidates to explain the rationale behind each decision. By framing the solution as a step-by-step operational process, candidates not only demonstrate conceptual mastery but also develop practical skills directly applicable in corporate finance and treasury management.

Case Study: Interest Rate Management

Interest rate fluctuations can significantly impact both lending institutions and corporate borrowers. A bank managing a portfolio of floating-rate loans might employ swaps to convert exposure into fixed-rate obligations, thereby reducing vulnerability to market changes. Exam-style questions often present such cases, asking candidates to evaluate swap terms, notional amounts, and payment schedules.

Candidates are expected to approach these problems as operational exercises rather than abstract calculations. By visualizing the treasury process, assessing potential outcomes, and implementing hedging strategies, they develop practical understanding. This approach bridges the gap between theoretical knowledge and professional execution, ensuring readiness for real-world responsibilities.

Scenario-Based Integration of Concepts

Many examination questions require simultaneous application of multiple concepts. For instance, a scenario might involve evaluating money market investments, hedging foreign exchange exposure, and managing interest rate risk concurrently. Certified candidates are trained to synthesize knowledge across these domains, developing cohesive strategies that address complex financial realities.

In practice, this might involve selecting short-term money market instruments to optimize liquidity, while using forward contracts and swaps to hedge currency and interest rate exposures. By converting scenario-based questions into narrative operational solutions, candidates reinforce their ability to integrate theoretical understanding with practical application, preparing them for the multifaceted challenges of professional dealing roles.

Practical Applications in Treasury Operations

The ACI Dealing Certificate equips professionals to operate effectively in treasury functions. Day-to-day operations often involve managing cash flow, monitoring market movements, and executing trades with precision. For example, a treasury manager may need to decide between various money market instruments to meet short-term obligations, hedge currency exposure for international transactions, and structure derivative positions to minimize interest rate risk.

Exam questions simulate such operational responsibilities, asking candidates to evaluate choices, calculate potential outcomes, and recommend optimal strategies. By converting these questions into practical scenarios, candidates develop both analytical acumen and procedural confidence, essential for success in high-pressure financial environments.

Enhancing Decision-Making Skills

Practical application of ACI knowledge extends beyond technical proficiency; it enhances decision-making skills in complex and dynamic markets. Scenario-based exercises cultivate the ability to analyze multiple variables, weigh trade-offs, and implement strategies that balance risk, return, and operational feasibility. For instance, evaluating the impact of central bank policy changes on money market instruments and currency positions requires both macroeconomic awareness and operational insight.

Certified candidates develop a structured approach to decision-making, using scenario analysis, sensitivity testing, and operational judgment to navigate uncertainties. This practical acumen is a defining feature of professionals who hold the ACI Dealing Certificate, enabling them to operate confidently and effectively in real-world financial contexts.

Translating Exam Questions into Operational Narratives

A key strategy for mastering the ACI examination involves converting abstract questions into operational narratives. For example, a question asking about the use of forward contracts to hedge currency exposure can be reframed as a treasury scenario: assessing client invoices, evaluating exchange rate forecasts, calculating forward points, and implementing a hedging strategy. This method ensures that candidates internalize concepts in a manner that mirrors real-world application.

Similarly, derivative-related questions are best understood through operational storytelling. Candidates imagine themselves executing swaps, options, or futures in a treasury environment, considering notional values, maturity dates, and market conditions. This approach transforms theoretical knowledge into applied intelligence, reinforcing both comprehension and professional competency.

Applying Knowledge to Portfolio Management

Certified professionals often apply ACI knowledge to manage investment portfolios, combining money market instruments, derivatives, and currency positions. This requires continuous monitoring of market conditions, assessing risk exposure, and adjusting positions to optimize returns. For example, managing a diversified portfolio of short-term investments involves balancing yield, liquidity, and counterparty risk while ensuring compliance with regulatory guidelines.

Exam questions simulate these responsibilities, asking candidates to evaluate trade-offs, calculate potential outcomes, and propose optimal strategies. By approaching these problems as operational exercises, candidates develop practical expertise, analytical agility, and a holistic understanding of market dynamics.

Enhancing Professional Credibility

The practical application of ACI knowledge enhances professional credibility. Candidates who can integrate money market, foreign exchange, and derivative expertise into coherent operational strategies are recognized as capable, reliable, and knowledgeable professionals. This credibility is essential for roles in treasury, trading, risk management, and financial advisory, where precise execution and informed decision-making are paramount.

Operational understanding, reinforced through scenario-based learning and case studies, ensures that certified professionals are equipped to navigate complex financial environments. By continuously applying theoretical concepts to practical challenges, candidates build both confidence and competence, positioning themselves as valuable assets within financial institutions.

Introduction to Preparation Challenges

Preparing for the ACI Dealing Certificate, identified by the exam code 3I0-008, presents an array of intellectual and operational challenges. The syllabus encompasses money markets, foreign exchange operations, derivatives, and risk management, each with nuanced concepts and practical applications. Many candidates encounter difficulties in managing the breadth of content, understanding complex instruments, and applying theoretical knowledge to scenario-based questions. Addressing these challenges requires a combination of structured study techniques, mental resilience, and adaptive learning strategies that transform preparation into a coherent and effective process.

Understanding potential obstacles early in preparation allows candidates to implement strategies that mitigate anxiety, cognitive overload, and inefficiency. By focusing on the most demanding concepts and practicing scenario-based problem-solving, candidates can convert challenges into opportunities for deep comprehension and operational competence.

Complexity of Derivatives

Derivatives often represent the most intricate and intimidating component of the syllabus. Futures, options, swaps, and exotic instruments involve multiple variables, including notional amounts, strike prices, settlement conventions, and interest rate differentials. Candidates frequently struggle to internalize the interrelationship between these variables and their practical implications.

A common exam scenario might involve constructing a hedging strategy using swaps and options to mitigate interest rate and currency risk for a corporate portfolio. Instead of attempting to memorize formulas, candidates are encouraged to approach the problem as an operational narrative: evaluating exposure, calculating potential outcomes, selecting appropriate instruments, and considering residual risk. This approach fosters a deeper understanding and allows candidates to tackle similar scenarios in the examination and professional practice.

Managing Cognitive Load

The extensive syllabus can contribute to cognitive overload, where the sheer volume of concepts impedes comprehension and retention. Money market instruments, foreign exchange conventions, derivatives, and risk management principles each involve distinct mechanisms and operational nuances. Integrating these areas without a structured approach can overwhelm even experienced candidates.

To mitigate cognitive load, candidates are advised to employ cognitive scaffolding, breaking complex topics into smaller, manageable subcomponents. For example, mastering treasury bills and certificates of deposit before advancing to repo agreements and commercial paper allows for progressive comprehension. Similarly, understanding spot and forward foreign exchange transactions before tackling currency swaps and options establishes a strong foundation. This structured approach enhances memory retention and reduces the mental strain associated with high-density learning.

Time Management Challenges

Time management is another frequent obstacle. Balancing preparation across multiple topics, allocating time for revision, and practicing scenario-based exercises can be daunting. Candidates may find themselves spending excessive time on familiar concepts while neglecting more challenging areas.

An effective solution involves creating a dynamic study timetable that prioritizes high-weighted or complex topics. Incorporating timed practice sessions and mock exams helps simulate exam conditions, reinforcing both knowledge and pacing. During preparation, candidates should periodically reassess their progress, adjusting focus areas to ensure balanced coverage and efficient use of available time.

Exam Anxiety and Stress

The pressure of high-stakes certification examinations can induce anxiety, which adversely affects concentration and performance. Candidates may experience apprehension when confronting unfamiliar scenario-based questions or time-limited tasks. Stress can also exacerbate difficulty in recalling complex concepts, particularly in derivatives or risk management calculations.

Techniques such as mindfulness, meditation, and cognitive rehearsal are effective for managing exam-related stress. For instance, visualizing the process of executing a forward contract or a swap under hypothetical market conditions can reinforce understanding while promoting mental calm. Regular breaks, physical activity, and structured relaxation routines further enhance focus and cognitive clarity, enabling candidates to approach the examination with equanimity.

Integrating Knowledge Across Topics

A common challenge lies in integrating concepts across money markets, foreign exchange, derivatives, and risk management. Scenario-based questions often require simultaneous application of multiple domains, demanding analytical flexibility and operational insight. Candidates may struggle to synthesize information from different areas, leading to fragmented solutions or incomplete strategies.

For example, a question may involve evaluating a corporate portfolio with exposure to short-term funding requirements, fluctuating foreign currency payments, and interest rate variability. Candidates must combine knowledge of money market instruments, forwards, swaps, and hedging principles to construct a coherent solution. Practicing integrated scenarios transforms fragmented knowledge into a cohesive framework, improving both exam performance and professional operational capability.

Handling Technical and Numerical Complexity

Many exam questions involve calculations, such as determining forward points, swap valuations, accrued interest, or yield comparisons. Candidates often face difficulty in applying formulas accurately under time pressure, especially when multiple variables are involved. Misapplication of calculation conventions can lead to incorrect results, even when conceptual understanding is strong.

To overcome this, candidates should practice numerical exercises regularly, emphasizing not only procedural steps but also the reasoning behind calculations. For instance, calculating forward points for a currency pair can be approached by understanding the relationship between spot rates, interest rate differentials, and settlement conventions, rather than treating it as a rote mathematical procedure. This enhances both accuracy and conceptual clarity.

Balancing Depth and Breadth of Knowledge

Another frequent challenge is balancing depth of knowledge in complex areas with sufficient coverage of the broader syllabus. Candidates may excel in derivatives but neglect nuances of money market instruments or foreign exchange conventions. Conversely, focusing excessively on fundamental topics may leave insufficient preparation for high-weight, scenario-based questions.

A structured study approach, incorporating weighted prioritization and progressive learning, allows candidates to maintain this balance. By allocating focused study sessions to complex instruments while periodically reviewing foundational concepts, candidates ensure comprehensive understanding without sacrificing depth. Mock exams and scenario-based exercises further reinforce this equilibrium, integrating both detailed analysis and broad coverage.

Adapting to Scenario-Based Questions

Scenario-based questions often present unfamiliar operational contexts, requiring adaptive thinking and application of multiple concepts. Candidates may feel unprepared when confronted with novel scenarios that do not directly align with memorized examples.

The recommended strategy is to internalize principles rather than memorize solutions. For example, when presented with a hypothetical corporate hedging scenario, candidates should first identify exposures, determine the objectives of hedging, evaluate suitable instruments, and calculate implications. Approaching questions as narrative exercises ensures flexibility in response and develops analytical agility, enabling candidates to handle diverse scenarios confidently.

Enhancing Retention with Active Learning

Retention of complex material is critical to overcoming preparation challenges. Passive reading or rote memorization often proves inadequate for the ACI Dealing Certificate. Active learning strategies, such as self-quizzing, scenario simulation, and peer discussion, significantly improve long-term comprehension and recall.

For example, a candidate may explain the mechanics of an interest rate swap to a peer or simulate a treasury scenario involving foreign exchange exposure. These activities reinforce understanding, clarify misconceptions, and transform abstract concepts into applied knowledge. Active engagement also enhances problem-solving speed and accuracy, which is essential for success in time-constrained examinations.

Mitigating Common Misconceptions

Candidates often encounter misconceptions regarding instrument mechanics, risk implications, and market conventions. For instance, misinterpreting settlement dates in foreign exchange or oversimplifying swap valuation can lead to errors in both exams and practical application. Recognizing and correcting these misconceptions is critical for operational competence.

A proactive approach involves reviewing past errors, analyzing the reasoning behind mistakes, and practicing similar scenarios. For example, understanding the distinction between spot-next and tom-next currency trades clarifies settlement conventions and improves accuracy in related calculations. This deliberate correction of misconceptions reinforces conceptual clarity and practical application.

Maintaining Motivation and Consistency

Sustained motivation is essential for overcoming the cumulative challenges of preparation. Candidates may encounter fatigue, waning focus, or self-doubt, particularly when grappling with complex derivatives or integrated scenario questions. Maintaining consistency through structured schedules, realistic goals, and incremental progress tracking supports both cognitive retention and psychological resilience.

Incorporating small milestones, such as mastering a subset of instruments, completing mock exams, or solving integrated scenarios, provides a sense of achievement and reinforces perseverance. Consistent engagement ensures that candidates build competence gradually, reducing overwhelm and fostering a confident approach to examination challenges.

Leveraging Peer and Expert Guidance

Seeking guidance from peers, mentors, or subject-matter experts can help candidates navigate difficult concepts and operational challenges. Discussing scenario-based questions, clarifying procedural steps, and receiving feedback on strategies enhances comprehension and practical insight. For example, discussing interest rate derivatives or currency hedging strategies with a mentor can illuminate subtleties in valuation and operational execution that might be overlooked during self-study.

Collaborative engagement also encourages the exchange of alternative approaches, exposing candidates to diverse problem-solving techniques. This multiplicity of perspectives enriches analytical thinking and enhances readiness for the multifaceted scenarios encountered in both the examination and professional practice.

Adapting Study Strategies Based on Feedback

Regular self-assessment and feedback are vital for overcoming preparation challenges. Candidates should evaluate performance in mock exams, numerical exercises, and scenario-based questions, identifying areas of weakness and adapting study strategies accordingly. For instance, repeated errors in swap valuation may indicate a need for deeper conceptual review, whereas misinterpretation of foreign exchange conventions may suggest additional scenario practice.

By continuously refining their approach, candidates ensure efficient use of study time, reinforce comprehension, and gradually eliminate gaps in knowledge. This adaptive strategy transforms preparation from a static process into a dynamic and responsive learning journey, building both confidence and operational capability.

Building Cognitive Resilience

Finally, preparing for the ACI Dealing Certificate requires cognitive resilience—the ability to process complex information, adapt to novel scenarios, and perform under pressure. This resilience is cultivated through consistent practice, scenario simulation, stress management, and reflective learning. By repeatedly confronting challenging questions and integrating feedback, candidates strengthen their capacity to navigate complexity, solve multifaceted problems, and maintain focus during the examination.

Cognitive resilience not only supports examination success but also underpins professional competence in treasury and trading roles. Certified professionals are expected to analyze dynamic market conditions, implement hedging strategies, and make informed decisions under uncertainty, all of which demand sustained mental agility and operational clarity.

Preparing for the Exam Day

The culmination of preparation for the ACI Dealing Certificate, recognized by the code 3I0-008, involves meticulous planning and strategic execution on the day of the examination. Candidates who have dedicated weeks or months to mastering money markets, foreign exchange, derivatives, and risk management must translate theoretical knowledge and operational insight into practical performance. Exam day demands not only conceptual clarity but also time management, mental focus, and procedural efficiency, as the scenario-based nature of questions requires applied reasoning and decision-making under pressure.

A critical aspect of preparation involves familiarizing oneself with the structure of the exam. Candidates often encounter questions that blend multiple concepts, such as assessing liquidity risk in money market instruments while simultaneously evaluating currency exposure and derivative hedging strategies. Understanding the types of questions, anticipated time allocation, and typical complexity enables candidates to approach each scenario with confidence and analytical precision.

Time Allocation and Question Sequencing

Effective time management is paramount for successful performance. Candidates must allocate sufficient time to analyze complex scenarios, perform calculations, and construct narrative explanations of their operational reasoning. Questions that involve foreign exchange exposures, interest rate derivatives, or integrated money market strategies can be time-intensive, and failing to manage pacing can compromise performance.

A recommended approach is to prioritize questions based on confidence and complexity. Simple or high-confidence questions should be addressed first to secure marks quickly, while more intricate scenarios involving multi-step calculations and strategic decision-making should be approached subsequently. Periodic time checks during the exam help ensure balanced progress across all questions, reducing the risk of incomplete responses and enhancing overall performance.

Maintaining Mental Equanimity

Exam day stress can interfere with cognitive processing, particularly when confronting unfamiliar scenarios or high-pressure calculations. Candidates who maintain composure and mental equanimity are better equipped to analyze questions methodically, apply learned principles, and construct coherent operational narratives. Techniques such as controlled breathing, brief mental visualization of procedures, and compartmentalization of complex problems help manage anxiety and preserve focus.

For instance, when confronted with a scenario involving hedging a multinational corporation’s foreign exchange exposure, the candidate may initially feel overwhelmed by the number of variables. By breaking the problem into manageable steps—assessing exposures, selecting instruments, calculating forward points, and evaluating residual risk—focus is restored, and the solution can be articulated with clarity and precision.

Scenario-Based Problem Solving

The examination frequently presents integrated scenarios that require candidates to apply knowledge across multiple domains simultaneously. For example, a treasury team might need to manage short-term liquidity through money market instruments while simultaneously hedging foreign currency payments and mitigating interest rate risk. Candidates are expected to synthesize these elements into a coherent operational strategy, demonstrating both analytical acumen and practical insight.

By practicing scenario-based questions during preparation, candidates cultivate the ability to visualize operational processes, anticipate outcomes, and make reasoned decisions. For example, calculating the effect of a rise in LIBOR on a forward contract or swap position can be approached as a narrative exercise: evaluating market conditions, determining the optimal hedge, and projecting potential residual exposure. This method transforms abstract calculations into applied knowledge, aligning exam performance with professional competence.

Handling Numerical Complexity

Many exam scenarios require precise numerical analysis, including calculations related to forward points, accrued interest, derivative valuations, and yield comparisons. Candidates must not only perform calculations accurately but also interpret results in the context of operational decision-making. Misinterpretation of numerical outcomes can lead to flawed strategies or suboptimal conclusions.

A recommended approach involves converting calculations into narrative reasoning. For instance, instead of mechanically computing forward points, the candidate visualizes the treasury scenario: assessing currency exposure, evaluating interest rate differentials, determining settlement implications, and selecting an appropriate contract. By embedding calculations within operational narratives, candidates reinforce comprehension, reduce errors, and enhance exam performance.

Leveraging Conceptual Knowledge

Conceptual clarity underpins success on exam day. Money markets, foreign exchange, derivatives, and risk management are interconnected, and candidates must understand these interrelationships to solve complex scenarios. For example, a question might describe a portfolio of short-term investments with exposure to currency fluctuations and interest rate variability. Candidates must integrate knowledge of money market instruments, forward contracts, swaps, and hedging strategies to formulate an optimal solution.

Candidates who have internalized principles through active recall, scenario-based practice, and cognitive scaffolding are able to navigate such questions with agility. Conceptual understanding allows for adaptability, enabling candidates to apply familiar methods to novel problems while maintaining operational accuracy.

Exam-Day Logistics

Practical considerations on exam day, such as arriving early, ensuring proper documentation, and organizing reference materials, contribute to a smooth experience. Minimizing external distractions and preparing mentally prior to the start ensures that candidates can focus entirely on analytical and operational tasks.

Familiarity with the exam environment, timing, and expected procedures reduces cognitive load and prevents unnecessary stress. By combining logistical preparation with strategic problem-solving and mental composure, candidates can approach the examination with confidence and efficiency.

Post-Exam Reflection

After completing the examination, reflection is an essential step in consolidating learning and preparing for future professional application. Reviewing questions, analyzing decision-making processes, and identifying areas of strength and weakness contribute to long-term knowledge retention and skill development.

For example, a candidate might review a scenario involving a multinational treasury exposure to evaluate the effectiveness of applied hedging strategies. Reflection enables identification of miscalculations, conceptual gaps, or procedural inefficiencies, fostering continuous improvement. This post-exam analysis is not solely for academic purposes but also serves as preparation for real-world operational challenges in treasury and trading roles.

Leveraging Certification for Career Advancement

The ACI Dealing Certificate provides tangible benefits in professional growth. Certified candidates are recognized for their operational proficiency in money markets, foreign exchange, derivatives, and risk management. The credential enhances credibility in trading, treasury, and financial advisory roles, signaling a validated capability to analyze complex scenarios, mitigate risk, and implement operational strategies.

Professionals who have successfully completed the examination can leverage their expertise to pursue roles such as treasury manager, dealer, risk analyst, or financial consultant. The certification demonstrates not only technical knowledge but also applied judgment, operational insight, and strategic thinking—qualities that are highly valued in competitive financial markets.

Continuous Professional Development

Certification is not the endpoint but a foundation for ongoing professional development. Markets are dynamic, with evolving instruments, regulatory frameworks, and risk considerations. Candidates are encouraged to continue expanding their knowledge through scenario analysis, workshops, market research, and participation in professional networks.

For example, a treasury professional may track changes in central bank policies, currency volatility, or derivative innovations to refine operational strategies. By integrating continuous learning into daily practice, certified professionals maintain relevance, enhance decision-making, and strengthen their capacity to navigate complex financial landscapes.

Reflective Learning and Operational Mastery

Reflective learning involves assessing past decisions, analyzing outcomes, and applying lessons to future scenarios. For instance, evaluating the effectiveness of a hedging strategy implemented in a mock exam or practice exercise can inform better strategies in real-world operations. This iterative process cultivates a mindset of continuous improvement, analytical rigor, and operational excellence.

Candidates who adopt reflective practices develop deeper insight into market dynamics, risk interdependencies, and strategic execution. This approach ensures that knowledge gained during preparation for the ACI Dealing Certificate translates seamlessly into professional competence, enabling sustained performance in treasury and trading environments.

Enhancing Decision-Making Skills

The culmination of exam preparation, strategic execution on exam day, and post-exam reflection reinforces critical decision-making skills. Candidates learn to assess complex financial scenarios, evaluate multiple instruments, anticipate market movements, and implement coherent strategies. These skills are not only essential for examination success but also foundational for professional effectiveness in high-stakes financial environments.

For example, the ability to integrate money market instruments, derivatives, and foreign exchange hedging into a cohesive operational plan reflects a level of applied reasoning and professional maturity that distinguishes certified individuals. Scenario-based practice, reflective learning, and conceptual understanding collectively cultivate this capacity, ensuring readiness for both examination and career demands.

Conclusion

The journey toward the ACI Dealing Certificate encompasses meticulous preparation, strategic examination execution, and thoughtful post-exam reflection. Candidates who master money markets, foreign exchange, derivatives, and risk management, while cultivating mental resilience and operational acumen, emerge not only as successful examinees but also as competent professionals equipped for dynamic financial environments.

Exam day strategy, including time management, scenario-based problem-solving, numerical precision, and mental equanimity, ensures that candidates can translate preparation into performance. Post-exam reflection consolidates learning, identifies areas for improvement, and reinforces professional skill development. The certification serves as both a validation of knowledge and a springboard for career advancement, positioning candidates to navigate complex treasury and trading responsibilities with confidence, strategic insight, and operational mastery.

The ACI Dealing Certificate is therefore not only an examination but also a transformative journey, cultivating the analytical, operational, and strategic capabilities essential for sustained success in the ever-evolving global financial landscape.